Motilal Oswal News Update: Colgate Comeback on Track with 25% Growth Potential

On 24 October 2025, brokerage firm Motilal Oswal Financial Services Ltd. upgraded its outlook on Colgate‑Palmolive (India) Ltd., saying the company could see around a 25 % growth upside. This is a big deal because Colgate has been fighting headwinds lately, tough competition, slower demand, and cost pressure. Now, the research house believes Colgate’s turnaround plan is on track.

New products, stronger distribution, and a push into premium oral care are helping. For investors, this means a potentially brighter future. For the brand, it signals a shift from survival mode to growth mode. Let’s explore what’s changed at Colgate, why Motilal Oswal is so optimistic, and what this could mean for the consumer-facing world of Indian FMCG.

Colgate’s Comeback Journey

Colgate-Palmolive India had a tough run in the past year. Urban demand slowed and competition intensified. The company responded with a clearer plan. The plan focused on product innovation, advertising, and distribution upgrades. New formats and premium offerings were launched to win back consumers. These moves started to show traction by mid-2025, even as sales cycled against a strong prior year. Analysts note that the company is moving from defensive tactics to selective growth steps.

Motilal Oswal’s Bullish View

On 24 October 2025, Motilal Oswal upgraded Colgate to a positive stance and suggested roughly a 25% upside from current levels. The brokerage pointed to improved demand trends and better response to recent launches. Motilal Oswal highlighted rising ad investments and targeted innovation as the key triggers for recovery. Their report argues that market share erosion has begun to stabilise and that margins can improve as volumes recover.

Strong Business Fundamentals

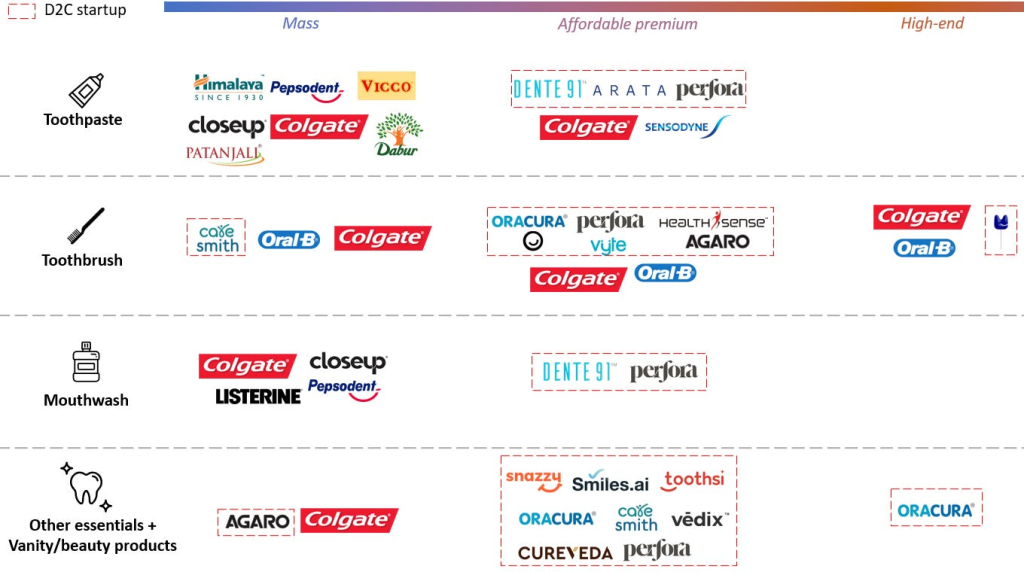

Colgate remains the market leader in India’s oral-care segment. The brand still enjoys wide household penetration and high trust. Distribution strength is deep in urban markets and growing in smaller towns. The company also benefits from a diverse portfolio that spans mass to premium categories. This gives Colgate flexibility to defend volume and push higher value items when consumers trade up.

