Netweb Technologies Gains Spotlight on ₹450 Crore Order Win

On September 20, 2025, Netweb Technologies announced a big win. We learned that the firm secured a purchase order worth about ₹450 crore.

The deal is for their “Tyrone AI GPU Accelerated Systems”. Netweb will build major AI computing systems and deliver them by the end of the financial year 2025-26. We see this as more than just a sale. It marks Netweb’s growing muscle in India’s AI infrastructure race. Investors took notice. Shares jumped, hitting record highs.

Let’s explore what the order means for Netweb. We will look at its impact on market value, competition, and India’s push toward sovereign AI power. We will also consider risks ahead.

Company Overview

Netweb Technologies is an Indian firm that builds high-end computing solutions. These include AI systems, supercomputers, private cloud, data centre servers, storage, and enterprise workstations. It is known for designing and manufacturing much of its hardware in India, under the Tyrone brand.

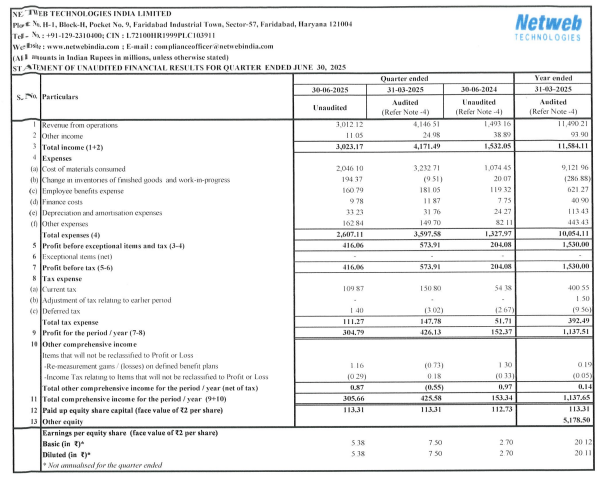

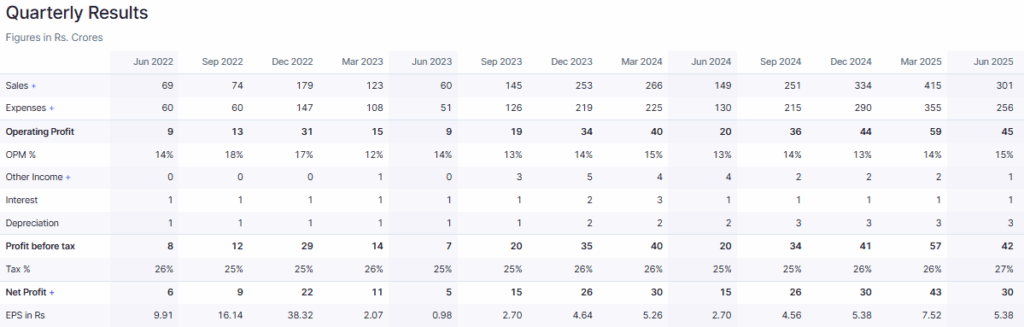

In Q1 FY26 (for the quarter ending June 30, 2025), the company’s revenue more than doubled compared to the same period a year ago. It reported an operating income of ~₹301.2 crore. Profit after tax also rose to ~₹30.5 crore from ~₹15.24 crore last year. This growth reflects strong demand for AI-led infrastructure and computing power.

Details of the ₹450 Crore Order

Netweb has secured a purchase order worth approximately ₹450 crore, excluding applicable taxes, for its Tyrone AI GPU-Accelerated Systems. The buyer is said to be “one of the largest Indian-headquartered global providers of technology distribution and integrated supply chain solutions, though the name is not publicly disclosed”.

The contract calls for the deployment of an AI infrastructure facility. Execution is expected by the end of the financial year 2025-26. This includes delivery of GPU-accelerated systems and supporting hardware/software to build up compute capacity.

Strategic Importance of the Deal

This order further strengthens Netweb’s position in India’s AI and HPC (High-Performance Computing) infrastructure market. It adds to a recent ₹1,734 crore order the company won earlier in September 2025, for servers built on NVIDIA’s Blackwell architecture under India’s sovereign AI mission.

The deal enhances the company’s revenue visibility. Large orders help with planning capacity, cost amortization, and margin stability. It also underscores Netweb’s role in India’s push for technology self-reliance, especially in AI/GPU infrastructure.

