Nikkei Gains: Japan index nears 50,000 as Asian markets rally further

On October 21, 2025, Japan’s benchmark stock index Nikkei 225 edged gains closer to the 50,000-point mark, marking a striking surge in investor optimism. Markets across Asia are riding this wave, fueled by strong export performance, tech-sector strength, and a weaker yen that’s earning cheers from global buyers.

In Tokyo, the momentum reflects a deeper shift: Japan’s companies are posting solid earnings and investors are banking on reforms and growth. Meanwhile, other major Asian markets are likewise rallying, as traders chase opportunities in a region that is increasingly stepping into the spotlight. This climb of the Nikkei isn’t just a statistical blip it signals renewed confidence in Japan’s economy and Asia’s role in global finance.

In the following sections, we’ll explore what’s driving this rise, how the region is responding, and what risks lie ahead.

Background: The Nikkei’s Recent Journey

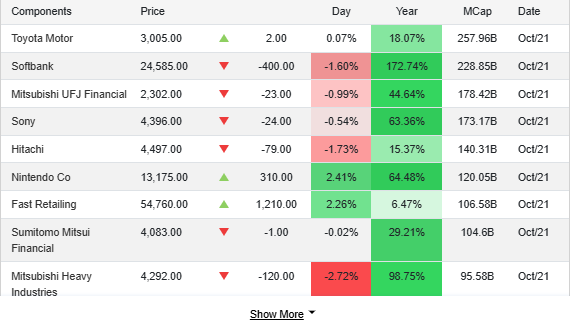

As of October 21, 2025, the Nikkei 225 has climbed sharply. The index reached record highs in recent sessions and moved close to the symbolic 50,000 level. This rise follows months of steady gains. Large exporters and tech firms have driven much of the move. Foreign buying has added fuel. Market commentary links the surge to political shifts and easing trade tensions that boosted risk appetite.

Key Drivers Behind the Nikkei Gains

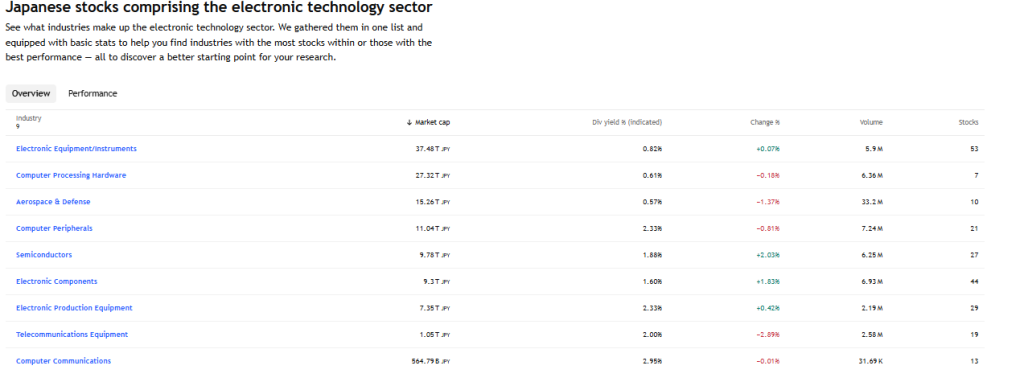

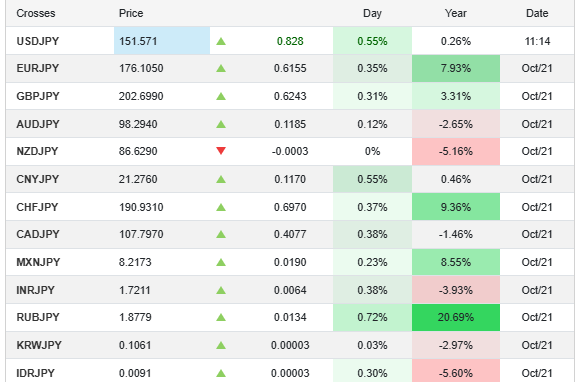

Technology firms pushed the market higher. Semiconductor and AI chip makers reported strong orders. Auto and industrial exporters also posted better sales forecasts. These results lifted investor confidence in corporate profits. A weaker yen helped exporters. The yen traded near the 151-per-dollar mark, making Japanese products cheaper abroad and boosting overseas earnings for listed firms.

