Nvidia H200 Chip Now Allowed for China Exports Following Trump’s Greenlight

On December 8, 2025, the US gave a big surprise when the export ban on Nvidia’s H200 AI chip to China was lifted. Donald Tump announced the change, opening a new chapter in the global AI arms-race.

The H200 isn’t just another processor. It’s one of Nvidia’s most powerful AI chips. Now Chinese companies could soon get their hands on serious computing firepower. This decision flips years of strict export controls. It reshapes who leads in AI technology and where the line is drawn between innovation and security.

Let’s explore why the greenlight matters. We look at what makes H200 special. And we dig into the ripple effects this move could send across the global tech world.

Why the H200 Matters: More Than a Faster Chip

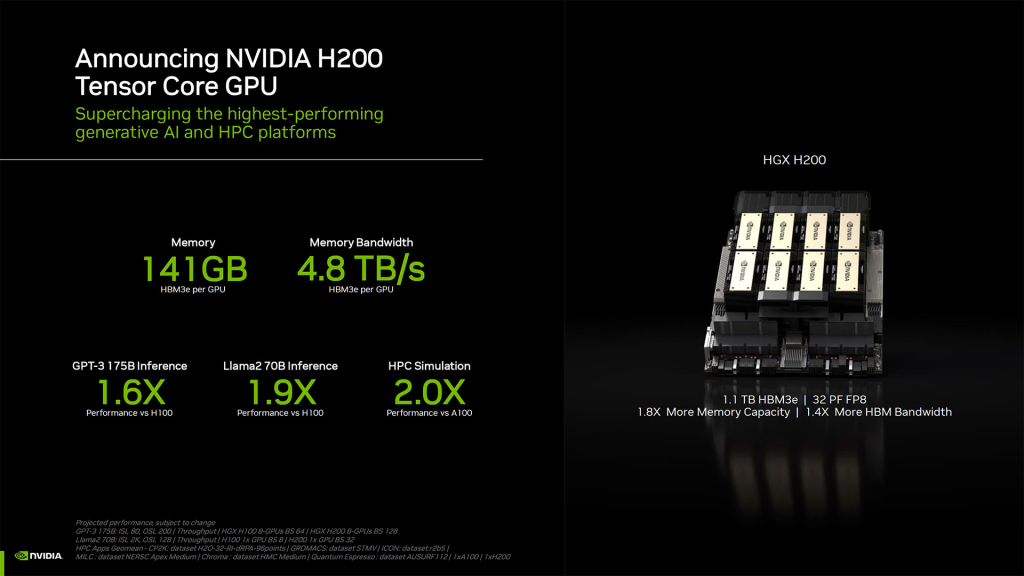

The Nvidia H200 is a major step up from previous chips. It features 141 GB of HBM3e memory and 4.8 TB/s bandwidth. This allows AI models to train faster and handle much larger datasets. The improved throughput also boosts inference speed for research and production tasks. Firms using the H200 can reduce training costs and time significantly.

Nvidia designed this chip to support generative AI, scientific simulations, and high-performance computing. With these capabilities, the H200 changes how companies build and scale large AI models. It also positions Nvidia as a key provider of global AI infrastructure.

Inside the Trump Greenlight: What Changed and When

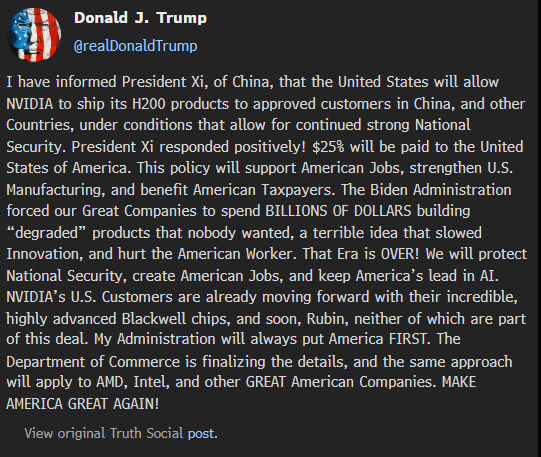

On December 8, 2025, the U.S. government announced that controlled H200 exports to China are now permitted. President Donald Trump authorized the shift, signaling a new approach to AI export controls. Shipments will be allowed only to approved Chinese firms, with compliance oversight from the Commerce Department.

Each order will undergo vetting, and a 25% fee may apply. The approval does not extend to Nvidia’s newest Blackwell chips, keeping the most advanced technology restricted. This move represents a careful balance between economic opportunities and national security concerns.

How Chinese Tech Firms are Likely to React

Chinese cloud and AI companies are expected to act quickly. Baidu, Alibaba Cloud, and Tencent Cloud are preparing to expand their computing capacity once the H200 becomes available. Smaller AI startups may lease compute power from larger providers.

