New Zealand Shares Trade Flat Ahead of Crucial US Economic Data, SkyCity CRO Steps Down

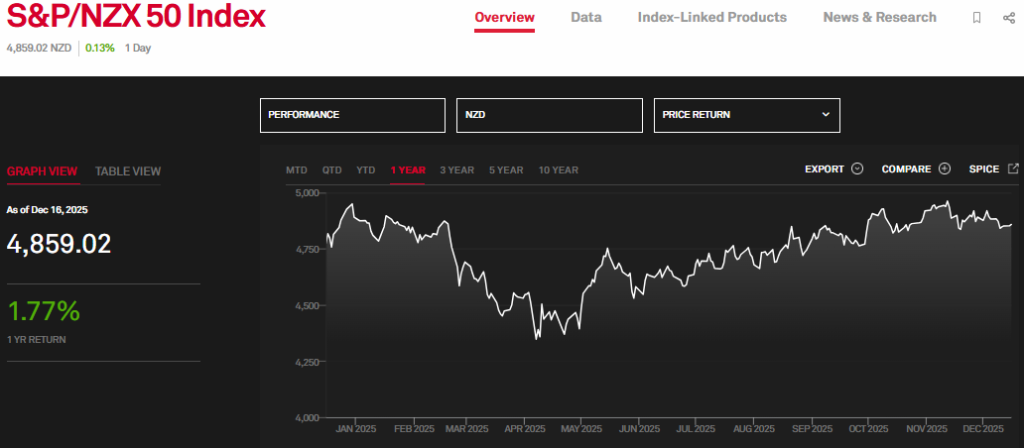

On 15 December 2025, New Zealand shares index, the S&P/NZX 50, barely moved. The market closed almost flat as traders waited for big US economic reports. These data will shape views on inflation, jobs, and future interest rates. Markets in New Zealand often move with global cues, especially from the United States.

At the same time, SkyCity Entertainment is again under the spotlight after a senior risk executive left the company. This adds a local story to the global market pressure. In a quiet trade session, these events matter more than normal price moves. Investors now face both global uncertainty and important company-level news.

This article looks at why New Zealand shares are flat, what the key US data could mean, and how leadership changes at SkyCity may influence confidence.

Market Mood Check: What “Flat Trading” Really Signals?

On 15 December 2025, New Zealand’s benchmark S&P/NZX 50 index saw a quiet session, with prices barely moving by the close. Trading remained shallow and cautious as local investors paused ahead of key global data days. Many industrial and tech service stocks weighed on the index, while some smaller gainers offered limited support.

Flat trading like this often shows hesitation. Investors hold off on big bets when they expect major economic reports. These reports, especially from the United States, help set expectations for interest rates. When markets are quiet, it is usually because traders are waiting to see if global trends will shift. The NZX’s sluggish session reflects this defensive stance.

In such conditions, short moves do not mean markets are weak. They can signal stability as traders weigh new information before acting. This sets the tone for the next trading days.

US Economic Data in Focus: Why NZ Investors are Watching Closely

New Zealand markets have been unusually still because global cues matter more now than ever. The US stock markets, including the S&P 500 and Dow, showed mixed performance in mid-December 2025 as investors awaited crucial data releases on inflation and retail sales expected around 16 December 2025. These figures are key for gauging future Federal Reserve action.

US data often influences currencies and bond yields worldwide. If inflation or jobs numbers surprise to the upside, markets may price in less chance of interest rate cuts. This can strengthen the US dollar and pressure other markets like New Zealand’s. The NZD and global equities typically respond to these shifts because they affect trade and capital flows.

Local traders closely follow these signals. A strong US report may push NZ investors toward safer assets. A weak number could lift risk appetite and boost NZX activity.

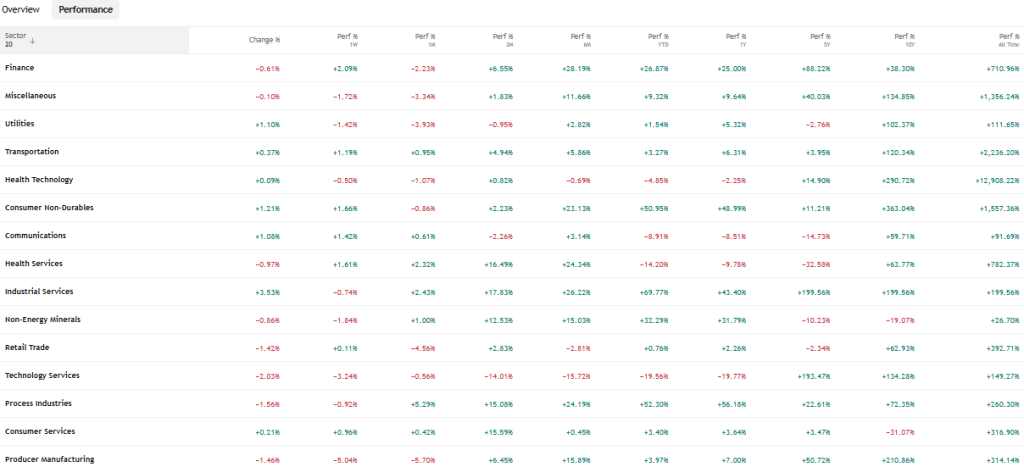

Sector Breakdown: Winners, Laggards, and Standouts on the NZX

During the flat session, some stocks showed movement, highlighting how different sectors reacted. Industrial and tech services stocks generally lagged, with names like Ventia Services and Gentrack experiencing notable declines.

