Netflix Earnings: Streaming Giant’s Stock Dips 8% ahead of Q3 Results

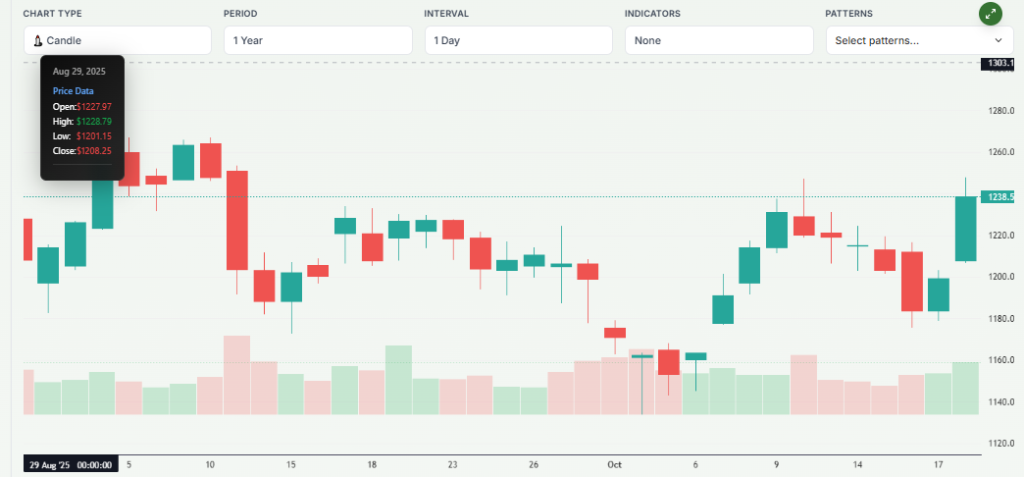

On October 21, 2025, Netflix, Inc. is set to release its third-quarter earnings results. Ahead of the announcement, the company’s stock has slipped about 8 percent. Investors are uneasy. They want to know if Netflix can keep growing and make its big bets pay off.

The streaming giant has been pushing into new areas like ad-supported plans and video games. But growth is harder now than it was at its peak. With so many eyes on what comes next, even a small misstep could shake confidence. In short, Netflix’s haul of new users, how much each one pays, and how fast ads bring in money all matter right now.

This report will look at what’s expected, what the risks are, and why this quarter might be more important than most.

Netflix Earnings: Market Reaction & Immediate Drivers

On October 21, 2025, Netflix shares opened under pressure. The stock slid roughly 8% ahead of the firm’s third-quarter report. Traders and investors showed clear nervousness. The move reflected high expectations and thin margins for error.

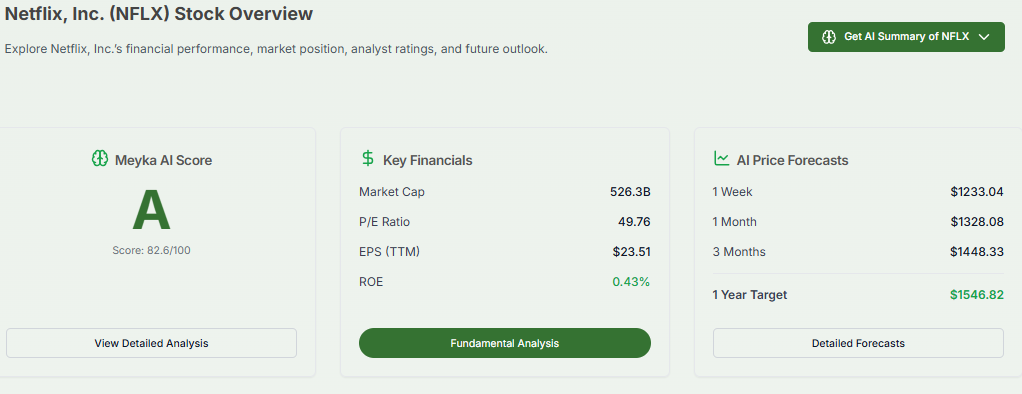

Options markets signaled a large expected swing tied to the earnings release. Some analysts pointed to stretched valuations after a strong 2025 run. Others flagged near-term catalysts, such as new ad partnerships and the success of recent hits. Short sellers and profit-taking also added to the selling pressure. The market was essentially asking a simple question: Can Netflix justify its valuation with evidence of durable growth?

