New Zealand Shares Slip Amid Cautious Trading Ahead of US Fed Rate Decision

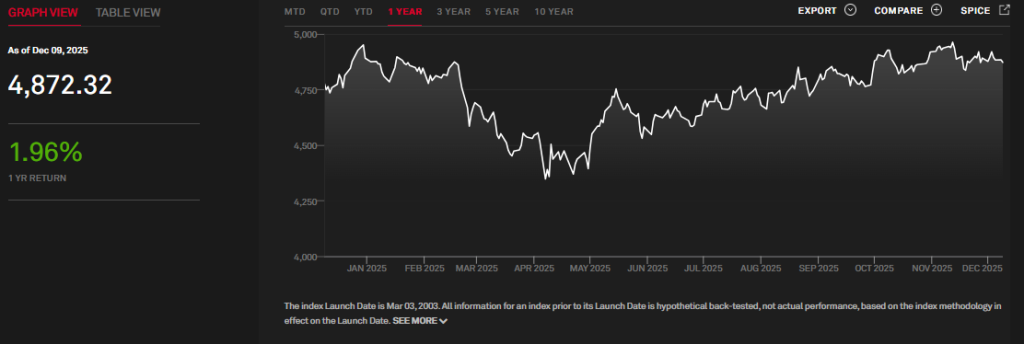

On Tuesday 8 December 2025, New Zealand shares slipped as traders paused ahead of the looming Federal Reserve (Fed) interest-rate decision.The main index, S&P/NZX 50, closed slightly lower reflecting a mood of caution rather than panic.

Investors are watching the Fed closely because its signal on U.S. rates tends to ripple through global markets. That in turn can affect the value of the New Zealand dollar, capital flows, and local company profits.

In a thin trading session, many opted to wait it out. Some held shares. Others are locked in cash. The result: quiet trading, modest losses, and nerves waiting for clarity.

This dip shows how closely tied New Zealand’s market is to global rate moves even before local fundamentals come into play.

Key NZX Movers: Winners, Laggards, and Outliers

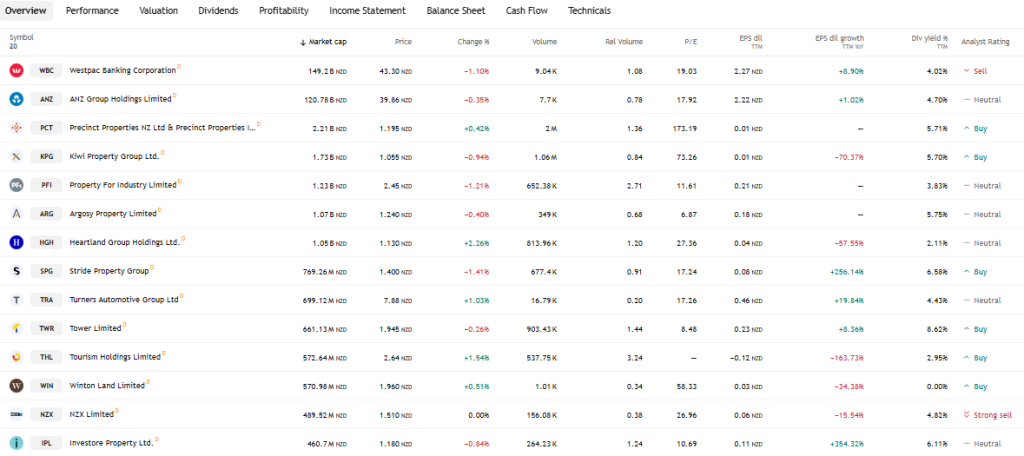

Trading on December 9, 2025, showed caution across the board. The S&P/NZX 50 slipped about 0.2% to roughly 13,455. Markets moved slowly. The volume was light. Large caps and industrial names led the slide. Vulcan Steel and Steel & Tube were notable decliners during the session. These shifts reflected short-term risk aversion rather than a broad sell-off.

Mid-cap stocks saw sharper intraday swings. Sectors such as distribution services and non-energy minerals recorded outsized moves. Some mid-caps reacted to changes in commodity prices and to currency swings. A few smaller names gained after sector-specific news, creating pockets of opportunity despite the overall dip.

Unexpected gainers included exporters and commodity-linked firms. Those companies benefit when the New Zealand dollar softens. Gains there partially offset pressure on rate-sensitive sectors. Technical traders pointed to these names as short-term hedges against a wider fall.

Why the US Fed Decision Matters More for NZ

The Federal Reserve meeting on December 9-10, 2025, set the tone for global markets. Fed expectations affect the US dollar and global rates. That, in turn, affects NZ dollar moves and capital flows to New Zealand. Fed futures showed strong odds of a 25-basis-point cut ahead of the meeting. Market pricing around that cut shaped investor behaviour in Wellington.

New Zealand firms often hold US-dollar debt. Changes in dollar strength alter borrowing costs. A Fed pause or hawkish tilt could push Treasury yields higher. That would raise funding costs worldwide. NZ companies with heavy leverage feel those changes fast.

