NVDA News Today: AI Boom Has Just Begun, Says Nvidia CEO

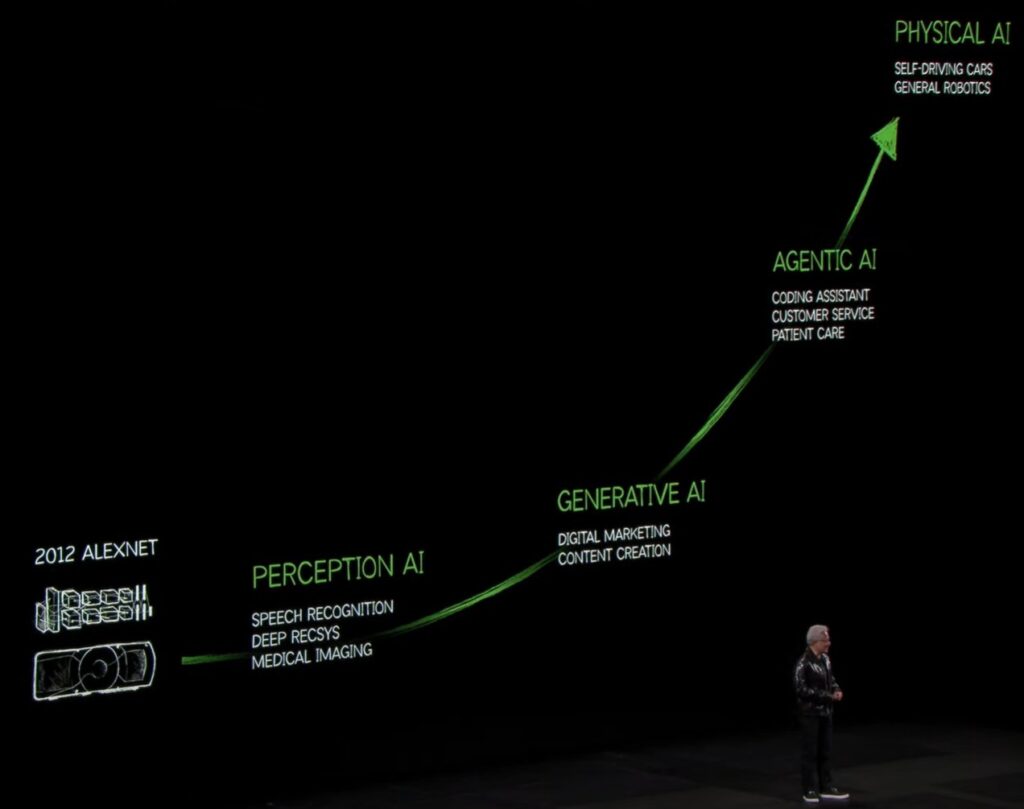

Artificial intelligence is no longer a future idea. It is here, shaping how we live, work, and connect. At the center of this change stands Nvidia, the chipmaker powering the most advanced AI systems. Recently, Nvidia’s CEO made a bold statement: the AI boom has just begun. This view is not only about technology. It reflects the way entire industries are now being rebuilt around AI.

We see hospitals testing AI for faster diagnosis. Banks are using it to detect fraud in seconds. Retailers track customer behavior with smarter tools. Even governments are building national AI projects. All these changes need one thing: massive computing power. That is where Nvidia comes in.

As we look at this moment, the message is clear. AI is moving from research labs to daily business use. It is still early, and growth potential is huge. Let’s analyze Nvidia’s role, the CEO’s vision, and what the AI wave means for investors, companies, and society.

