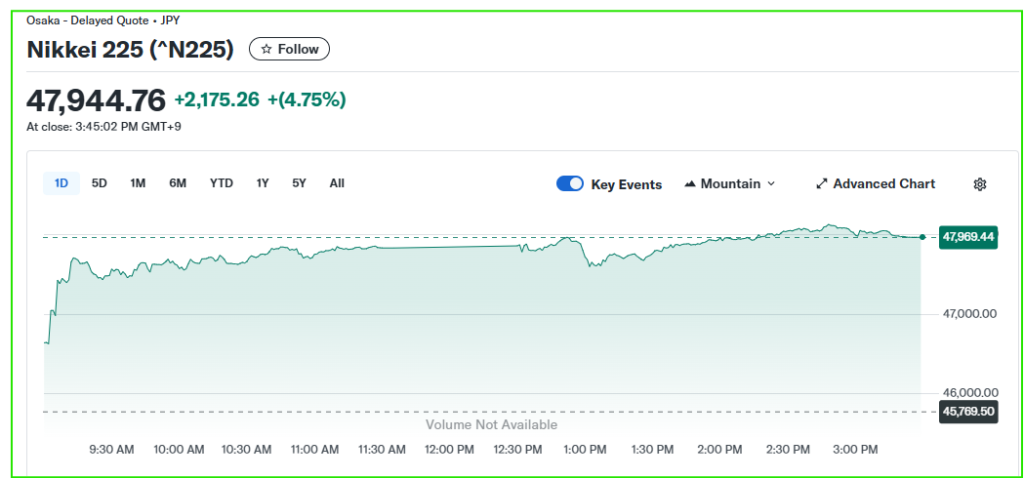

Nikkei Stock Index Soars 4.5% After Japan’s Ruling Party Picks Hardline Leader

The Nikkei Stock Index surged as investors reacted to the ruling party’s choice of a hardline leader, driving a big daily gain for Tokyo stocks. Traders welcomed the prospect of fiscal stimulus and market-friendly policy, while the yen weakened on expectations of looser monetary conditions.

The move rippled through Asian markets and pushed global risk appetite higher.

Nikkei Stock Index Soars on Leadership Shock

What happened in the Tokyo markets

Japanese stocks jumped sharply at the open, with the Nikkei posting gains in the high single digits intraday before settling around a 4.5% rise as traders priced in policy shifts. The surge pushed the benchmark to levels not seen in months, reflecting broad buying across sectors.

Which sectors led the rally

Defense contractors and industrials outperformed, given the new leader’s hawkish posture on security and spending. Automakers also rose after reports that trade tensions might ease, supporting cyclical names favored by global investors. Volume expanded as foreign demand increased.

Why did investors react so strongly? Markets saw the leadership pick as likely to bring fiscal support and clearer policy direction, which boosts corporate revenue outlooks.

Nikkei Stock Index and Policy Expectations

How the leadership choice affects the fiscal and monetary outlook

The new party leader is seen as more willing to back fiscal stimulus, which can lift growth and corporate profits. Markets quickly priced in a shift toward looser fiscal policy, easing fears about a slow domestic recovery. That pushed the Nikkei higher as investors rotated into cyclicals.

What this could mean for the Bank of Japan

Traders reduced bets on an early BOJ tightening cycle, lowering implied odds of a rate hike by year’s end. A dovish tilt from rates markets often helps local equities by making borrowing cheaper and supporting earnings.

Some desks used AI Stock research to scan order flows and gauge how policy signals would affect positioning across Tokyo and overseas desks.

Is a fiscal package guaranteed? No, but market pricing shows increased odds as investors reassess the new leader’s appetite for stimulus.

Nikkei Stock Index and Yen Movements

Yen reaction and currency impact on exporters

The yen slid sharply as traders weighed the policy mix, weakening against the dollar and boosting exporters’ earnings prospects in yen terms. A weaker currency often helps big exporters, further supporting the Nikkei’s rally.

How exporters and banks respond to currency swings

Export-heavy sectors typically gain on a softening yen, while banks may lag if long yields rise. Traders balanced sector bets based on sensitivity to exchange rates and long-term margin impacts.

