Netherlands Offloads 46% Stake in TenneT Germany for $11.3 Billion

On September 24, 2025, the Dutch government announced it would sell a 46% stake in TenneT’s German unit. The deal is worth up to €9.5 billion, about $11.3 billion. This move is part of the Netherlands’ long-term plan to reduce its ownership in German energy infrastructure.

The buyers include Dutch pension fund manager APG, Norway’s sovereign wealth fund Norges Bank, and Singapore’s sovereign wealth fund GIC. TenneT Germany runs more than 14,000 kilometers of high-voltage power lines. It is the largest operator of high-voltage grids in the country. These lines are key to keeping the electricity system strong, especially as renewable energy grows.

The sale comes after a failed attempt last year to sell TenneT Germany to the German government. The Dutch government said Berlin may still buy a minority stake through state-owned lender KfW. Talks on this are expected to start soon.

This transaction could have a big impact on Europe’s energy market. It highlights the need for major investments to modernize power grids across the continent.

Background on TenneT and Its Significance

TenneT is a major player in Europe’s electricity network. It runs more than 25,000 kilometers of high-voltage lines in the Netherlands and Germany. In Germany alone, it manages around 14,000 kilometers, serving over 25 million people. The company also manages 19 offshore connections. These help bring wind and solar energy into the grid.

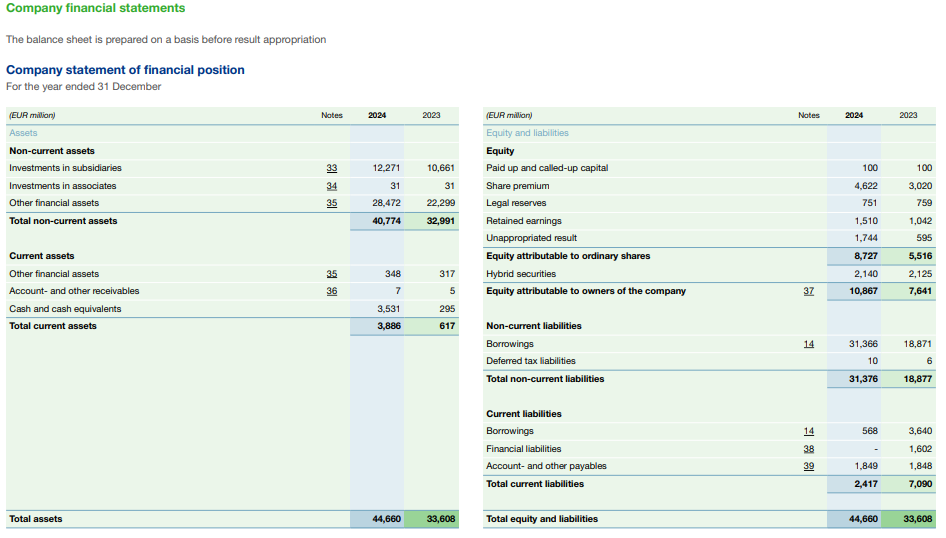

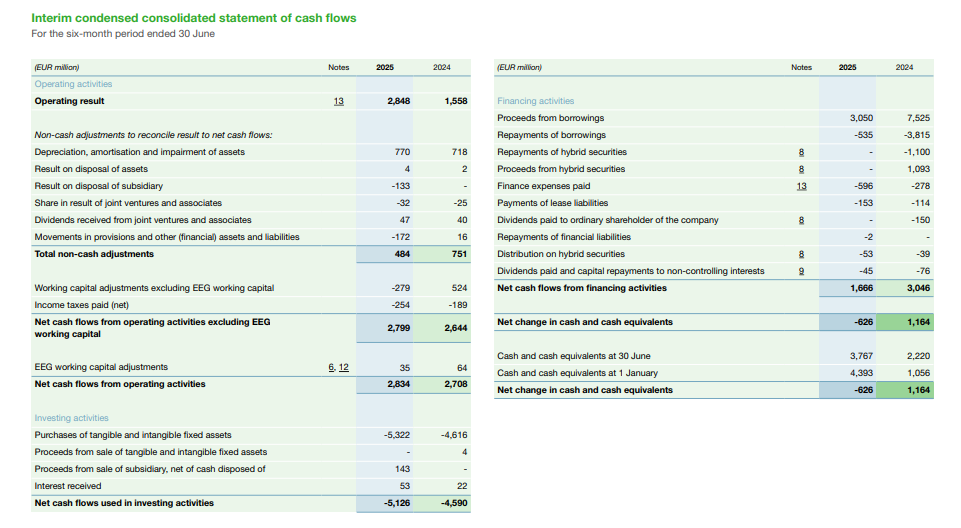

In 2024, TenneT earned €9.999 billion in revenue and had assets worth €21.783 billion. The Dutch Ministry of Finance owns the company, showing the Netherlands’ strong role in European energy.