What Investors Expect in Netflix Q3 Results?

Investors will watch several headline numbers. Revenue and adjusted EPS top the list. Analysts expect about $11.5 billion in revenue for Q3 and an EPS of around $6.96. Margin trends will matter too. Forecasts point to an improvement in operating margins as subscriber monetization improves. The ad business will be scrutinized.

Estimates suggest ad revenue remains a small slice of the total but is growing quickly. Wall Street will also look for commentary on content costs, marketing spend, and free cash flow. Management guidance for Q4 and for full-year 2025 will have an outsized effect on the stock. If guidance shows acceleration, the market could reverse some losses. If it disappoints, the selloff could deepen.

Netflix Subscriber Growth and Engagement

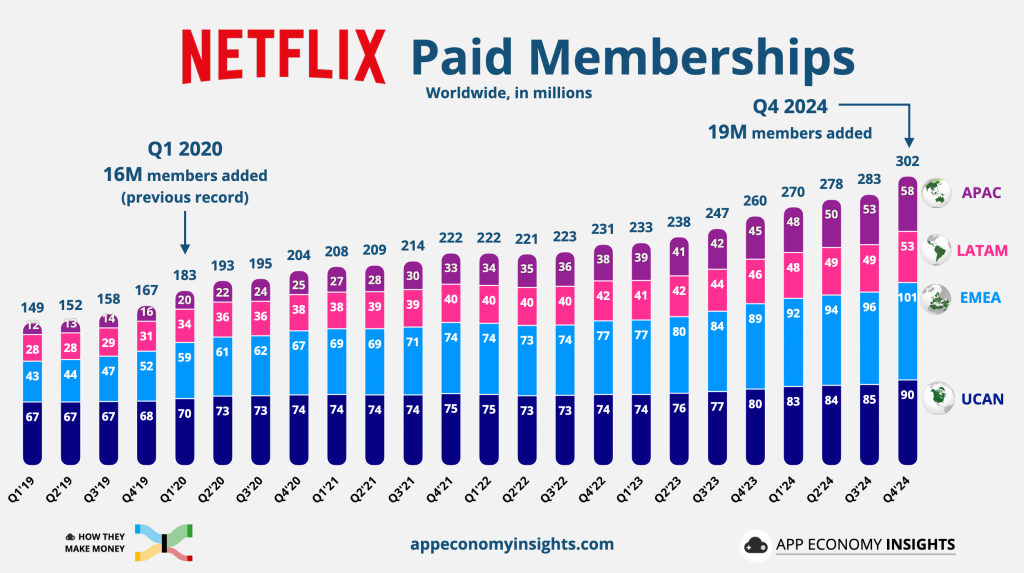

Netflix no longer emphasizes raw subscriber counts the way it once did. Yet user growth still underpins long-term upside. Analysts expect millions of net new subscribers in Q3, driven largely by the ad tier and international demand.

