MSFT Stock Today: Can Microsoft Hit $600 Amid Record AI Growth?

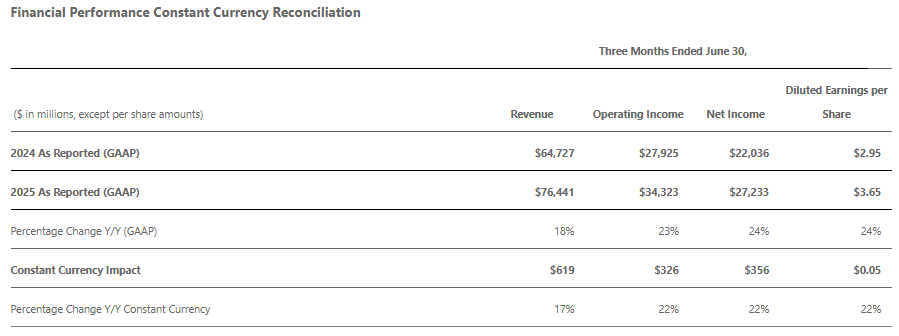

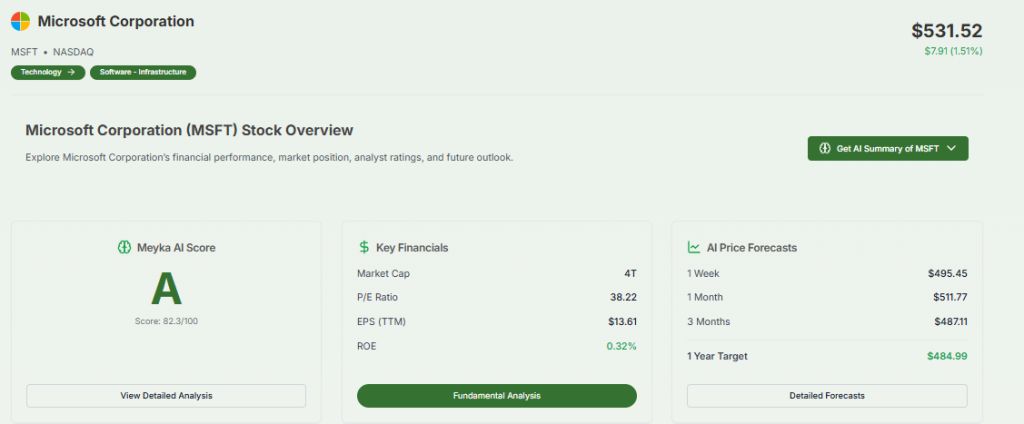

On 28 October 2025, MSFT (Microsoft) shares hovered around $531.52 as investors weighed the company’s rapid expansion in artificial intelligence. Across its cloud and AI divisions, Microsoft is driving growth and grabbing headlines. Its cloud platform, Azure, and enterprise AI tools are becoming core to businesses around the world. At the same time, the question on many minds is simple: can Microsoft hit $600 per share?

The lofty target hinges on sustained AI monetisation, margin improvements, and strong guidance ahead. But there are headwinds too: heavy investment costs, stiff competition, and macro uncertainty could slow the climb. This article unpacks those forces and asks: Is a $600 stock price for Microsoft realistic in the current climate?

Why AI Now Drives Growth?

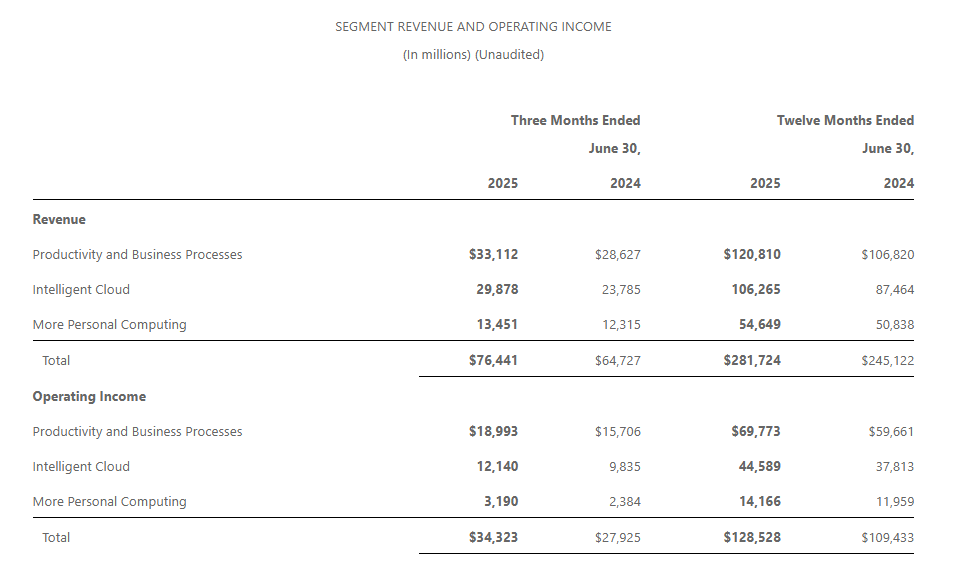

Microsoft has pushed AI to the top of its strategy. Fiscal 2025 results showed broad gains. Annual revenue rose to $281.7 billion. Azure surpassed $75 billion in yearly revenue and posted rapid growth. These figures reflect strong enterprise demand for cloud and AI services.

