Navan IPO: Travel Tech Firm Raises $923 Million, Eyes Global Expansion

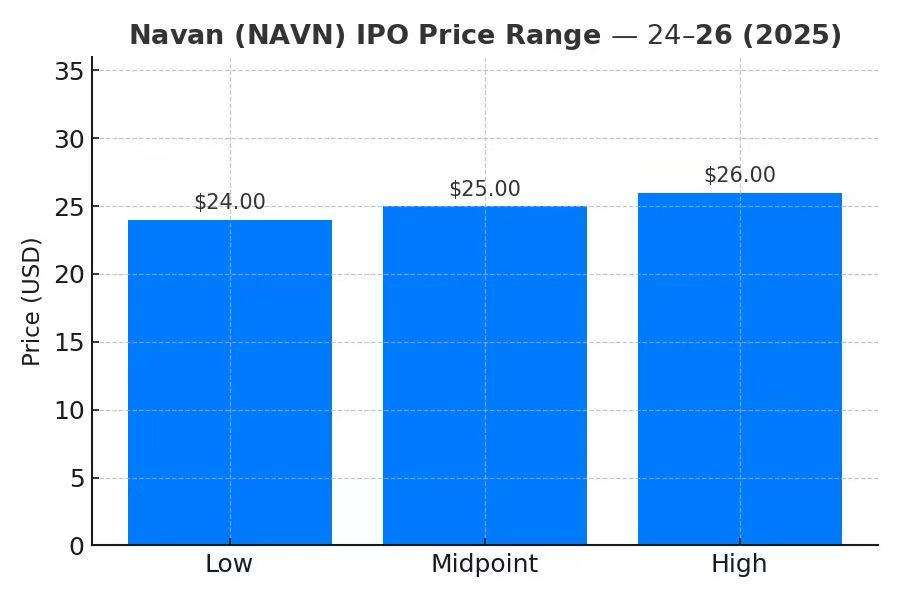

On October 30, 2025, Navan, Inc. made a splash on the market by raising around $923 million in its IPO. The Palo Alto-based travel-and-expense platform priced its shares at $25 each, landing at a valuation of roughly $6.2 billion. This move marks a bold step in the rebound of business travel and tech IPOs alike.

Navan started in 2015 as TripActions and later evolved into a full-scale corporate travel, payments, and expense-management solution. With this public listing, the company aims to expand its global reach, deepen its use of artificial-intelligence-driven tools, and capture more of the enterprise travel market. The timing shows confidence not only from Navan itself, but from investors who believe the travel-tech wave is on the rise.

Navan: Company Background

Navan began in 2015 as TripActions. The company rebranded to Navan in February 2023 to reflect a broader product set that covers travel, payments, and expense management. The platform aims to unify booking, corporate cards, and expense reporting into a single workflow for business customers.

Over the years, Navan built partnerships and acquired local travel specialists to strengthen its global footprint. The firm also added AI capabilities to automate tasks and personalize travel choices.

Navan IPO Details

Navan priced its shares at $25 each on October 30, 2025. The company raised about $923.1 million in the IPO. The offering included 30 million new shares and about 6.9 million shares sold by existing holders. The listing gave Navan a market valuation near $6.2 billion, and the shares trade under the ticker NAVN on Nasdaq. Major underwriters included Goldman Sachs, Citigroup, and Morgan Stanley.

Market Context and Timing

Business travel has been recovering since 2024. Firms are again sending employees to meetings and conferences. That trend made late-2025 a logical time for a travel tech IPO. The U.S. IPO pipeline in 2025 showed more appetite for tech firms that demonstrate clear revenue growth. Navan’s filing and roadshow began in October 2025, signaling management’s confidence in demand for its shares. The timing also reflects investor interest in platforms that tie travel to corporate spend management.

Use of IPO Proceeds

The company plans to use proceeds to fund global expansion. Funds will go into Europe, Asia-Pacific, and other markets where enterprise travel is rebounding. Investment will also support product development. Navan has highlighted plans to expand its AI products and automation features. The company may also deploy capital for targeted acquisitions to add local distribution or vertical expertise.

