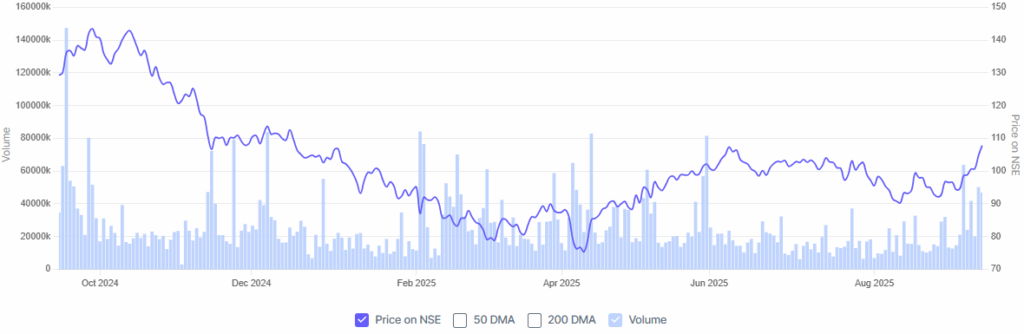

Motherson Share Price Climbs 2% in Early Trade

The Indian stock market opened on a strong note today, with Motherson share price witnessing a gain of nearly 2% during early trade. Investors have shown renewed interest in the stock, driven by recent developments in the global automobile sector, strong quarterly results, and improving market sentiment.

As one of the most influential auto component manufacturers in India, Motherson is closely watched by both institutional investors and retail traders.

Market Overview and Stock Momentum

The stock market has been highly volatile in recent weeks due to concerns around global demand, oil prices, and inflationary pressures. Despite these challenges, Motherson has managed to deliver a positive performance. The Motherson share has climbed steadily, showing resilience against broader market fluctuations.

Analysts suggest that the early rally reflects investor confidence in the company’s long-term business model. With consistent expansion plans and diversification into new markets, Motherson has built a reputation for stability even during uncertain times.

Why Motherson Shares Are Rising

Several factors contributed to the sharp rise in Motherson share price today:

- Strong Global Presence – The company supplies components to leading automobile manufacturers across Europe, North America, and Asia. This diversified presence shields it from regional downturns.

- Robust Order Book – Motherson’s healthy order pipeline has given investors confidence that revenue growth will remain stable.

- Operational Efficiency – Recent cost-cutting measures and streamlined operations have improved margins.

- Industry Tailwinds – The global automobile industry is recovering, with demand for electric vehicles and premium cars providing additional opportunities.

This positive outlook has encouraged both domestic and foreign institutional investors to increase their stake in the company.

Impact on the Indian Stock Market

The rise in Motherson share not only reflects the company’s strength but also provides momentum to the overall stock market. Auto and auto-ancillary stocks are considered vital indicators of economic growth. A strong performance in this segment signals healthy demand trends in both domestic and international markets.

The company’s upward movement is also influencing investor sentiment toward other automobile-related stocks. As a result, several auto stocks gained traction in today’s trade.

Stock Research and Investor Sentiment

Stock research reports released by leading brokerage firms have consistently highlighted Motherson as a strong buy due to its growth potential. Analysts believe the company’s continued investments in technology, research, and global acquisitions have positioned it well for the future.

Moreover, the stock has attracted attention from investors seeking long-term value. While short-term fluctuations are expected, Motherson’s stable earnings profile and expanding product portfolio make it an attractive choice for those investing in the auto sector.

Motherson’s Role in Emerging Technologies

The automobile industry is undergoing a major transformation, especially with the rise of AI stocks, automation, and electric vehicles. Motherson has already taken steps to align itself with these shifts. The company has been investing in smart automotive solutions, digital manufacturing, and AI-driven production processes.

This forward-looking strategy has allowed Motherson to remain competitive against global rivals. Investors view this adaptation as a key driver of sustainable growth. The company’s entry into electric vehicle components, lightweight materials, and sensor technologies is expected to strengthen its position further.

Financial Performance and Outlook

The company recently reported strong quarterly numbers, reflecting improved revenue growth and better operating margins. This financial performance has reassured investors who were concerned about global demand slowdowns.

Going forward, analysts expect Motherson to continue its growth trajectory by focusing on:

- Expansion into new geographies

- Strategic acquisitions of auto component firms

- Strengthening EV-related product offerings

- Maintaining cost efficiency through innovation

Such strategies indicate that the current rally in the Motherson share is not just a short-term spike but part of a larger growth story.

Comparison With Other Auto Component Stocks

Motherson’s performance stands out compared to other auto component manufacturers. While many companies in the sector are still recovering from supply chain disruptions, Motherson has maintained strong order inflows. Its global client base, which includes leading automakers like Volkswagen, Daimler, and Toyota, gives it a significant advantage.

This global edge allows Motherson to generate consistent earnings, making it one of the top picks among auto-ancillary stocks in India.

Risks and Challenges

Despite its strong outlook, Motherson faces certain risks:

- Global economic slowdown is affecting auto sales

- Rising raw material costs, particularly steel and aluminum

- Currency fluctuations are impacting export revenues

- Intense competition in the auto component space

However, the company’s diversified business model and global operations help reduce the impact of these challenges.

Investor Takeaway

The recent 2% rise in Motherson share price demonstrates the market’s confidence in the company’s future. With strong fundamentals, expanding global presence, and focus on new technologies, Motherson continues to remain a promising investment option in the stock market.

For investors looking for long-term value, this stock offers exposure to the growing global automobile industry, making it a solid candidate for portfolio diversification.

FAQs

The stock gained due to strong quarterly results, a healthy order pipeline, and growing demand in the automobile sector.

Yes, analysts consider Motherson a strong long-term pick due to its global presence, diversified client base, and investments in emerging technologies.

Motherson is expanding its product line to include EV components, lightweight materials, and digital solutions, positioning itself strongly in the future mobility space.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.