Political change in Tokyo also mattered. Hopes for growth-friendly policies from incoming leadership encouraged risk-taking. In market reports, analysts used an AI stock research analysis tool to scan earnings and trend signals, which highlighted tech and export strengths.

Regional Context: Asia’s Broader Rally

The Nikkei gain came alongside gains across Asia. Hong Kong’s Hang Seng and South Korea’s Kospi both posted solid advances. China’s mainland indices rose as well. Traders pointed to easing trade tensions between the U.S. and China and expectations of policy support. Investors rotated into regional equities as global risk sentiment improved. This synchronous lift in Asian markets shows that the rally is not isolated to Japan. It reflects a wider shift in capital flows toward Asia.

Economic and Policy Factors in Japan

The Bank of Japan’s stance remains a key factor. Markets expect the central bank to stay cautious about raising rates quickly. That view supports equity prices and keeps the yen softer. The incoming government signaled plans for fiscal measures and reforms. Such steps can raise growth expectations if implemented well.

Corporate governance actions and higher shareholder returns have also attracted investors. Still, inflation above target complicates the picture. A weaker currency can push up import costs and lift consumer prices. Balance between growth and price stability will be watched closely.

Investor Sentiment and Market Outlook

Short-term sentiment is upbeat. Fund managers and retail traders show greater risk tolerance. Analysts revised some year-end targets higher after recent moves. However, caution exists. Key risks include a sudden yen rebound, global growth slowdown, or a setback in U.S.-China diplomacy. Earnings season will test optimism.

If companies deliver stronger profits, the rally can sustain. If not, profit-taking could trim gains. Market strategists note that technical momentum looks strong but that valuation stretches may prompt consolidation.

Sector Winners and Company Highlights

Technology and auto sectors stand out. Chip equipment makers and software firms linked to artificial intelligence saw large inflows. Major exporters reported improving order books for overseas markets. Financials lagged at times due to interest-rate sensitivity.

Energy and materials gained on commodity strength and strategic raw-material deals. These sector shifts show how structural themes AI adoption, auto electrification, and export recovery are reshaping Japan’s market leaders.

Risks and What could Derail the Rally?

Political headlines can quickly change market tone. Policy pledges do not always translate into action. A faster-than-expected global rate rise could damage high-valuation tech stocks. A stronger yen would cut exporters’ dollar profits when converted. Geopolitical tensions or a sharp slowdown in China would hit regional trade and corporate earnings. Credit stress or bank problems abroad can also spill over through financial channels. Investors should watch these triggers closely.

Global Implications

A sustained Nikkei rally signals deeper appetite for Asian risk assets. Global investors may shift capital toward markets with strong corporate earnings and reform momentum. A higher Nikkei can influence asset allocation in major funds and pension portfolios. It could also lift confidence in Japan’s role as an investment hub for technology and manufacturing. Cross-border flows may strengthen regional currencies, though the yen’s path will remain central to trade dynamics.

Wrap Up

By October 21, 2025, the Nikkei gains near 50,000 reflected more than short-term euphoria. Strong corporate performance, a weaker yen, and positive regional cues all played parts. Political shifts and trade optimism added momentum. The path ahead depends on earnings, currency moves, and global risk trends.

Markets may climb further if fundamentals hold. Conversely, shocks to growth or policy could slow the advance. Close monitoring of earnings and policy signals will be essential for investors who are watching whether this rally can turn into a lasting leg of Japan’s market recovery.

Frequently Asked Questions (FAQs)

On October 21, 2025, the Nikkei rose close to 50,000 points as strong tech profits, export growth, and a weak yen boosted investor confidence across Japan’s market.

A weaker yen makes Japanese exports cheaper overseas. This increases company profits when converted to yen, helping lift stock prices and support the Nikkei 225 index.

Experts say the Nikkei could rise further if earnings stay strong and policy support continues, but global risks or yen changes might slow the market’s momentum

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.