Domestic chip development will continue, but access to H200 will accelerate AI projects. The demand for these high-performance chips is strong, even amid regulatory caution. Beijing has stressed oversight of foreign technology adoption, but Chinese firms see the H200 as critical for large-scale AI research.

Nvidia’s Strategic Win and Business Effects

The approval represents a significant business opportunity for Nvidia. China is one of the largest markets for data-center GPUs. Access to the H200 could substantially boost Nvidia’s revenue in 2026. Inventory and production plans may shift to meet new Chinese demand. At the same time, competitors such as AMD and Intel will monitor how Nvidia leverages this opportunity. The move reinforces Nvidia’s dominance in AI infrastructure and strengthens its position with cloud providers worldwide.

What This Means for the Global AI Balance

Access to H200 chips narrows the compute gap between China and other nations. Chinese researchers can train larger models faster, speeding up developments in language processing, vision, and multimodal AI.

Countries without access may face slower AI progress. This shift has geopolitical implications, as AI leadership increasingly influences global technology and economic power. The approval also resets discussions on international AI trade and export controls.

Market Impact: Investors and Competitors Respond

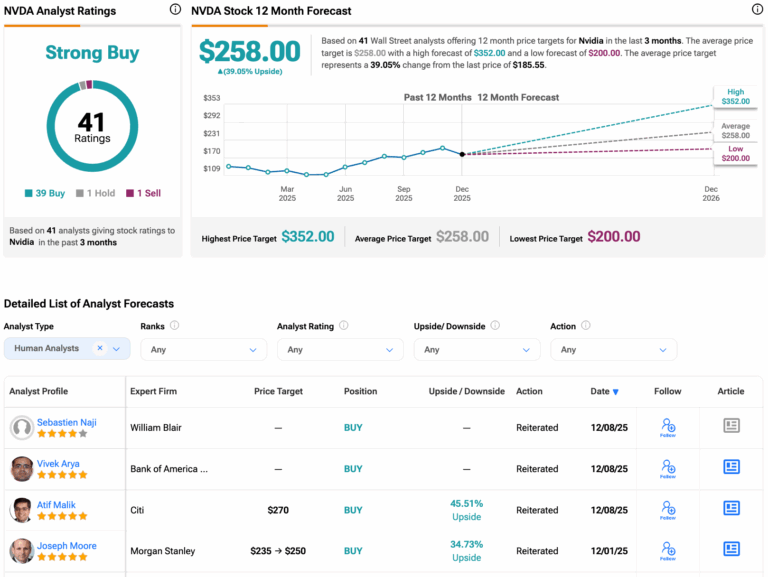

Markets reacted quickly to the announcement. Nvidia stock saw positive movement due to expected Chinese demand. Rivals with alternative AI chips experienced mixed effects. Cloud providers in Asia may face margin pressures due to rising compute costs.

Analysts used an AI stock research analysis to model potential revenue scenarios for Nvidia and its competitors. Overall, the market views the H200 approval as a calculated strategic win for Nvidia.

Nvidia H200 Chip: Risks That Still Remain

Despite the approval, significant risks persist. Shipments require strict U.S. regulatory approval. Congress could introduce tighter restrictions later. Smuggling and illegal re-exports remain possible, with recent U.S. Justice Department cases showing how easily chips can be diverted. Supply chain disruptions could also slow shipments, as H200 production depends on TSMC and HBM3e memory suppliers. Firms must carefully manage compliance to avoid legal and operational risks.

What’s Next: Shipments, Pricing, and Timelines

The Commerce Department will release detailed guidance in the days following December 8, 2025. Shipments are expected to begin in early 2026, with phased deliveries for vetted companies. Pricing may include a premium due to demand and compliance requirements. Cloud providers and hyperscalers will likely secure contracts quickly to maintain competitive advantage. The approval could also affect timelines for domestic Chinese chip development, influencing AI training cost and capacity.

Conclusion: A Measured Shift with Wide Ripples

The H200 export approval is a targeted easing of U.S. controls. China gains access to powerful AI infrastructure, while the U.S. keeps its most advanced technology restricted. The move reshapes AI competition and global compute power distribution. Future policy decisions will depend on political, economic, and security factors. For now, Nvidia and Chinese AI firms stand to gain significant advantages, marking a pivotal moment in the global AI race.

Frequently Asked Questions (FAQs)

Yes. On December 8, 2025, the U.S. allowed Nvidia to export H200 AI chips to approved Chinese companies. Exports must follow strict rules and government review.

No. The approval covers only H200 chips. Nvidia’s newest Blackwell chips are still restricted and cannot be shipped to China under U.S. export rules as of December 8, 2025.

Exports must go to approved customers only. The U.S. Commerce Department reviews shipments, and a 25% fee may apply. Rules started on December 8, 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.