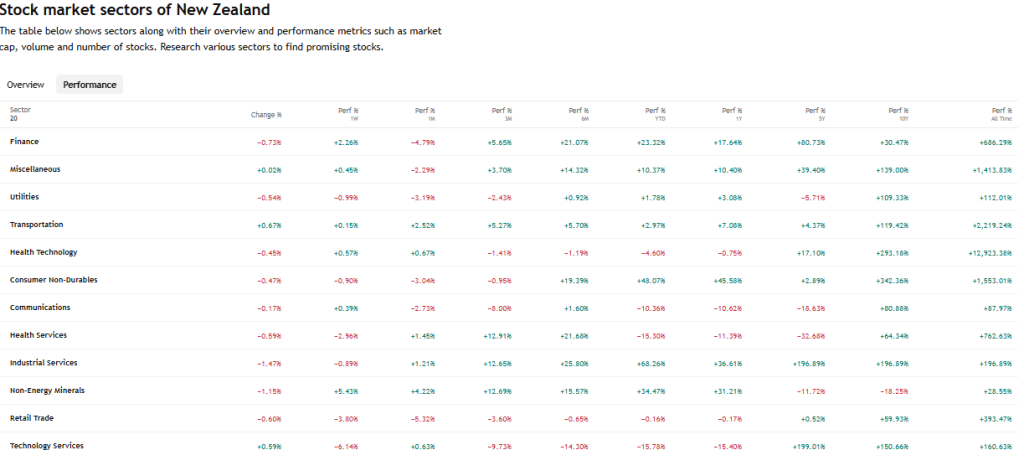

New Zealand Shares: Sector-By-Sector Breakdown

Property and REITs were among the most exposed sectors. Yields rose in the US and that lifted local funding costs. Higher yields compress property valuations. This pressure shows up quickly in listed real-estate trusts and developers on the NZX. Some REIT managers warned that refinancing costs may rise if rate complacency fades.

Export-led industries had mixed results. A softer NZD helps commodity exporters. Dairy and meat firms can see margin gains when the currency weakens. But the benefit depends on input costs and any USD-denominated debt. Companies with large offshore operations face both currency and shipping risks.

Energy and utilities showed defensive traits but traded lower with the market. Investors usually favour these names for steady cash flow. That buying paused as traders weighed global rate risk. Company specific news, such as contract wins or regulatory updates, still drove isolated moves.

Tech and growth stocks lost momentum. Liquidity concerns reappeared as investors priced the Fed’s path. Funding for growth companies is tied to global risk appetite. A perceived tightening in US policy reduces the pool of cheap capital available to local tech firms. This leads to earlier drawdowns than in larger markets.

Global Market Context: NZ Traders Watching Three Key Signals

US Treasury yields were a principal watchpoint. December brought a sharp move in long-term yields. That rise reduced room for risky asset rallies and made lenders more selective. NZ traders tracked the 10-year US yield closely to gauge capital cost trends.

Wall Street futures sent mixed signals through the NZ session. The futures market set the tone before the domestic open. When US futures fell, NZX sentiment turned defensive. Conversely, stable futures allowed selective buying in exporters and yield plays. Real-time monitoring of futures became core to intraday decisions.

Commodity prices also mattered. Dairy and metals remain key for NZ earnings. Shifts in those markets can offset exchange-rate pain. Traders scanned commodity feeds for any sudden moves that could flip sector outlooks.

Local Investor Behaviour: Themes Emerging Ahead of the Decision

Many investors chose cash or short-dated bonds. Short holdings protect capital while preserving optionality for a post-Fed move. Brokerage platforms reported higher buy orders for treasury bills and term deposits. This flight to liquidity was visible in reduced equity turnover for the session.

Analysts trimmed near-term earnings forecasts for certain sectors. The main concern was rising funding costs if the Fed proved slower to ease than markets expected. Research teams updated models and widened scenario ranges to reflect higher interest-rate uncertainty. Some used an AI stock research analysis tool to run stress tests on balance sheets and interest expense sensitivity

Retail investor activity cooled. Smaller investors often sit out ahead of major Fed events. Fewer retail trades were recorded on high-volatility names. This reduced depth amplified price moves on smaller cap stocks when institutional flows did shift.

Outlook After the Fed: New Zealand Shares

If the Fed holds rates, NZX may see a relief rally. A neutral Fed message could reduce short-term volatility. Banks and rate-sensitive sectors might recover some ground. Currency moves would likely be modest. Traders should watch immediate yield reactions for confirmation.

If the Fed signals earlier cuts, risk assets could rally. Lower US rates tend to weaken the dollar. A softer dollar often strengthens NZ-exporter profits in NZD terms. Growth and tech stocks might regain momentum. Foreign capital could re-enter NZ small caps seeking yield and growth.

If the Fed turns more hawkish, the NZX faces headwinds. A surprise hawkish stance pushes yields up. The NZD would likely rise, which can hurt exporters. Property and highly leveraged companies would feel the biggest strain. That scenario often leads to deeper sector rotation and selective risk management.

Strategic Takeaways for NZ Investors

Focus on balance-sheet strength. Companies with low leverage weather higher rates better. Favor firms with strong cash flow and predictable earnings. Consider exporters that can benefit from any NZD weakness. Monitor funding schedules for property and corporate borrowers to spot refinancing risk early. Rebalance portfolios to reduce concentrated exposure in rate-sensitive names. Use staged re-entry after clarity from central banks.

Bottom Line

On December 9, 2025, New Zealand shares traded with restraint. The Fed’s decision and messaging were the main drivers. Local moves reflected global forces as much as domestic trends. Traders should watch yields, the NZD, and company funding timelines. That trio will shape NZX direction in the coming days.

Frequently Asked Questions (FAQs)

New Zealand shares fell on 9 December 2025 because investors were careful before the US Federal Reserve decision. Many waited for clear guidance, which reduced buying and lowered prices.

The US Fed impacts the NZX by changing global interest rates. These changes move the US dollar and the NZ dollar, which then affect company costs, profits, and investor confidence.

Rate changes affect property firms, utilities, and tech stocks the most. These sectors depend on borrowing costs, so their prices move quickly when global interest rates shift.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.