Moschip Technologies Surges 48% in Six Sessions on Strong Investor Demand

In just six trading sessions, Moschip Technologies has surprised the market with a sharp 48% rise in its stock price. This sudden surge has caught the attention of both retail and institutional investors. The company, known for its work in semiconductor design and system solutions, has become one of the top gainers in the tech space.

We live in a time when semiconductors are at the heart of every digital product, from smartphones to electric cars. As India pushes forward with its semiconductor mission, companies like Moschip are finding themselves in the spotlight. Strong demand, positive market mood, and fresh interest in the sector have created a powerful rally.

But the big question is what is fueling this rise? Is it only investor excitement, or is there something more solid behind the numbers? Let’s explore the reasons behind Moschip’s growth, how the market is reacting, and what we should expect going forward.

About Moschip Technologies

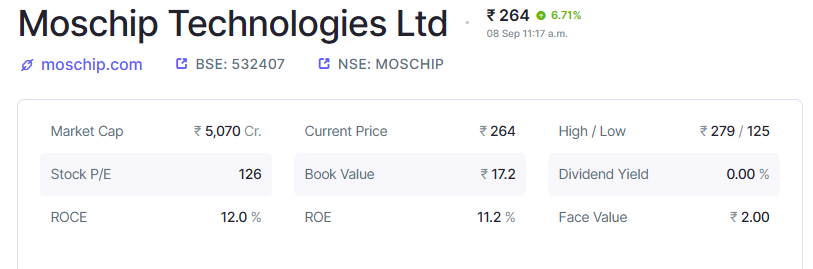

MosChip Technologies is an India-headquartered semiconductor and product engineering firm. The company designs chips and system solutions for connectivity, consumer devices, and industrial use. MosChip also offers services in embedded systems and IoT product engineering. Its public filings list regular quarterly reports and investor documents that show a steady focus on design services and product development.

Stock Market Performance

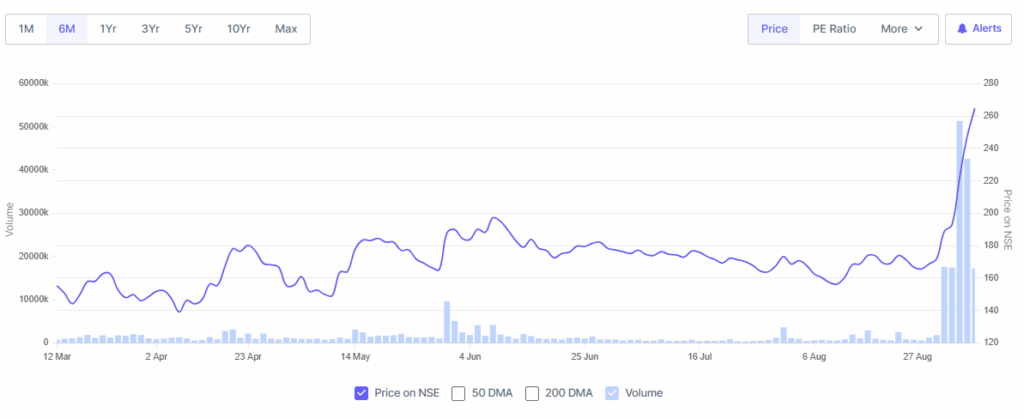

MosChip’s stock jumped about 48% in six trading sessions. The surge pushed the share price to fresh multi-month highs and produced strong daily gains, including near-double-digit moves on some sessions. Trading volumes rose sharply during the rally, with several sessions seeing many times the average daily turnover. The market cap also climbed as investors bought into the story. News outlets and market trackers documented the six-session run and the high volumes that accompanied it.

Key Drivers Behind the Rally

One clear reason for the rally is the broader push on semiconductors in India. Recent government initiatives and industry events have boosted investor interest in domestic chip design and assembly plays. MosChip sits squarely in that narrative, so its stock drew attention after policy signals and public pronouncements supporting the sector.