Energy and materials sectors also faced pressure, while a few smaller companies bucked the trend. For example, ikeGPS Group recorded solid gains, and apparel company KMD Brands managed to edge higher.

Meanwhile, snapshot updates from 16 December 2025 suggest some NZX stocks were in positive territory by mid-session. Turners and a2 Milk held gains, and major utilities like Meridian and Mercury saw small rises. At the same time, names like Gentrack, Serko, and Oceania Healthcare showed weaknesses. This mixed performance reveals how stock-specific news and earnings can drive moves even in a quiet trading environment.

SkyCity Entertainment in the Spotlight: CRO Resignation Explained

In the midst of the flat trading environment, SkyCity Entertainment made headlines with a major leadership change. On 16 December 2025, the company announced that Chief Risk Officer Carolyn Kidd will resign, effective 31 January 2026. Her departure comes just as the company continues to address compliance and risk management enhancements across its New Zealand and Australian operations.

Kidd joined SkyCity in April 2023 and brought experience from major financial institutions. Her role included strengthening procedures in areas like financial crime controls and enterprise risk. SkyCity’s statement made clear the board plans to keep building on improvements already made.

This exit is significant because risk leadership is essential for regulated businesses like casinos. Investors watch these roles closely, especially when regulators have been active in reviewing compliance. Changes at this level can signal internal strategy shifts or reflect broader governance challenges, and they can influence confidence among shareholders.

Regulatory Overhang: Why Risk Leadership Changes Matter for SkyCity

SkyCity operates in a tightly regulated industry that demands strict compliance with anti-money-laundering and responsible gaming laws. In recent years, the company has faced scrutiny and enforcement actions related to these obligations. The CRO’s role in managing compliance frameworks is central to navigating these waters.

Investors often view changes in risk leadership as important governance signals. A smooth transition can reassure markets that the company is managing long-term risks well. But sudden or poorly explained departures sometimes raise concerns about internal issues or future costs related to regulatory compliance.

SkyCity has already dealt with other executive changes in 2025, including a CFO resignation in October, suggesting a period of strategic refresh.

Broader Corporate Governance Implications for NZ Stocks

Executive moves at prominent NZX companies like SkyCity have ripple effects. They remind investors that leadership stability matters for long-term planning and risk oversight. Many institutional and retail investors now incorporate governance quality into their decision-making models.

In a market already cautious because of global data uncertainty, governance news can amplify shifts in sentiment. When a major company reshapes its risk or finance teams, peers in related sectors may also see heightened scrutiny.

Currency, Commodities, and External Pressures

During this period, the NZD also showed limited direction, reflecting broader uncertainty about US rate decisions. While recent historical data show the kiwi often moves with US signals, unclear rate-cut prospects can leave it flat. Past episodes of mixed US inflation reports have left the NZD in a holding pattern.

Commodity prices and Chinese economic signals remain important for NZ exporters. China’s commitment to supportive fiscal policy earlier in December lifted some sentiment in Asian markets, but mixed global cues kept the Kiwi trading shallow.

What Investors are Watching Next?

Investors have their eyes on the US reports due around 16 December 2025, including retail sales and possibly inflation data. These will help clarify whether the Federal Reserve might cut rates in 2026 or maintain a tighter stance. Global equity reactions already show caution in big tech and cyclical sectors.

Locally, upcoming New Zealand economic data such as GDP and inflation figures will add to the picture. Traders watch key technical levels for the NZX50 to judge whether recent calm will break into volatility.

Closing Insight: Is Flat Trading a Pause or a Turning Point?

The NZX’s flat session in mid-December 2025 reflects a market in balance between waiting for global economic direction and digesting local company news. The combination of cautious trading patterns and meaningful leadership changes at SkyCity suggests a market that is alert but not yet driven to major moves.

Whether this quiet phase leads to a breakout or continues as consolidation will depend on upcoming data from the United States and local economic signals. Markets are in a pause, but the next releases could quickly shift sentiment and drive clearer trends.

Frequently Asked Questions (FAQs)

New Zealand shares are flat on 15 December 2025 as investors wait for key US economic data that may affect interest rates, global markets, and short-term risk sentiment.

US inflation, jobs, and retail sales data matter most, as they guide Federal Reserve policy and influence bond yields, currencies, and global investor confidence, including New Zealand markets.

SkyCity’s Chief Risk Officer resigned on 16 December 2025 amid ongoing regulatory focus, drawing investor attention to governance, compliance controls, and leadership stability at the company.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.