Mortgage Rates Today: Will December 2025 Bring a Drop After the Fed Meeting?

Mortgage rates have been tough for homebuyers all year. As of early December 2025,the average 30-year mortgage sits above 6 % in the U.S. and has not dropped much. The big question now is this: will rates finally fall after the Federal Reserve meets on December 9-10, 2025?

This meeting is the last major policy decision of the year. Markets are watching closely for hints about future rate cuts. Some think a cut could push mortgage costs lower. Others say rates may stay high even if the Fed acts.

For buyers, sellers, and anyone thinking about refinancing, this moment matters. The answer could affect monthly payments, home prices, and loan decisions heading into 2026.

Let’s explore what today’s rates look like, what the Fed is signalling, and whether a drop is really coming.

Mortgage Rates Today: Where They Stand Right Now?

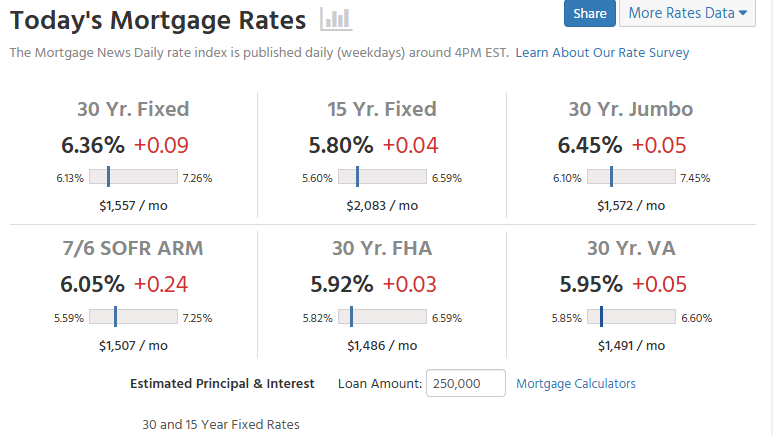

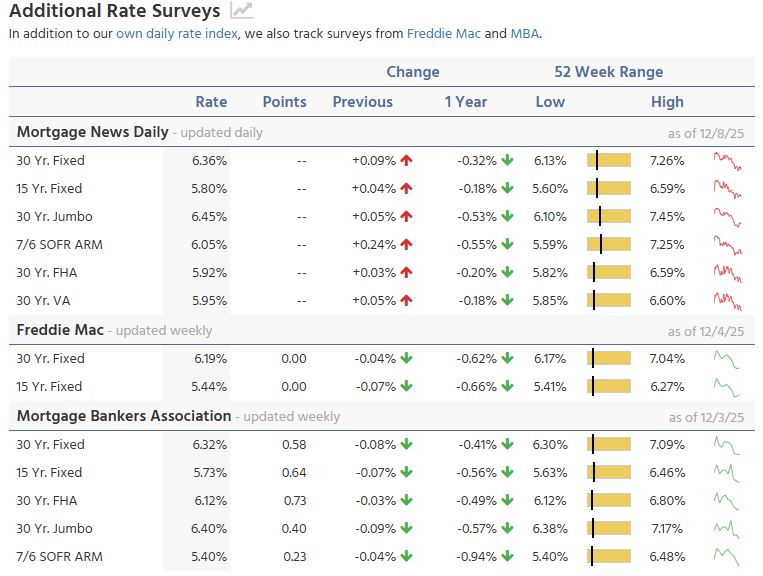

As of December 4, 2025, the 30-year fixed mortgage averaged 6.19%. This was down slightly from the prior week. The 15-year fixed averaged 5.44% on the same date. These weekly figures come from Freddie Mac’s Primary Mortgage Market Survey.

Lender surveys show small day-to-day swings. Bankrate reported a 30-year average near 6.28% in early December. That number reflects lenders’ live pricing and borrower demand.

Markets now watch Treasury yields and mortgage-backed securities (MBS). Lenders price loans from both. Small moves in yields can change headline rates quickly. Recent headlines suggest traders expect a Fed move in mid-December.

What the December 2025 Fed Meeting Actually Signaled

The Federal Open Market Committee met on December 9-10, 2025. Markets priced in a likely quarter-point cut to the federal funds rate. Fed officials used cautious language about inflation and job gains. The forward guidance focused on data dependency rather than a fixed path.

That wording matters for long yields. If the Fed signals several cuts ahead, long-dated Treasury yields can fall. That helps MBS and can pull mortgage rates down. If the Fed stresses uncertainty, yields may hold. The Fed’s balance sheet comments also affect long yields. Treasury issuance plans matter too.

