Nvidia Stock News: Nvidia Earnings Hit Record High Despite AI Bubble Concerns Trade War Risks

The story begins with Nvidia’s record-breaking Q2 2025 earnings, $46.74 billion in revenue, and adjusted earnings per share of $1.05. Yet despite these stellar results, shares slipped as investors grew wary of a potential AI bubble and mounting trade war tensions between the U.S. and China. This sharp contrast between financial success and market anxiety frames the deeper analysis ahead.

Nvidia Earnings: Record Revenue Meets Investor Caution

Nvidia delivered a blockbuster quarter with 56 percent year-over-year revenue growth to $46.7 billion, beating Wall Street expectations, and profits soared nearly 60 percent to $26.4 billion. Yet the stock slipped after hours, weighed by worry over slowing data center demand and general fear of an overhyped AI wave.

Why is that happening, exactly?

Investors are cautious because Nvidia’s guidance projects $54 billion in Q3 revenue, a strong forecast but lacking any assumed H20 chip sales to China, due to lingering U.S. export restrictions and uncertainty about trade conditions. That omission highlights how trade war dynamics threaten revenue growth even in a booming AI market.

Historical Context of Nvidia’s Growth

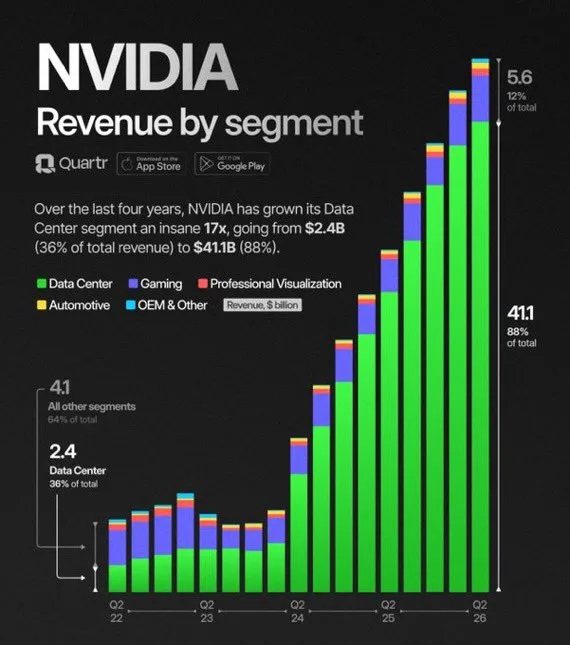

Over the past five years, Nvidia has gone from being a leading gaming GPU supplier to the backbone of the global AI economy. In 2020, quarterly revenue stood at just $3.87 billion, a fraction of today’s $46.74 billion.

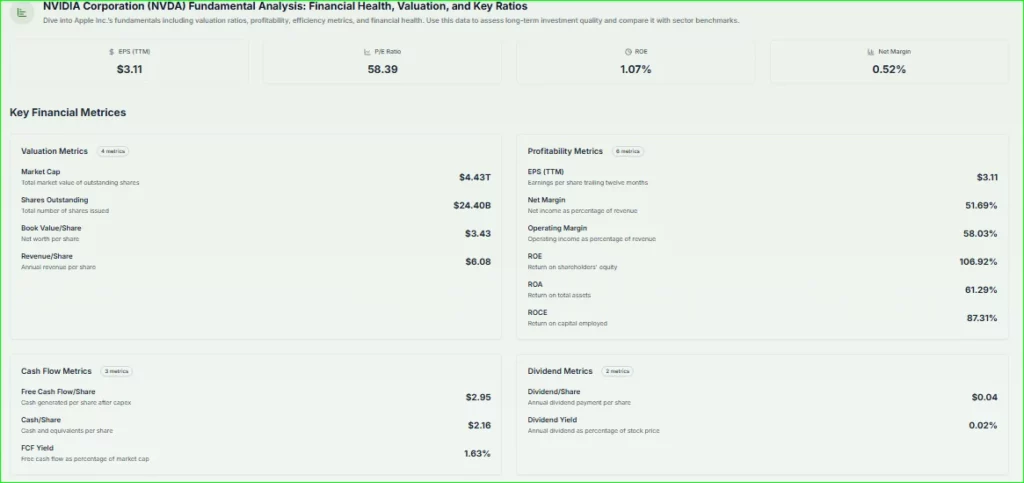

Its market capitalization crossed the $1 trillion milestone in mid-2023 and surged past $4 trillion in 2025, a pace of value creation rarely seen in tech history. This meteoric rise explains both Wall Street’s enthusiasm and its anxiety: the speed of this speed raises the question of how sustainable Nvidia’s dominance truly is.

Is the AI Bubble real?

What’s fueling worry about an AI bubble? Nvidia’s market cap, now over $4 trillion, reflects immense investor enthusiasm, but some analysts warn valuations may be pricing in decades of AI growth all at once, which can feel bubble-like.

Wall Street remains split: some investors see Nvidia as a long-term infrastructure leader; others fear overly optimistic sentiment could unravel if growth stalls or starts to moderate.

China trade tensions remain a crucial risk

Geopolitical headwinds are real. Nvidia reported no China H20 chip revenue this quarter, reflecting ongoing US-China trade restrictions. Although a revenue-sharing agreement was arranged, many analysts say recovery will take time.

Moreover, constraints may accelerate China’s domestic AI chip production, reducing Nvidia’s long-term share. That underlines how trade policy is a key variable in Nvidia’s financial trajectory.

Breakdown of Revenue Segments

While Nvidia’s data center revenue dominates headlines, its other segments continue to play key roles. Gaming revenue contributed roughly $3.4 billion, professional visualization generated about $750 million, and automotive chips added another $1.2 billion.

