Nvidia Second-Quarter Earnings to Reveal Impact of AI Growth

Nvidia stands at a critical juncture as investors await its second-quarter earnings report on Wednesday. The semiconductor giant’s performance will provide crucial insights into the stock market dynamics surrounding artificial intelligence investments.

The company achieved remarkable milestones this year, becoming the world’s most valuable company with a market capitalization exceeding $4 trillion in July. This achievement reflects unprecedented demand for its graphics processing units powering AI applications worldwide.

Revenue Expectations Signal Continued Growth

Wall Street analysts project Nvidia will report earnings of $1.01 per share for the second quarter. Revenue expectations stand at $46.05 billion, representing 53 percent growth compared to last year.

These projections follow an exceptional fiscal year where Nvidia generated $130.5 billion in annual revenue. The previous quarter delivered $44.1 billion, marking a 69 percent increase year-over-year.

Historical Performance Sets High Bar

The company maintained triple-digit revenue growth for five consecutive quarters between mid-2023 and 2024. This extraordinary performance established Nvidia as the dominant force in AI chip manufacturing.

The stock market has responded enthusiastically to this growth trajectory. Nvidia now comprises almost 8 percent of the S&P 500 index, giving its earnings reports significant market-moving potential.

Market Concerns About AI Investment Returns

Despite Nvidia’s success, broader concerns about AI investments have emerged. OpenAI CEO Sam Altman recently suggested investors might be “overexcited about AI” developments.

A Massachusetts Institute of Technology survey revealed troubling data about AI adoption. The study found 95 percent of enterprises saw no return on their AI investments despite billions invested sector-wide.

Bubble Fears Echo Historical Patterns

Market observers draw parallels between current AI enthusiasm and the “Nifty Fifty” phenomenon of the 1970s. That period saw investors overpay for growth stocks before a significant market correction.

These concerns create uncertainty for Nvidia despite its strong fundamentals. The stock market watches carefully for signs of sustainable growth versus speculative excess.

Geopolitical Challenges Impact Revenue

Trade restrictions present significant challenges for Nvidia’s international business. The Trump administration’s ban on H20 chip sales to China took effect in April.

Initial projections estimated this ban would cost Nvidia approximately $8 billion in lost revenue. An August agreement required the company to share 15 percent of H20 chip sales with the US government.

Financial Impact Already Visible

The restrictions delivered a $4.5 billion blow to Nvidia’s fiscal first-quarter finances. This impact demonstrates how geopolitical tensions directly affect technology company earnings.

The stock market closely monitors these developments for broader implications. Trade policies increasingly influence semiconductor industry profitability and growth prospects.

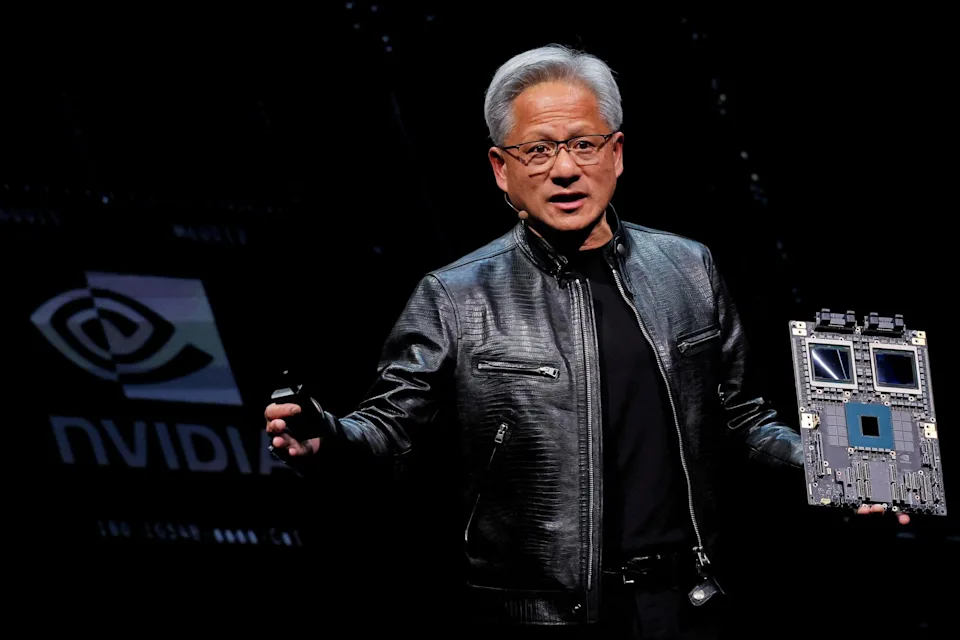

Blackwell B200 Drives Future Growth

Nvidia’s Blackwell B200 GPU represents its latest advancement in AI processing technology. This chip addresses growing computational demands from artificial intelligence applications.

Enterprise customers require increasingly powerful hardware for AI workloads. The Blackwell architecture provides significant performance improvements over previous generations.

Market Implications Beyond Nvidia

Wednesday’s earnings report carries implications for the entire technology sector. Nvidia’s performance often signals broader trends in AI investment and adoption.

The stock market uses these results as a barometer for technology sector health. Strong results could boost confidence, while disappointment might trigger broader selling.

Investment Outlook Remains Complex

Nvidia faces both exceptional opportunities and significant risks moving forward. Demand for AI computing power continues growing across industries.

However, valuation concerns and geopolitical uncertainties create volatility. Investors must balance growth potential against these meaningful challenges.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.