Microsoft has also expanded AI features across Microsoft 365, GitHub, and Dynamics. That expansion aims to turn usage into steady revenue through new seat-based pricing and enterprise contracts. The company’s scale gives it an advantage. Cloud scale lowers marginal costs for model training and deployment. This advantage matters when customers choose a trusted cloud for mission-critical AI workloads.

MSFT Stock Current Position

The Bull Case: Path(s) to $600

Analysts who favor Microsoft’s upside point to three linked realities. First, Azure and enterprise AI can sustain above-market revenue growth for several years. Strong quarterly results in mid-2025 showed Azure accelerating well beyond expectations. Second, Copilot and related AI offerings can create higher revenue per user if price and adoption rise together. Third, margin recovery or stability despite capex would support multiple expansions.

Several brokerages raised targets in 2025. Some published targets now sit near or above $600. Oppenheimer, for example, set a $600 target after seeing sustained AI monetization trends. The market’s average analyst target also moved higher, implying sizable upside from current levels. If Microsoft keeps growing revenue, converts AI adoption into paid seats, and keeps margins resilient, the market could price the stock toward $600.

The Bear Case: Why $600 is not Certain?

The case against a $600 price is also strong. Microsoft plans massive AI infrastructure spending. Management announced an approximately $80 billion investment in AI-enabled data centers for fiscal 2025. That outlay increases depreciation and near-term cash needs. Heavy spending can pressure free cash flow and compress margins if revenue does not ramp fast enough. Competition adds pressure.

Amazon and Google keep investing in cloud and AI. Startups and specialized model vendors also erode pricing power. Macro conditions can reverse multiples quickly. If interest rates or risk appetite rise, highly valued tech names could face a sharp multiple contraction. Under that scenario, even continued revenue growth may not lift the stock to $600.

What must happen for $600 to become Likely?

For the market to accept a $600 valuation, a few outcomes must occur and be visible in short order. First, core enterprise products must show clear monetization. Copilot seat conversions and subscription upgrades must rise at a measured pace. Second, Azure must sustain high growth rates in consecutive quarters while improving gross margins.

Third, guidance must remain strong. Management should either demonstrate that capex is driving durable revenue gains or that margin dilution is temporary. Fourth, analyst models must shift: more firms need to raise their 12-month targets to near or above $600. Finally, signs of robust institutional buying would help support a higher multiple. Investors often rely on third-party signals, such as model changes generated by an AI stock research analysis tool, to confirm that fundamentals are truly improving.

Key Risks to Monitor

A few concrete risks will determine whether momentum holds. Rising capital expenditures without matching revenue growth is the most direct risk. Chip supply bottlenecks or price pressure on AI hardware could slow deployments. Regulatory scrutiny of AI models may impose compliance costs or limit product features.

Customer concentration or slower enterprise adoption would reduce upside. Finally, market sentiment matters; a broad tech sell-off could pull Microsoft down even as fundamentals improve. Watch these signals alongside quarterly financials to judge the trend.

Valuation Reality Check

Putting a $600 target into context is simple math. At $600 per share, Microsoft’s market capitalization would require either a notable rise in earnings or a higher price-to-earnings multiple. Analysts’ consensus price targets in mid-to-late 2025 clustered above $600 on average, but estimates vary widely.

Some top-bull scenarios assume persistent double-digit top-line growth and steady margin improvement. Other, more conservative cases show that slowing growth or margin pressure keeps fair value well below $600. Investors should treat $600 as a bullish case rather than a baseline expectation. Links to analyst consensus and individual targets are available for closer inspection.

What to Watch Next for MSFT Stock?

The next few quarters will be decisive. Look for clear evidence of paid-seat growth in Microsoft 365 Copilot and Dynamics AI. Scrutinize Azure’s growth rate and margin trends in the coming earnings calls. Track capital expenditure trends and management commentary on the timing of returns from AI infrastructure. Monitor analyst coverage for systematic target upgrades. Finally, watch macro indicators that affect multiples, such as market-wide risk appetite and interest rate moves. Together, these signals will show whether the path to $600 is widening or closing.

Conclusion

Microsoft’s AI strategy is a major structural bet. Recent results validate parts of that bet. However, the company also carries large near-term costs. A $600 share price is possible. It requires steady revenue growth, clear monetization of AI features, and margin stability despite heavy spending. If those conditions fail to materialize, the stock may trade well below that level for an extended period.

Investors should weigh the bullish signals against the real costs and competition. Staying focused on concrete metrics, Copilot monetization, Azure growth, capex efficiency, and updated guidance will offer the clearest path to an informed decision.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.