Nvidia’s Leadership in AI

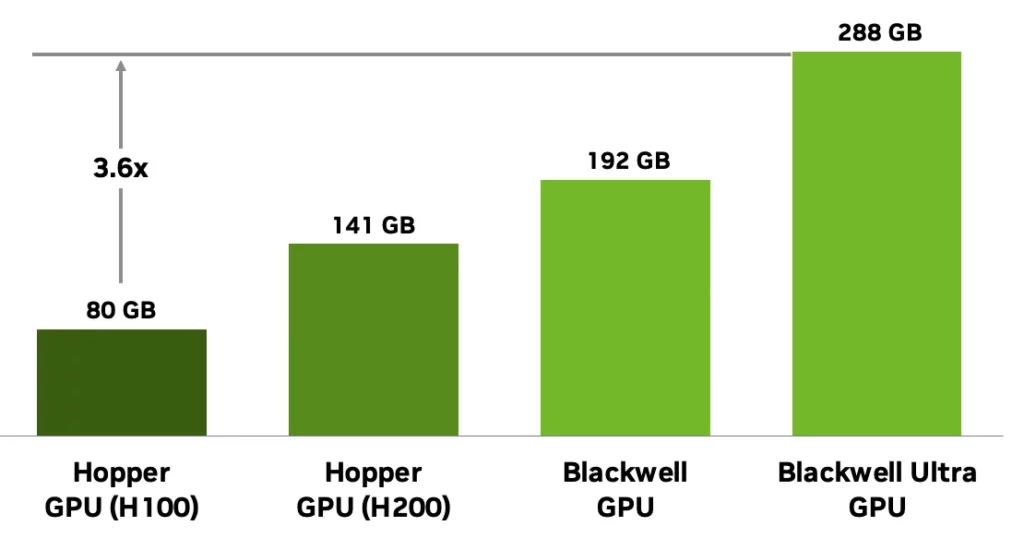

Nvidia leads the market for AI compute. Its GPUs power large language models and many other AI systems. The company turned GPUs from gaming parts into data-center engines. The Blackwell family of chips followed Hopper and showed big jumps in speed and efficiency.

Nvidia also bundles software and tools that make it easier for companies to run AI. Cloud providers and big enterprises buy Nvidia hardware and software for training and inference tasks. The close ties to hyperscalers and enterprise software make Nvidia central to AI deployments.

CEO’s Vision: Why the AI boom has Just Begun?

Nvidia’s CEO says the AI era is still at its start. He argued that much of the world has yet to adopt AI at scale. He described the coming years as a major build-out of computing and data centers. The company projects trillion-dollar levels of infrastructure spending by 2030. The CEO called the opportunity “multi-trillion dollars” over the next five years and said demand for advanced chips will keep growing. His tone was confident even after investors reviewed the latest forecast.

Financial Performance and Market Impact

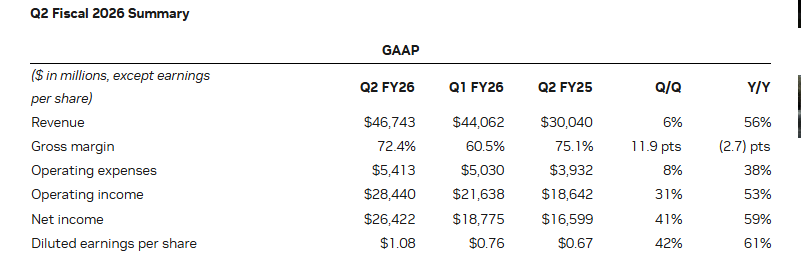

Nvidia posted a record quarter with roughly $46.7 billion in revenue. Profits also rose strongly year-on-year. Data center revenue remains the biggest driver. Still, the stock fell after management gave a cautious near-term outlook. Traders reacted to signs that year-over-year growth may be slowing from the blistering pace of the past two years.

Analysts say the company is still profitable and growing, but the market is sensitive to guidance and China risk. The earnings call drew attention because it mixed classic strength with softer near-term signals.

Global AI Ecosystem and Demand Drivers

Training modern models takes huge pools of compute. Firms building big models buy racks of GPUs and larger networks. Hyperscalers are expanding data center capacity and custom racks. Startups and old-line companies alike need AI inferencing in production. Even nontech sectors like healthcare and finance are designing AI projects that use heavy computing.

Countries are also funding sovereign AI programs and data infrastructures. All of these forces push demand for high-performance accelerators and the networking and storage that support them.

Challenges and Risks Ahead

There are real limits and risks. Export controls and trade tensions restrict some chip sales to China and complicate forecasts. Nvidia reported no H20 shipments to China in the quarter, and regulatory rules have affected how the company approaches that market.

Competition is intensifying. AMD, Intel, and custom chips from cloud providers aim at parts of the same market. Supply constraints and scarce advanced packaging capacity can also slow deliveries. Finally, investor expectations are very high. That raises the chance of sharp stock moves if results or guidance disappoint.

Investor Outlook: What to Watch Next?

Key things to track include Blackwell demand and enterprise adoption beyond early pilots. Watch data center orders, cloud contracts, and any updates on export licenses for higher-end chips. Software traction is also important. Broad adoption of platforms like NVIDIA AI Enterprise could boost recurring revenue and make sales stickier.

Keep an eye on capital returns like the buyback program and on any push into networking and storage solutions. Analysts will watch margins, the pace of shipments to large customers, and how the company manages China exposure.

Wrap Up

Nvidia sits at the heart of the AI build-out. The CEO’s message was clear: the big wave of AI spending lies ahead. The company has strong products, deep cloud ties, and a broad software stack. Still, trade limits, competition, and sky-high expectations create real risk.

For investors and customers, the period ahead offers large opportunities and likely volatility. Close attention to data center demand, regulatory moves, and product rollouts will be essential to judge how fast and far this AI boom runs.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.