Netweb Technologies Shares Jump 9% After Securing Major Order

Netweb Technologies grabbed attention as its shares rose 9% in a single day. The jump surprised many investors and market watchers. This rise followed the company’s announcement of a major order, showing strong demand for its services. Such moves often signal confidence in a company’s future growth, not just short-term excitement.

This new order marks an important step for Netweb. It shows that its technology solutions are attracting large clients. The company has grown steadily over the years, but this deal strengthens its credibility in the market. Investors are now watching closely to see how Netweb executes the project, as success could lead to more business opportunities.

Let’s look at what this major order means for Netweb Technologies. We examine how the stock market reacted and what the company’s future may hold as it builds on this momentum.

About Netweb Technologies

Netweb Technologies India Ltd is a leading Indian original equipment manufacturer (OEM) that focuses on high-performance computing solutions. Founded in 1997, the company delivers advanced IT infrastructure, including servers, storage, and networking systems.

Over the years, Netweb has earned a strong reputation for engineering excellence and innovation. The company invests heavily in research and development, allowing it to provide solutions that meet the changing needs of clients. This focus on quality and innovation makes Netweb a trusted partner for government, education, and private sector projects.

Financially, Netweb shows steady growth. Its market capitalization currently sits around ₹13,690 crore. Despite market fluctuations, the company’s strategic moves and strong product portfolio have supported its resilience and continued progress.

The recent jump in Netweb’s share price, after announcing a major order, reflects growing investor confidence. This milestone highlights the company’s role in advancing India’s technological infrastructure and strengthens its position in the high-performance computing market.

Details of the Major Order

On September 3, 2025, Netweb Technologies announced a major order worth ₹1,734 crore. This deal is part of India’s IndiaAI Mission, which aims to strengthen the country’s artificial intelligence capabilities. The project will build a sovereign AI infrastructure, boosting India’s global position in AI.

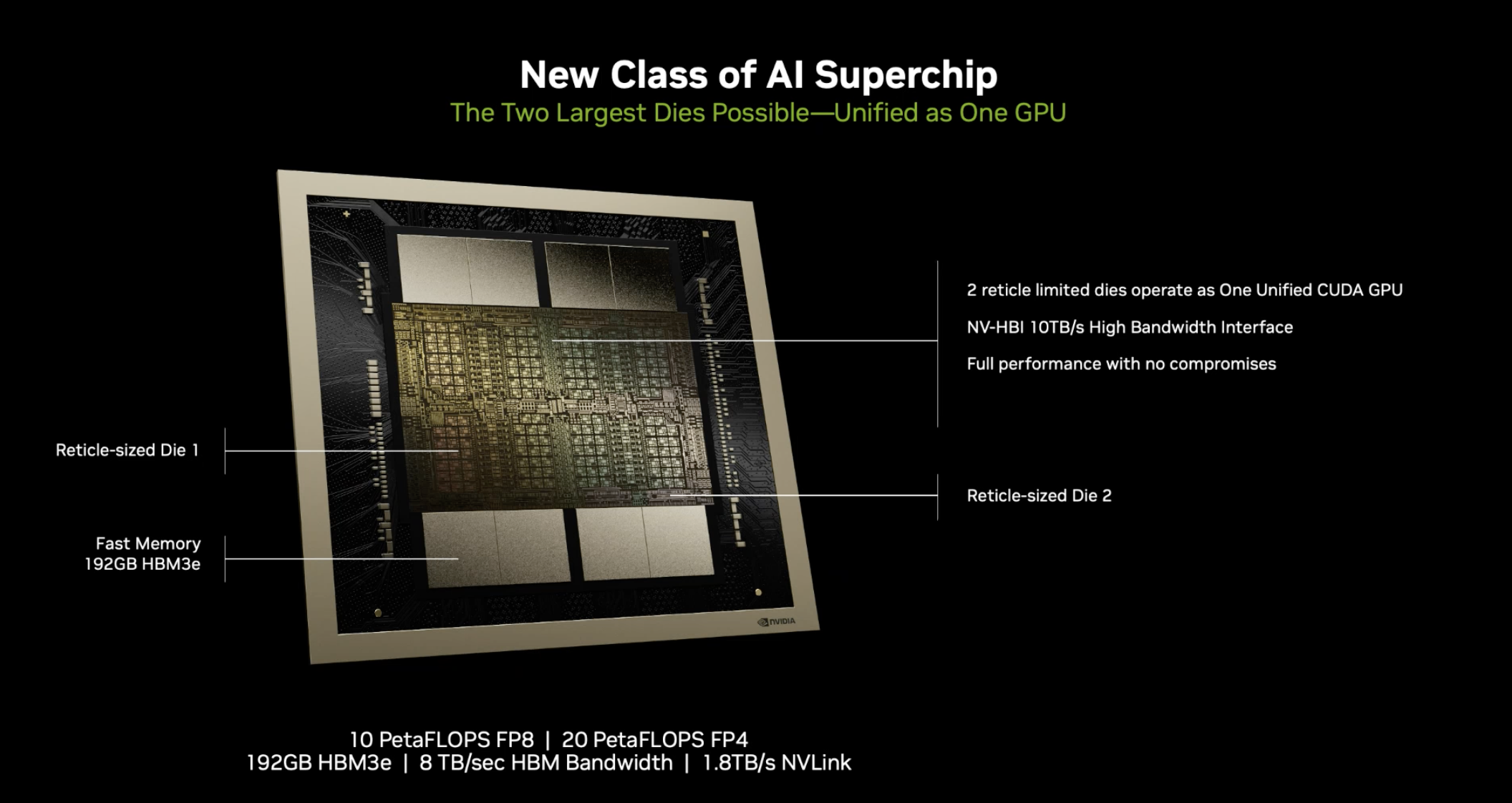

The order involves supplying advanced GPU-accelerated servers using NVIDIA’s Blackwell architecture. These servers can handle high-throughput, memory-heavy tasks, making them ideal for generative AI, foundational model training, and exascale computing.