Why Mortgage Rates Can Drop Even If the Fed Doesn’t Cut in December

Mortgage rates often follow the bond market more than Fed moves. Mortgage-backed securities trade on expectations. If investors flock to safe assets, MBS prices rise and mortgage rates fall. Conversely, if investors demand higher yields, mortgage rates can climb even when the Fed eases. This disconnect is common. Recent reporting shows markets have largely priced in a December cut. But pricing can shift fast on new data.

Three Scenarios for December 2025-Q1 2026

Scenario one: rates drop. This happens if inflation data keeps cooling and Treasuries rally. Lower long yields would push MBS prices higher. Lenders would then lower posted rates. Scenario one is what many investors expect if the Fed signals a clear easing path.

Scenario two: rates stall. This occurs when the Fed cuts but signals only limited easing. Bond markets may not rally enough to change mortgage pricing. Lenders could widen spreads to protect margins. Scenario two keeps homebuying decisions on hold for many borrowers.

Scenario three: rates rise. This is less likely but possible. Strong jobs or a surprise inflation uptick can push yields higher. If Treasury supply suddenly increases, yields may rise even with Fed easing. That would keep mortgage rates stubbornly high.

The 2025 Housing Market’s Reaction: Buyers, Sellers, and Inventory Shifts

Buyers are watching rates closely. Lower rates coax some hesitant buyers back. Still, many potential buyers face tight savings and existing monthly costs. A modest rate drop may only nudge those already ready to move. Market commentary in early December suggests more buyers could return if rates slip below 6%.

Sellers face a hard choice. Many homeowners are locked into loans from earlier, lower-rate cycles. Those sellers must weigh giving up a cheap mortgage against capturing a higher sale price. If rates fall, some locked-in sellers may list. That would slowly ease inventory tightness.

Builders will watch financing costs. Lower mortgage rates can boost demand for new homes. That can push builders to increase starts. Still, supply chain limits and labor costs may temper fast expansion.

How to Position Yourself: Lock, Float, or Wait for Q1 2026?

Loan locking is a personal choice. Locking protects a buyer from sudden rate jumps. Floating can save money if rates fall. If the planned closing date is soon, locking is more practical. If the closing is months away, floating with frequent checks can work.

When rates move, lenders may change pricing intra-day. Active buyers should watch rate news on CPI, PCE, and jobs days. Some traders and analysts even use an AI stock research analysis tool to read Fed language and market flows. That approach helps spot buying or selling pressure in MBS markets.

Refinancers should set a clear threshold. For many, the math turns favorable when the 30-year rate drops enough to cut monthly payments meaningfully. Credit line, closing costs, and time in the home all matter.

Refinance Outlook: Is December 2025 the Start of “Refi Wave 2.0”?

Many homeowners who took loans in 2023-2024 carry rates above 6.5% or 7%. A sustained move below 6% could trigger a wave of refinancing. Lender capacity and margin pressure will shape how quickly a refi surge shows up. Freddie Mac data through early December shows modest rate easing, which could set the stage if follow-through occurs.

Lenders may tighten credit if volumes spike. That would blunt some refi demand. Watch lender lockboards and rate sheets for signs of real shifts.

Expert Commentary Angle

Economists and bond traders give mixed views. Some forecast steady easing into early 2026. Others urge caution because global risks and fiscal moves can change yields fast. Mortgage-market analysts highlight that MBS spreads and mortgage credit risk will determine how much rate cuts reach borrowers’ monthly payments. Recent news coverage and analyst commentary underline this split in opinion.

Conclusion: What to Watch Next

Key data to watch includes the jobs report, CPI, and the next round of Fed minutes. Also watch Treasury auctions and MBS spreads. Small moves in these areas will shape whether mortgage rates fall meaningfully in December 2025 and into Q1 2026. Current trends show modest easing as of early December. The real change depends on fresh economic data and how markets read Fed signals.

Frequently Asked Questions (FAQs)

Mortgage rates may ease after the December 9-a10, 2025 Fed meeting, but nothing is sure. Rates depend on inflation, jobs, and bond markets. Buyers should watch updates closely.

Some experts think rates could drift lower in early 2026 if inflation keeps cooling. But rates may stay firm if the economy stays strong. Trends can change month to month.

Locking protects you from sudden jumps. Waiting might help if rates fall. The best choice depends on your timeline, loan type, and market news from December 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.