Market Reaction and Investor Sentiment

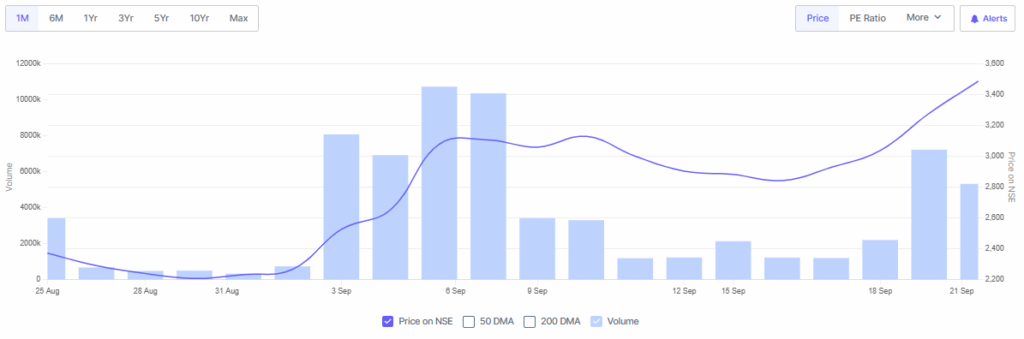

Shares of Netweb Technologies reacted strongly. On September 22, 2025, the stock rose by about 8.11% in intraday trading to touch a record high of ~₹3,545 per share.

Investors see the order as validation of the firm’s strategy. More attention is turning to how AI systems are becoming a larger part of Netweb’s revenue mix. In Q1FY26, AI systems contributed ~29% of operating income, up from a much smaller share earlier.

Analysts remain bullish, though some caution that high expectations demand strong execution. Valuation metrics are under scrutiny given the fast growth.

Industry Context: Growing Demand for HPC & AI Infrastructure

India’s AI and HPC segments are growing fast. Government programs like the IndiaAI Mission aim to strengthen compute capacity, sovereign hardware/software design, and the use of large language models.

Demand comes from many sectors: education and research, defense, finance, and healthcare. These sectors need massive computing power for simulations, data analysis, and model training. Netweb’s offerings align with these needs.

Globally, AI infrastructure is a competitive space. Firms that can integrate hardware, software, and services often win contracts. Netweb’s in-house capabilities in design and manufacturing give it an edge. But competition from global hardware giants remains.

Financial Outlook & Growth Projections

Netweb’s recent financials show strong momentum. Revenue in Q1 FY26 rose ~101.7% year-on-year. Profit after tax rose by ~100% compared to Q1 FY25.EBITDA also saw large growth, with rising margins.

Analysts project continued revenue growth of 55-65% or more over the coming years if AI demand stays strong. Its AI segment is expected to contribute an even larger share of revenues.

Order book size is also significant. As of now, Netweb has a pipeline of orders in the thousands of crores. Execution of the ₹450 crore deal will add to that pipeline.

Challenges & Risks Ahead

Execution risk is real. Delivering advanced GPU-accelerated systems at scale by end-FY26 will require smooth logistics, supply of components, reliable manufacturing, and effective deployment. Delays could hurt margins.

Dependence on large orders from the government or big institutions means revenue can swing. If some contracts are delayed or cancelled, it could hit forecasts.

Competition remains intense. Global firms with greater R&D budgets may introduce newer, faster architectures. Also, hardware commoditization could pressure prices.

Valuation risk also exists. Some analysts note that the stock might be overvalued if growth slows or margins compress. Investors will watch closely whether delivery matches the promise, often using AI stock analysis tools and AI stock research tools for deeper insights.

Future Outlook & Conclusion

Netweb looks positioned for a strong run. The ₹450 crore order adds another layer to its growth story. If it executes well, it can solidify its role as a key player in India’s AI infrastructure build-out.

Its in-house design, Make-in-India manufacturing, and product portfolio put it in a good place. The growth of AI demand in India, backed by government policies and rising enterprise adoption, offers fertile ground.

However, growth will only materialize if Netweb maintains discipline in execution, keeps up innovation, manages supply chains, and delivers value. If all aligns, this order could mark a turning point for the company and help it scale to much larger heights.

Frequently Asked Questions (FAQs)

On September 20, 2025, Netweb Technologies got a ₹450 crore order for its Tyrone AI GPU Systems. The deal will be completed by the financial year 2025-26.

On September 22, 2025, Netweb’s stock price went up over 8% in intraday trade. It reached an all-time high level of about ₹3,545 per share.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.