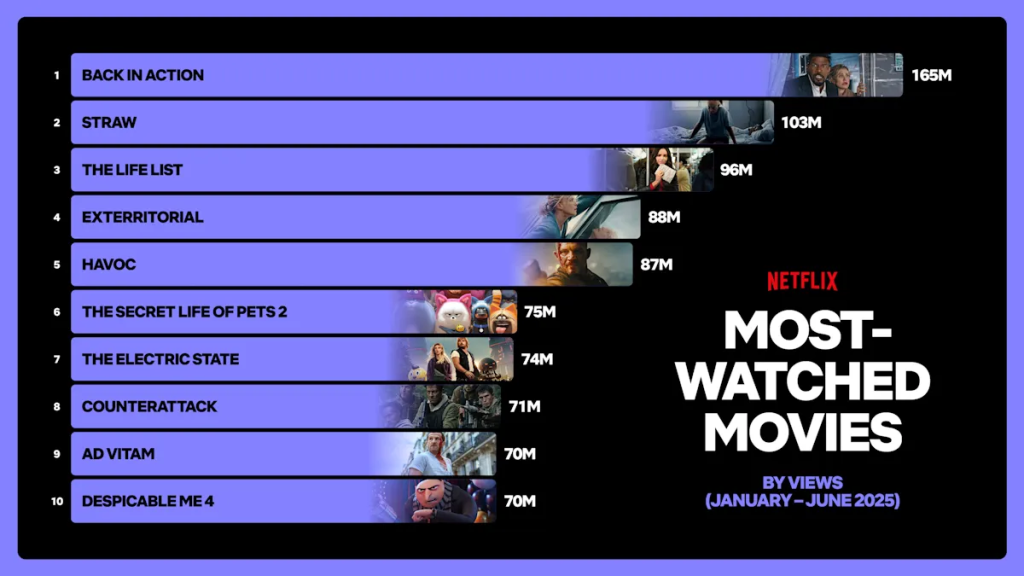

The ad tier now boasts tens of millions of users globally. That tier lowers friction to entry and fuels volume. However, engagement metrics are mixed. Gaming and short-form experiments have yet to move the needle materially on time spent. Some hit shows did boost signups and viewing hours in recent months.

Regional dynamics remain crucial. Growth in emerging markets can be rapid but brings lower ARPU. The U.S. and Canada market continues to deliver higher revenue per user. Investors will parse any regional breakdown provided in the release or the call for signs of sustainable momentum.

Netflix Earnings Mix ARPU, and Profitability

Revenue now comes from a blend of subscriptions and ads. The mix matters far more than the headline growth rate. ARPU will be a leading indicator of how well Netflix is monetizing the ad tier and higher-priced plans. Price increases implemented over the past year should lift ARPU if churn remains contained.

On the cost side, content amortization and marketing are the big levers. Higher content spend can depress near-term margins but drive future retention. Recent consensus models show margins improving versus last year. That suggests the market expects better monetization and cost discipline. Free cash flow generation will be closely watched because it signals whether the company can invest aggressively while still returning value to shareholders.

Strategy and Content Pipeline

Netflix’s strategy now spans multiple fronts. Ad-supported plans, global originals, live events, and games are all part of the roadmap. The ad partnership announced with major ad platforms promises broader reach and richer ad inventory.

Content remains the biggest single growth engine. Recent tentpole releases, including new seasons of popular series and event programming, can boost short-term subs and engagement. The company also experiments with merchandising and licensing to diversify revenue.

Competition is intense. Disney, Amazon, and local players keep pressure on content budgets and pricing power. Netflix’s comparative advantage is scale and data-driven content decisions. Execution will determine whether new initiatives like gaming scale enough to matter. Observers are using tools such as an AI stock research analysis tool to parse data and sentiment ahead of the call.

Risks, Surprises, and What Could Move the Netflix Stock?

Several things could move the stock dramatically. A miss on revenue or EPS would likely deepen the decline. Weak ad sales or a slowdown in ARPU growth would also be damaging. Rising content costs without commensurate engagement gains are another red flag. On the positive side, a clear acceleration in ad revenue or higher-than-expected subscriber additions would lift sentiment.

Management’s forward guidance will be pivotal. If the company raises the outlook or signals faster ad monetization, markets could reward the stock. Conversely, conservative guidance could trigger another wave of selling. Investors should watch the Q&A on the earnings call for clues about advertiser demand and content spending plans.

Final Words and Investor Takeaway

The October 21, 2025, Netflix earnings Q3 report is high-stakes. The prior run-up in price requires near-perfect execution. Investors will judge Netflix on growth quality, monetization of the ad tier, and margin improvement. The most important numbers are revenue, EPS, ARPU, and any regional splits offered. Management commentary on advertising traction and content cadence will determine how the market reads the results.

For traders, the options market implies a big move. For long-term holders, the quarter will show whether Netflix’s strategic bets can translate into durable cash flows. Monitor the release and the conference call closely. The stock’s next direction depends largely on the clarity of Netflix’s path to sustainable and profitable growth.

Frequently Asked Questions (FAQs)

On October 21, 2025, Netflix stock fell about 8%. Investors were worried about Q3 results, slower growth, and rising competition in the streaming market.

Analysts expect around $11.5 billion in Netflix earnings and higher profits in Q3 2025. Focus will be on new subscribers, ad-tier growth, and future guidance from Netflix.

Netflix’s ad-supported plan, launched globally in 2025, brings new users and ad revenue. It helps boost growth but may lower average revenue per user slightly.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.