Financial Performance and Growth Outlook

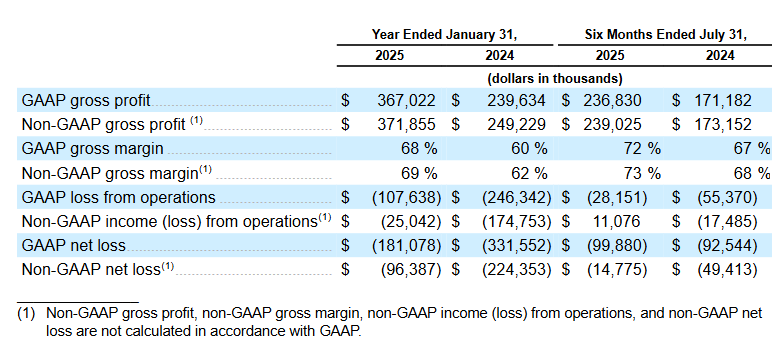

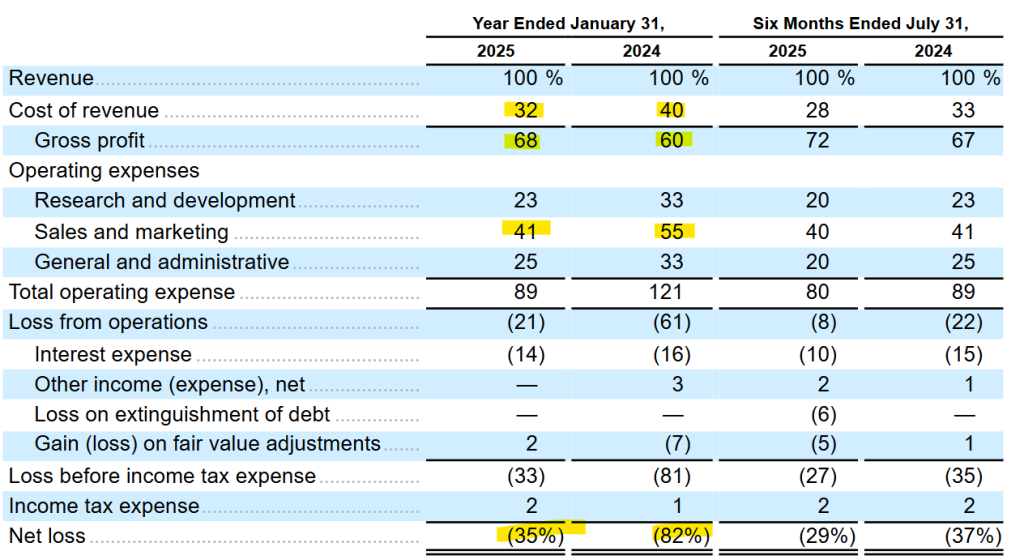

Navan reported strong top-line momentum in recent filings. The S-1 showed revenue growth but persistent losses tied to investment and financing costs. For 2024, management projected revenue in the high hundreds of millions, with notable growth in enterprise clients and payment volumes. Analysts now watch metrics like gross bookings, annual recurring revenue, and customer retention. Profitability will depend on scaling payments revenue and getting expense margins to improve as enterprise adoption rises.

Competitive Overview

The market includes legacy travel management companies and newer tech players. Competitors range from SAP Concur and American Express GBT to niche fintech-enabled platforms. Navan’s integrated model is a differentiator. It bundles travel booking with a corporate card and expense automation. That integration can simplify workflows for finance and travel teams. However, incumbents have deep client relationships and global reach. Navan must win business on product value and operational reliability.

Challenges and Risks

The recovery of corporate travel is uneven across regions and sectors. A slowdown in global growth or corporate hiring could curb demand. Data privacy and local regulation pose compliance risks when expanding abroad. Integration of payments and expense products brings operational complexity. The stock may face volatility after listing, especially if the market reassesses growth versus profitability. Finally, past higher private valuations set investor expectations about future performance.

Expert and Market Reactions

Market response to pricing showed solid demand. Reporters and analysts noted that the IPO, sized at about $923 million, signaled renewed investor interest in travel tech. Early coverage highlighted the company’s revenue growth and the clear product strategy that links travel to corporate spend. Some commentators flagged the gap between current valuation and peak private valuations seen in 2022. Trading in the first days will reveal how the market values Navan’s path to profit.

Navan IPO: Future Roadmap

Navan has signaled plans to push deeper into AI-driven automation and analytics. The company launched agentic AI initiatives earlier in 2025 to speed workflows and reduce manual tasks. Navan will likely roll out more finance controls, more airline and hotel content, and advanced reporting tools for CFOs. Expansion in Europe and Asia will focus on local partnerships and compliance. The firm may also use acquisitions to add niche products or regional teams. The ability to convert bookings into profitable payment revenue will be crucial.

Wrap Up

The Navan IPO on October 30, 2025, is a milestone for travel technology. The listing gives the company fresh capital to scale internationally. Success will depend on turning high growth into durable profits. Close attention should go to product adoption, payment margins, and regional traction. The first months of public trading will test investor patience and the strength of the travel-tech recovery.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.