Nasdaq and S&P 500 Futures Rise After Apple, Amazon Earnings Beat

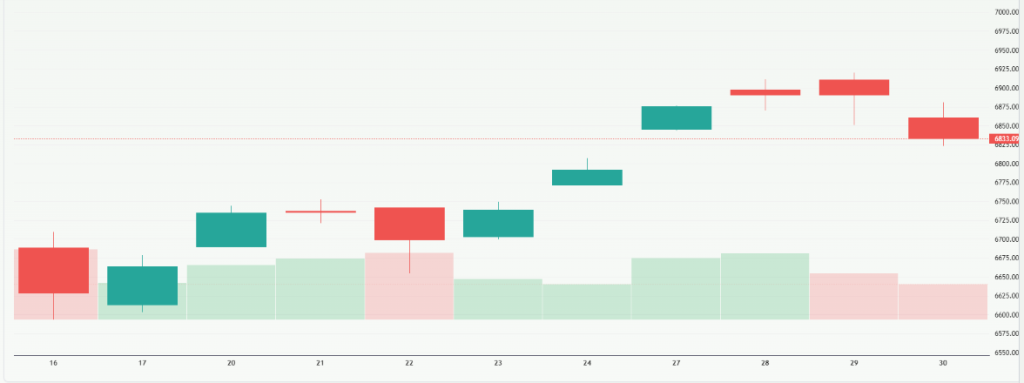

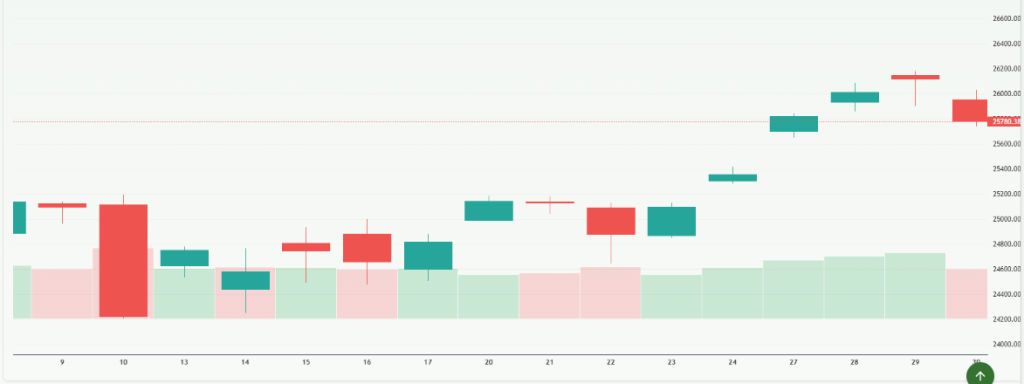

On October 31, 2025, U.S. stock futures jumped as upbeat earnings from Apple and Amazon lifted market sentiment. The S&P 500 and Nasdaq-100 futures both climbed in early trading, signaling a strong start for Wall Street. Investors cheered the results, seeing them as a sign that major tech companies remain resilient despite a mixed economic outlook. Apple impressed with stronger-than-expected iPhone and services sales, while Amazon’s cloud business showed solid growth. These two giants, together worth trillions, often set the tone for broader markets.

Their strong performance brought relief after weeks of market hesitation over interest rates and global tensions. Analysts now say that strong tech earnings could revive hopes for a year-end rally. The reaction shows how much confidence investors place in “Big Tech” to drive the market higher. The focus now shifts to whether this optimism can last through November’s trading sessions.

S&P 500 & Nasdaq: The Earnings Trigger

Apple and Amazon released stronger-than-expected quarterly results on Oct. 30, 2025. Apple reported record services revenue and forecast a robust holiday quarter. The company’s guidance suggested double-digit iPhone sales growth for the December period. Investors took this as a sign of sustained consumer demand for hardware and recurring services.

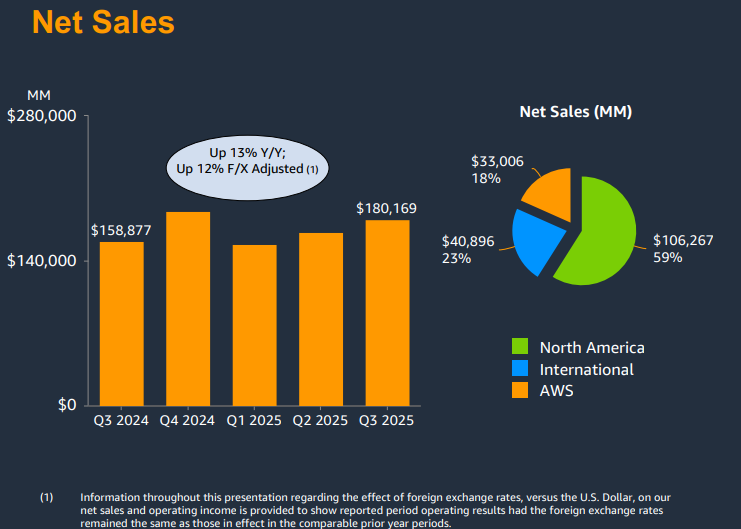

Amazon posted a faster cloud revenue pace than seen in recent years. AWS grew about 20% year-over-year and beat Wall Street’s estimates.

The combination of big beats lifted after-hours trading and pushed S&P 500 and Nasdaq-100 futures higher into Oct. 31, 2025. These results mattered most because Apple and Amazon are massive index components. Their earnings have an outsized effect on futures and market sentiment.