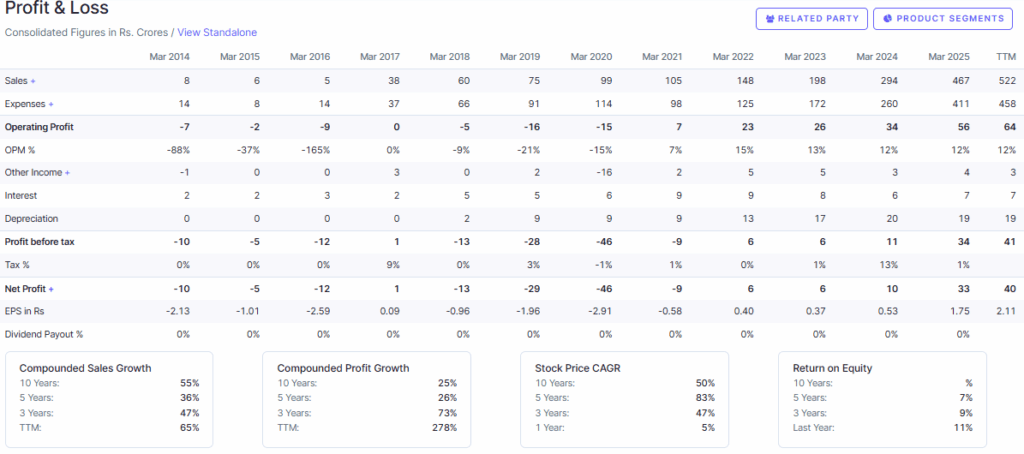

Company results also helped. The latest quarter showed major year-on-year jumps in revenue and profit. Reported net profit rose strongly compared with the prior year quarter, and operating income expanded. These numbers gave earnings backing to the recent price moves and added credibility to the rally.

Investor demand itself became a driver. Retail buyers joined institutional flows. That created momentum. When volume rises and many buyers compete for shares, prices can move fast. Market reports highlighted strong retail participation and large daily turnover during the rally.

Speculation and momentum trading likely played a role, too. Short windows of strong gains often attract momentum funds and short-term traders. Social media posts and market commentaries showed heightened chatter around MosChip during the rally. That chatter can feed further buying.

Investor Sentiment and Market Reactions

Analysts and market watchers offered mixed takes. Some highlighted the firm’s improving numbers and the sector tailwinds as reasons for optimism. Others warned that sharp, short-term moves often correct. Broker notes and rapid coverage by financial portals increased visibility for MosChip and helped shape public sentiment.

Media coverage amplified interest. Several national business outlets ran stories on the stock’s gains and linked the move to the government’s semiconductor push. This helped bring the stock to the attention of small investors and funds that monitor trending names. The result was a feedback loop: coverage drew buyers, and buyers led to more coverage.

Risks and Concerns

High volatility is a clear risk. Fast rallies can reverse quickly. Investors who buy at peaks may face sharp losses on pullbacks. Historical patterns show that stocks with sudden spikes often trade back after profit-taking days.

Valuation questions matter too. A large short-term price rise can push valuations beyond what the recent earnings justify. That makes the stock more sensitive to any negative news or slightly weaker results. Earnings revisions or lower guidance can trigger quick corrections.

Industry risks add another layer. The semiconductor cycle is global and can be volatile. Supply chain problems, sudden demand drops, or a slowdown in global tech spending could reduce order flow for design and engineering firms. Policy support helps, but it does not remove cyclical risk.

Future Outlook

If MosChip keeps growing revenue and profit, the case for a higher long-term valuation will strengthen. Continued deals in IoT, connectivity, and embedded systems can sustain steady growth. The company’s published financial reports show recent margin improvements and higher net profit, which support a cautious, optimistic view for the medium term.

Policy tailwinds can also matter. If India’s semiconductor push turns into concrete orders, capacity builds, or public-private projects, domestic design players could benefit. However, any durable gains will depend on repeat contracts, steady margins, and execution on product pipelines. Investors should watch upcoming quarterly updates and any new client wins closely.

Bottom Line

MosChip’s recent 48% surge in six sessions reflects a mix of solid quarterly numbers, strong investor interest, and positive sector sentiment driven by policy. The move shows how quickly small caps tied to hot themes can rally. At the same time, the jump brings valuation and volatility risks. Careful investors should follow earnings, volume patterns, and official company announcements before making decisions.

Frequently Asked Questions (FAQs)

Between late August and early September 2025, MosChip stock rose 48% due to better earnings, rising trading volumes, and positive news about India’s semiconductor growth plans.

MosChip shows growth in semiconductor design, but sharp price moves mean risk. Long-term safety depends on steady earnings, industry demand, and global trends, which may change anytime.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.