TenneT’s work goes beyond national borders. It operates 17 interconnectors with neighboring countries, allowing electricity to move across borders. This helps balance supply and demand, especially as Europe increases its use of renewable energy.

The company is also involved in projects to improve the grid. One example is the “Grid Booster” in Germany, which boosts efficiency and reliability. These projects show TenneT’s focus on modernizing the network for a greener, more sustainable energy future.

Details of the Stake Sale

On September 24, 2025, the Dutch government announced the sale of a 46% stake in TenneT’s German division to a consortium of investors for €9.5 billion (approximately $11.3 billion). The buyer consortium comprises Dutch pension fund manager APG, Norway’s sovereign wealth fund Norges Bank, and Singapore’s sovereign wealth fund GIC.

This sale was executed through a private placement of new shares, raising €8.5 billion for TenneT Germany. The primary objective was to stabilize TenneT’s credit rating and protect the Dutch government’s financial position.APG is set to acquire approximately 11% of the stake, while the remaining 35% will be divided between GIC and Norges Bank.

The Dutch government’s decision to divest follows a previous attempt to sell TenneT Germany to the German government, which was unsuccessful due to valuation disagreements. However, Germany has expressed interest in acquiring a minority stake in TenneT Germany through state-owned lender KfW, with discussions expected to commence later in the year.

Financial and Market Implications

The sale of the 46% stake in TenneT Germany has several financial and market implications:

- For the Dutch Government: The €9.5 billion raised from the sale will bolster the Netherlands’ public finances. This move aligns with the government’s strategy to reduce exposure to energy infrastructure investments abroad.

- For TenneT Germany: The capital infusion will support the company’s expansion plans, particularly in enhancing grid infrastructure to accommodate renewable energy sources. This is crucial as Europe aims to meet its climate goals.

- For Investors: The involvement of institutional investors like APG, Norges Bank, and GIC underscores the strategic value of energy infrastructure assets. These investors are likely to benefit from stable returns, given the essential nature of TenneT’s services.

The transaction also signals a broader trend in Europe’s energy sector, where substantial investments are needed to modernize power grids and integrate renewable energy sources. Such investments are critical for achieving energy security and sustainability goals.

Strategic Implications for Germany and Europe

The sale of a significant stake in TenneT Germany carries strategic implications for both Germany and the broader European energy landscape:

- TenneT’s role in managing a vast network of high-voltage lines is pivotal for ensuring a stable and reliable electricity supply. The infusion of capital from the sale will enable TenneT to enhance its infrastructure, thereby bolstering energy security.

- As Europe transitions to renewable energy, the need for robust grid infrastructure becomes paramount. TenneT’s investments will facilitate the integration of renewable sources, supporting Germany’s and Europe’s climate objectives.

- The involvement of international investors in TenneT Germany may influence future energy policy decisions. Germany’s potential acquisition of a minority stake could further align the country’s energy strategy with European objectives.

This transaction underscores the importance of strategic investments in energy infrastructure to navigate the challenges of the energy transition and ensure a sustainable and secure energy future.

Expert Opinions and Market Reactions

The sale of a 46% stake in TenneT Germany has drawn attention from experts and analysts. Analysts see this move as positive for TenneT. The capital from the sale can improve the company’s financial stability. It will also support plans to expand and modernize the grid.

Investors are confident in TenneT’s future. Big names like APG, Norges Bank, and GIC joined the deal. Their participation can strengthen the company’s governance and guide its strategic decisions.

The public has mixed views. Many welcome the deal for its financial and strategic benefits. However, some worry about foreign ownership of key infrastructure. Discussions about Germany possibly buying a minority stake may help ease these concerns.

Overall, this transaction fits the trend in Europe’s energy sector. It shows the need for big investments. These investments will modernize grids and help bring more renewable energy online.

Final Words

The Dutch government’s sale of a 46% stake in TenneT Germany for €9.5 billion marks a significant development in Europe’s energy sector. The transaction provides TenneT with the capital needed to enhance its infrastructure, supporting the integration of renewable energy sources and ensuring a stable electricity supply. The involvement of reputable institutional investors underscores the strategic value of energy infrastructure assets.

As Germany considers acquiring a minority stake, the transaction highlights the importance of strategic investments in navigating the challenges of the energy transition and achieving sustainability goals.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.