Market Context Before the Beat

Markets entered the week with mixed signals. Tech stocks had shown volatility as investors parsed AI spending, chip demand, and higher interest rates. Macro worries lingered. Traders watched inflation data and Fed commentary for clues on rate cuts. At the same time, any sign that large tech firms could grow revenues and margins eased fears.

The Apple and Amazon reports arrived during a pivotal stretch of earnings. Good numbers from these names reduced near-term uncertainty. Still, the broader market had narrow leadership: a handful of mega-caps had been carrying much of the gains all year. That made the market sensitive to a few big reports.

How Futures Reacted and What It Means?

S&P 500 futures rose roughly 0.6-0.7% while Nasdaq-100 futures gained about 1.2% after the reports. That move reflected two forces. First, the beats lowered the bar for corporate profit growth expectations. Second, the strong cloud results for Amazon suggested continued enterprise spending on compute and AI tools.

When futures move this way, traders expect a stronger open. But futures are not the final word. Market direction still depends on session-long flows, sector breadth, and follow-through from other earnings reports. The immediate takeaway is that big tech strength can lift sentiment across risk assets, at least for the short term.

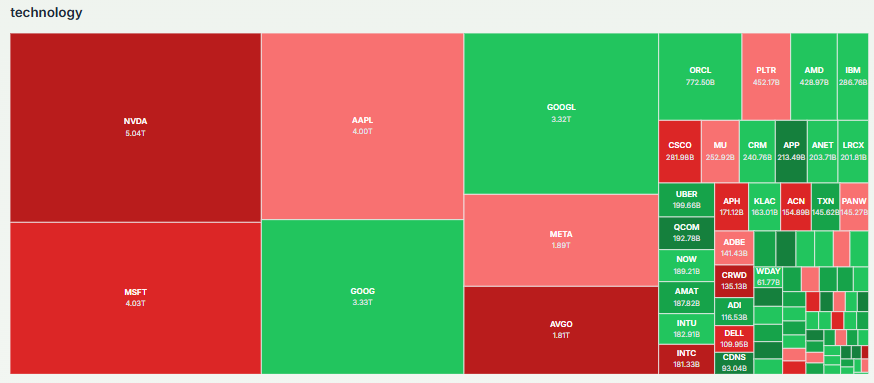

Sector and Index Implications

The tech sector stands to benefit the most. The Nasdaq is heavier in growth names and thus reacted faster and more strongly than the broader S&P 500. Banks, industrials, and small-caps may not follow unless they post their own good news. This makes the rally fragile if it remains concentrated. Still, strong tech earnings cut through some of the macro noise. They also reduce the urgency among earnings-watchers to mark down growth forecasts for key franchises.

For index investors, these reports boost headline returns, but they do not automatically fix shallow market breadth. Look past the index numbers to see how many stocks actually advanced on the day.

Risks and Things to Watch Next

Several risks could derail the upbeat tone. First, larger-than-expected Fed hawkishness would quickly cool investor appetite for growth stocks. Any signals that rate cuts will be delayed or smaller than expected could pressure valuations. Second, earnings season still has many large firms to report. If follow-on results disappoint, the current optimism could fade fast.

Third, geopolitical or macro shocks, trade tensions, weaker global PMIs, or a surprise inflation print remain possible. Finally, concentration risk is real: if only a few mega-caps carry gains, the market may correct once flows rotate away from them. Monitor Fed remarks and upcoming earnings from other big tech and cyclical names for signs of durability.

Practical Steps for Investors

Check earnings breadth. If gains are broad, sentiment is healthier. If gains come from two or three stocks, treat rallies cautiously. Consider trimming winners after big runs. Use stop orders or hedges if the exposure is large. For longer horizons, reassess portfolio weightings to avoid concentration in a handful of mega-caps.

Follow guidance and margin trends inside earnings reports, not just headlines. Analysts’ commentary on capex and AI spending is especially important. Many market participants now use an AI stock research analysis tool to scan large datasets quickly. Still, human judgment on valuation and balance-sheet strength remains essential.

Key Indicators to Track in the Near Term

Watch the actual open and intraday volume after Oct. 31, 2025. High volume on up days signals conviction. Low volume suggests a thin rally that could stall. Track follow-on earnings from other mega-caps. Monitor Fed speakers for any hawkish surprises.

Keep an eye on AWS revenue trends and Apple’s services growth. Both signal structural demand for cloud compute and recurring subscription revenue. Also watch macro prints: CPI, PCE, and employment numbers that could influence Fed timing. Together, these data points help determine if the futures move becomes a durable market trend or a short-lived pop.

Closing Note

The Apple and Amazon beats on Oct. 30-31, 2025, sparked a clear rally in S&P 500 and Nasdaq futures. The news eased some investor fears about demand and margins. Yet the rally’s strength depends on follow-through. Fed policy, upcoming earnings, and market breadth will decide the next leg. For now, the reports offer a reason for optimism. Stay alert. Strike a balance between caution and the opportunity to capture gains when the market exhibits genuine breadth.

Frequently Asked Questions (FAQs)

On October 31, 2025, S&P 500 futures rose as strong earnings from Apple and Amazon boosted investor confidence, signaling a possible market recovery.

Apple and Amazon reported better-than-expected profits on October 30, 2025, which lifted tech investor mood and pushed Nasdaq futures higher before market opening.

Investors will watch more earnings reports, Federal Reserve comments, and economic data to see if the rally from Apple and Amazon can continue through this week.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.