Nvidia Shares: Tumble Following Report of AI Chip Challenge from Google

Nvidia’s shares faced fresh pressure in November 2025 after reports claimed that Google is working on a stronger, next-generation AI chip. This news caught the market by surprise. It also raised a real question: Can Nvidia keep its lead in the fast-moving AI race?

The drop in Nvidia shares showed how sensitive investors are to competition in the chip industry. Nvidia has ruled the AI hardware market for years. Its chips power major cloud platforms, high-end data centers, and many AI models. But big tech firms are now building their own chips to cut costs and boost speed. Google is one of the strongest players in this space.

So when reports mentioned a more powerful Google chip, it signaled a possible change ahead. Investors took notice. Traders reacted fast. And the market began to debate whether this is a short-term shock or a long-term threat. This story is about more than one stock dip. It reflects a deeper battle for the future of AI computing.

What Triggered the Drop in Nvidia Shares?

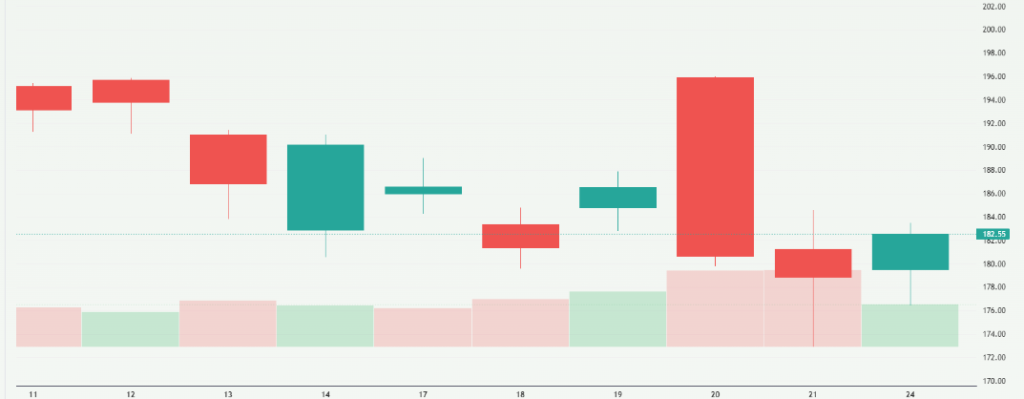

Nvidia’s stock slid sharply, despite strong earnings, largely because of growing worries about Google’s own AI‑chip push. On 20 November 2025, Nvidia reported better-than-expected third-quarter results, projecting Q4 revenue of around $65 billion, up from $62B expectations.

Yet, investors sold off. They saw Google’s newer and faster custom AI chips as a serious threat. These fears were amplified because Google is no longer keeping its high-performance TPUs just for itself.

Understand Google’s AI Chip Strategy

Google has been developing Tensor Processing Units (TPUs) for a long time. These are chips tailored specifically for AI workloads. In November 2025, Google more broadly deployed its 7th-generation TPU, called Ironwood, which is built for both training and inference. This chip can scale into pods of more than 9,000 units, offering tremendous compute power.

Also, Google is pairing these TPUs with its own Axion CPUs, built on Arm architecture. This gives Google full control over its AI hardware stack from CPU to accelerator. This vertical integration lets Google cut costs and reduce its dependence on outside suppliers.

The Competitive Landscape in the AI Chip Market

The AI hardware market is evolving fast. Until recently, Nvidia’s GPUs ruled the show. But now big tech firms are stepping in. Google is placing its TPUs in data centers run by other cloud providers, like small-scale companies that used to rely heavily on Nvidia. In one reported case, Google offered up to $3.2 billion to support a data center operator (Fluidstack) so it could adopt TPUs.

Meanwhile, other competitors are emerging. Broadcom is deepening its TPU business ties with Google. Even Qualcomm is entering the race with its own AI accelerator chips aimed at data centers.

This trend shows that hyperscalers, big cloud players, are betting on custom silicon. They want high efficiency. They also want to avoid supply risks tied to third-party chips.

Why Nvidia Still Holds a Strong Competitive Position?

Despite the heat, Nvidia is not out of the game. For one, it has a very strong ecosystem. Its CUDA platform is deeply embedded in AI development. Many AI researchers and companies rely on CUDA for building and running models.

Nvidia’s data center business is still booming. During its Q3 earnings, CEO Jensen Huang said the demand for its Blackwell chips was extraordinary and that “cloud GPUs are sold out.” That kind of demand gives Nvidia a long runway.

Also, the company’s relationships with major cloud providers remain very strong. Many of its top customers continue to place large orders. That helps Nvidia maintain its market share and margins, even under pressure.

Risks Ahead for Nvidia

Still, the risk picture is not simple. First, if more workloads shift to Google’s TPUs or other custom chips, Nvidia could see price pressure.

Second, Nvidia depends a lot on a handful of large cloud clients. If some of them decide to rely more on their own silicon, Nvidia’s growth could slow.

Third, supply chain risks remain. Scaling up production of advanced AI chips is hard, especially with tight high-end wafer capacity. Finally, investor sentiment is fragile. Even with strong earnings, any hint of competition or slowing growth can spark steep stock moves.

Market Outlook: What Investors Are Watching Now

Going forward, investors will closely watch Nvidia’s next earnings reports. They will look at how fast its cloud GPU orders grow, and whether Blackwell demand continues to stay “off the charts.”

They will also follow Google’s AI chip progress. In particular, they will track how widely Ironwood TPUs are adopted, and whether Google manages to place them in even more third-party data centers.

On the macro side, tech sector sentiment is fragile. Some investors remain worried about overvaluation in AI names. With rising competition and broad market risk, Nvidia’s long-term

The narrative is strong but not risk-free. Analysts are debating whether this is just a bump or a turning point. If Google chips gain real traction, Nvidia may need to respond aggressively. But for now, the company’s fundamentals remain solid.

Bottom Line

Google’s push into AI silicon is real and mounting. Its Ironwood TPUs, combined with Axion CPUs, give it a powerful hardware stack. This is clearly making investors nervous about Nvidia. Yet Nvidia’s strength, its ecosystem, strong relationships, and high demand, is not so easily shaken. As the battle for the future of AI chips heats up, all eyes will be on how these two giants move.

Frequently Asked Questions (FAQs)

Nvidia shares dropped in November 2025 after reports said Google was making new AI chips. Investors worried this could reduce Nvidia’s market share and future growth in AI hardware.

Google’s new Ironwood TPU offers high-speed AI computing and works with its own CPUs. It can handle large AI tasks, which could compete with Nvidia’s GPUs in data centers.

Yes, Nvidia remains strong. Its GPUs, CUDA software, and cloud partnerships are widely used. Demand for its AI chips is high, and its ecosystem keeps it competitive in 2025.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.