This shows that although AI data centers are the primary driver, Nvidia maintains a foothold across diverse industries. The company’s ability to spread its technology across gaming, design, and self-driving cars ensures that it is not entirely dependent on one stream of growth.

Nvidia’s dominance has not gone unchallenged. AMD is aggressively pushing its MI300 series chips, Intel continues to invest in Gaudi accelerators, and several AI-focused startups are building custom silicon. In parallel, hyperscalers like Google, Microsoft, and Amazon are accelerating development of their own in-house AI chips to reduce reliance on Nvidia.

While Nvidia remains the industry leader, the competition is intensifying, raising questions about whether its massive margins can hold over the long term.

Global Demand Signals

AI infrastructure spending is no longer confined to the United States and China. Europe is investing heavily in sovereign AI projects, the Middle East is building large-scale AI hubs tied to its energy wealth, and India is positioning itself as a cost-effective hub for AI research and deployment.

Nvidia’s chips are central to all these efforts, but trade restrictions and geopolitical friction could limit how far its reach extends in certain regions.

Social chatter: how traders and analysts see it

On X, insights surfaced that capture market sentiment. According to The Kobeissi Letter, Nvidia’s options market priced in a 6.1 percent post-earnings implied move, signaling cautious optimism

Another post pointed out that, despite trade war strains, Nvidia still shipped $5.5 billion worth of chips to China in Q1 2025, underscoring China’s long-term importance

These posts help us understand how options traders and analysts are balancing optimism and caution at the same time.

Valuation and Investor Behavior

Despite record profits, investors are wary of Nvidia’s sky-high valuation. The company trades at a forward price-to-earnings multiple of nearly 55, far above the historical average for chipmakers. Even with stellar revenue growth, some analysts warn that the stock price has run ahead of fundamentals.

This disconnect between financial results and investor behavior explains why shares dipped despite blowout earnings, a sign that Wall Street is pricing in perfection and fears any stumble could spark a correction.

Sustained AI demand but slowing growth signs

Despite data center revenue setting records at $41.1 billion, analysts noted it came just below estimates, indicating demand might be normalizing after earlier hypergrowth.

That echoes broader signs, such as slowing sequential revenue growth and a broader narrative of AI funding still strong, but investor enthusiasm already starting to moderate.

Macro Impact

Nvidia’s results ripple far beyond its own balance sheet. The company’s earnings have become a bellwether for the entire Nasdaq, and its $4 trillion valuation makes it one of the heaviest weights in the S&P 500. Strong results boost confidence across the broader tech sector, while any stumble could shake investor sentiment globally.

At the same time, AI startups benefit from Nvidia’s success, as surging chip demand validates their business models and makes it easier to secure funding.

Why it still matters, for markets and AI infrastructure

Nvidia’s importance extends beyond its own results. It accounts for over 7 percent weight of the S&P 500, so its performance often moves the entire index. If Nvidia underperforms, market sentiment can be shaken; if it beats again, the AI trade may get another boost.

Moreover, Nvidia’s Blackwell GPU ramp-up and the roadmap for Rubin show continued technological leadership. That gives investors confidence, even amid concerns, that Nvidia remains central to AI infrastructure.

Future Risks Beyond Trade War

Beyond trade tensions, Nvidia faces several structural risks. Its dependence on TSMC for advanced chip manufacturing means any supply chain disruption in Taiwan could severely impact production.

The massive energy requirements of AI data centers are also drawing regulatory scrutiny, particularly in Europe, where environmental concerns are rising.

On top of that, R&D spending continues to climb as Nvidia competes for top engineering talent, an arms race that could pressure margins in the years ahead.

Conclusion

In summary, Nvidia Earnings have shattered records thanks to surging AI and data center demand. However, investor caution around an AI bubble and trade war uncertainties, especially for China exposure, tempered the stock’s reaction. Nvidia’s financial strength, product pipeline, and market leadership are real, but so are the risks.

If Nvidia can sustain momentum and manage geopolitical headwinds, the company may continue to justify its lofty valuation. Otherwise, we may see recalibration in AI valuations more broadly. For now, Nvidia’s earnings are a decisive checkpoint in the future of the AI economy, driving optimism and skepticism in equal measure.

FAQ’S

Nvidia shares fell despite record results because investors are worried about an AI bubble, U.S.–China trade tensions, and stretched valuations. Strong earnings don’t always guarantee stock gains if market sentiment shifts.

Yes, analysts often expect Nvidia to beat earnings estimates due to strong AI demand, but guidance and external risks can influence the reaction more than the headline numbers.

Buying before earnings is risky. While Nvidia has a history of beating expectations, volatility around announcements can cause sharp swings up or down.

Some bullish analysts believe Nvidia could hit $1,000 if AI growth sustains, but risks like regulation, competition, and slowing demand could delay or prevent that milestone.

Critics argue Nvidia trades at high multiples compared to peers, suggesting overvaluation. Supporters counter that its leadership in AI chips justifies the premium.

Nvidia’s stock usually dips when growth fears, trade restrictions, or bubble concerns overshadow its strong earnings performance, triggering profit-taking.

Yes, many forecasts point to continued growth fueled by AI adoption, cloud demand, and gaming. However, market corrections and external risks may slow momentum.

Some Wall Street analysts project Nvidia reaching $1,200 or higher, though most place targets between $800–$1,000, depending on AI market strength.

Future earnings are expected to remain strong with double-digit growth, but guidance depends heavily on AI demand cycles and global supply chain stability.

Disclaimer

This is for information only, not financial advice. Always do your research.