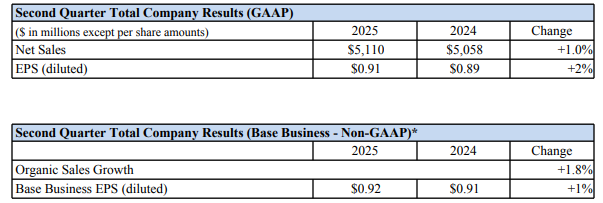

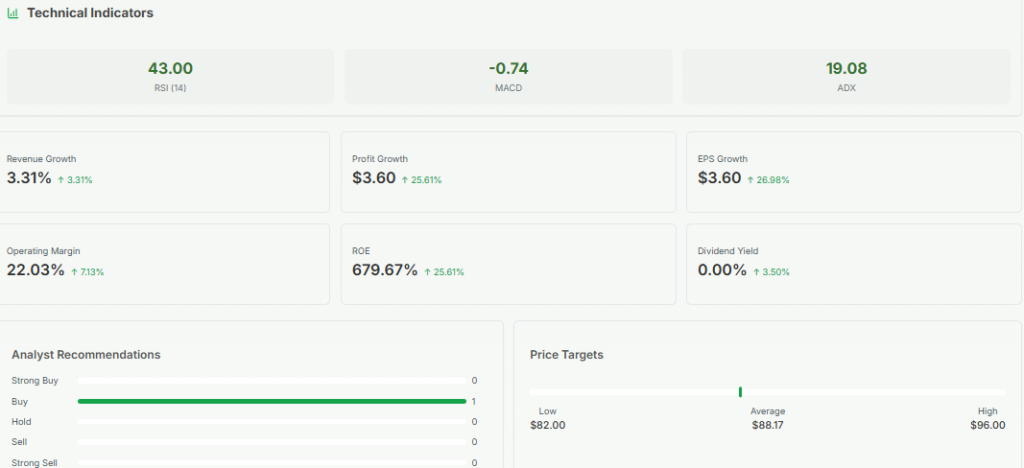

Financial Performance Snapshot

Recent quarters show mixed results. For the quarter ended June 30, 2025, Colgate reported a drop in net sales and flagged a challenging demand environment. Profitability also faced pressure due to high marketing spends and competitive pricing. In the September quarter of FY26, reported net profit fell materially, reflecting both tax/GST adjustments and softer volumes. These numbers underline that the recovery is still unfolding.

Consumer Demand Driving Growth

Consumers are shifting toward premium and health-oriented oral care. Whitening, gum care, and specialised sensitivity products are gaining traction. Urban shoppers show stronger interest in new formats and bundled systems that promise better outcomes. Rural demand is stabilising, and smaller towns are increasingly important for volume growth. Overall, rising awareness about oral health supports structural demand.

Future Growth Catalysts

Innovation will be the main engine. Colgate has been refreshing its portfolio with new formats and system-based products. Expansion into adjacent items, such as mouthwashes and electric toothbrushes, offers cross-sell opportunities. Deeper penetration in Tier-II and Tier-III cities can add scale. International levers, including exports and premium SKUs, could help margins over time. Using an AI tool for scenario modeling, brokers have quantified faster recovery paths under optimistic assumptions.

Risks and Challenges

Competitive intensity remains a material risk. Domestic players and herbal brands have become more assertive on price and distribution. Nationalist marketing and geopolitical tensions have also nudged some consumers toward local alternatives in recent months. Cost volatility for packaging and inputs can compress margins. Finally, any slowdown in consumer spending would delay the volume rebound. Investors should weigh these risks against the recovery thesis.

Investor Outlook

Short-term performance will likely track quarterly demand patterns and GST or tax impacts. Analysts expect sequential improvement if festive season demand and new launches sustain momentum.

Motilal Oswal’s 25% upside assumes steady improvement in volumes, modest margin expansion, and growth in premium categories. Value investors might see this as an opportunity if they accept cyclical risk. Traders should monitor market share trends, ad spend cadence, and the next two quarters of sales data.

Bottom Line

Colgate’s turnaround shows credible signs. The company still faces headwinds. Yet the strategy of innovation, focused marketing, and wider reach could restore growth. Motilal Oswal’s upgrade on 24 October 2025 reflects this renewed confidence. Recovery will not be linear. However, if launches and demand both improve, Colgate could reclaim momentum in India’s oral-care market.

Frequently Asked Questions (FAQs)

Colgate stock may have growth ahead, but it still faces demand pressure. Investors should study risks and market trends.

Motilal Oswal said on 24 October 2025 that new products, better marketing, and strong brand trust may support higher sales and profits if demand keeps improving.

New product ideas, more focus on premium care, and wider reach in small cities are helping sales. People also care more about clean teeth and gum health today.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.