Netweb will use its Tyrone Camarero AI platform to deliver the systems. The project is scheduled for the last quarter of FY26 through the first half of FY27. The financial benefits will be recognized during this period.

This order is strategically important beyond its financial value. It supports the government’s Make in India initiative, as the servers will be designed and built domestically. Netweb’s in-house research and development will play a key role, highlighting the company’s technical strength and innovation.

Stock Market Reaction

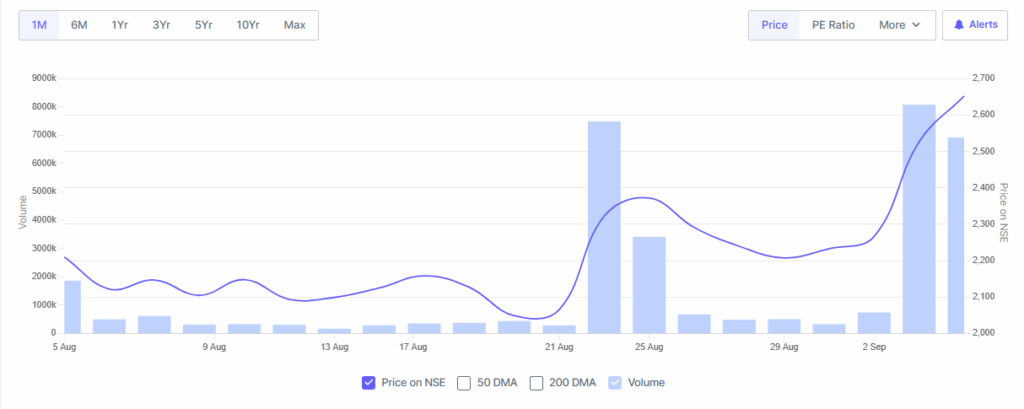

The ₹1,734 crore order announcement caused Netweb Technologies’ shares to jump sharply. On September 3, 2025, the stock opened at ₹2,355.90 and hit an intraday high of ₹2,464 on the NSE, rising about 9% from the previous close.

This surge shows investor confidence in Netweb’s strategy and the long-term potential of the AI infrastructure project. The company’s market capitalization also increased, reflecting positive sentiment in the market.

Analysts have highlighted the significance of the deal. Several SEBI-registered analysts estimate an upside of over 25% for Netweb’s stock. They cite the strategic value of the order and its alignment with India’s AI development priorities.

Strategic Implications for the Company

Winning this major order makes Netweb Technologies a key player in India’s AI infrastructure development. The project promises strong revenue growth and boosts the company’s credibility in high-performance computing.

Completing the project could lead to more opportunities in India and abroad. It shows that Netweb can handle large, complex projects, which may attract additional government and private contracts.

The deal’s alignment with the IndiaAI Mission and the Make in India initiative strengthens Netweb’s strategic position. It highlights the company’s dedication to national technological progress while promoting domestic innovation and manufacturing.

Expert Opinions / Analyst Insights

Industry experts have shown a positive outlook for Netweb Technologies after the major order announcement. Analysts emphasize the strategic importance of the project and its potential to boost the company’s growth.

The project’s use of NVIDIA’s Blackwell architecture highlights Netweb’s technological strength. It demonstrates the company’s ability to deliver advanced, state-of-the-art solutions. Partnering with a global tech leader also increases Netweb’s credibility in the high-performance computing market.

Challenges and Considerations

While the major order offers big opportunities, it also brings challenges. Completing such a large project requires careful planning and strong management to meet deadlines and maintain quality.

Risks include supply chain delays, complex technology integration, and the need for skilled staff to run and manage the AI infrastructure. Overcoming these issues will be key to achieving the project’s full benefits.

The high-performance computing sector is also very competitive and changes quickly. Netweb Technologies must keep innovating and improving its solutions to stay ahead and seize new opportunities.

Wrap Up

The recent jump in Netweb Technologies’ share price, after the ₹1,734 crore AI infrastructure order, marks a major milestone for the company. The project aligns with national priorities and establishes Netweb as a key player in India’s AI goals.

As Netweb executes the project, the focus will remain on tackling challenges, maintaining quality, and making the most of emerging opportunities. Completing the order could drive further growth and strengthen Netweb Technologies’ position in the high-performance computing sector.

Frequently Asked Questions (FAQs)

As of September 2025, Netweb Technologies India Ltd. has a promoter shareholding of 71.03%. Public shareholders hold the remaining 28.97%.

Analyses suggest that NETWEB shares are overvalued. The intrinsic value is estimated at ₹1,569.72, while the current market price is around ₹2,659.40, indicating a 41% overvaluation.

Analyst forecasts for NETWEB’s share price vary. One estimate sets a target at ₹2,558, with a range between ₹2,359 and ₹2,805.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.