Will the yen keep weakening? It depends on policy signals, BOJ guidance, and global dollar strength; volatility is likely near term.

Nikkei Stock Index in a Global Market Context

Asia and global markets follow Tokyo’s lead

The Nikkei move set a tone for the Asia Pacific session, though many markets were muted by regional holidays. Global risk assets rallied as traders digested both Japan’s political change and ripples from the US government shutdown, which pushed flows into stocks and alternative assets. Reuters and other outlets highlighted the broad market lift tied to political developments.

Cross border flows and investor positioning

Foreign investors appeared to pick up shares aggressively, a trend visible in higher trading volumes. Macro desks used AI Stock Analysis tools to model cross-border flows and their likely persistence into the next quarters.

Does this mean global markets are permanently upbeat? Not necessarily; sentiment can shift quickly on macro news, but today’s flows show renewed appetite for risk.

Nikkei Stock Index: Investor Sentiment and Market Mechanics

Retail versus institutional reactions

Institutional buyers, including asset managers and overseas funds, accounted for a large share of the move. Retail traders also stepped in, but institutions set the rhythm as they repositioned portfolios for potential fiscal-led growth. Coverage and market commentators noted that foreigners led much of the initial buying.

Trading volume and technical picture

Volume expanded on the up leg, with technical breakouts above key resistance prompting momentum traders to add positions. Analysts warned, however, that the market could see profit-taking if the policy narrative stalls. Short term, traders watch whether the rally broadens beyond cyclical leaders.

Is the rally sustainable? Sustainability hinges on whether policy signals turn into concrete measures and if global macro conditions remain supportive.

Nikkei Stock Index: Risks and What to Watch Next

Political risks and governance concerns

The new leader’s stance raises questions about fiscal prudence and BOJ independence, subjects investors will monitor closely. Any sign of political pressure on central bank policy could unsettle markets, even as near-term sentiment improves.

Key economic and market indicators to follow

Investors should watch: BOJ commentary, government spending announcements, yen moves, and foreign investor flows. Upcoming corporate earnings will reveal whether higher expectations translate into real revenue gains.

What are the immediate market risks? Rapid currency swings, policy missteps, and disappointing corporate updates could reverse some gains.

Social Signals and Market Commentary

Live reactions and social feeds

Market accounts posted fast takes as markets moved. See live tweets for color and instantaneous reads:

These capture trader sentiment and quick reactions from global desks.

How analysts are framing the story

Commentators point to a mix of policy optimism and technical momentum as the twin drivers of the Nikkei’s jump. Many emphasize that markets are pricing probabilities, not guarantees, and that investors should watch the policy rollout for confirmation.

Conclusion

The Nikkei Stock Index surge reflects a sharp re-rating of Japan’s growth and policy outlook after the ruling party picked a hardline leader. The market’s move ties to expected fiscal support, a weaker yen that helps exporters, and increased foreign buying.

Risks remain: BOJ signals, political pressures, and the pace of concrete policy measures will determine if gains hold.

For now, investors will be watching Tokyo closely, as well as global cues that can either reinforce or undo the rally. Use confirmed policy announcements and flow data to guide positioning in the days ahead, and monitor the next BOJ comments for clarity. AI Stock sentiment scanners may help traders track momentum in real time.

FAQ’S

The Nikkei Stock Index rose due to strong investor sentiment following Japan’s ruling party selecting a new hardline leader, which fueled expectations of fiscal stimulus and policy support.

A weaker yen boosts exporter profits, making their stocks more attractive, which often pushes the Nikkei higher. Conversely, a strong yen can drag the index down.

The Nikkei Stock Index is gaining from foreign inflows and policy optimism, but risks like yen volatility and global market uncertainty still remain. Investors should watch upcoming policy announcements.

Industrials, exporters, and defense-related stocks are leading the rally, supported by expectations of higher government spending and favorable currency movements.

The sustainability depends on concrete fiscal measures, corporate earnings, and global market trends. If policy support follows through, the rally may extend further.

Disclaimer

This is for information only, not financial advice. Always do your research.