Nvidia Stock Earnings: Shares Hit New Record on Fresh Export Approval

Nvidia’s stock earnings hit a record high on October 9, 2025, closing at $192.57. This was up 1.8% from the day before. The rise came after the U.S. allowed Nvidia to export billions of dollars’ worth of AI chips to the United Arab Emirates (UAE). This approval is a big step for Nvidia’s global AI growth.

Under an agreement made in May, the UAE will invest $1.4 trillion in the U.S. over the next ten years. In return, it can buy up to 500,000 of Nvidia’s top AI chips each year from 2025 to at least 2027. The deal could even continue until 2030. It shows the strong demand for advanced AI chips and Nvidia’s key role in supplying them.

The approval also shows a shift in U.S. export rules. The focus is moving from limits to smart partnerships. By sharing AI tech with trusted allies like the UAE, the U.S. strengthens its lead in global AI.

This news boosted Nvidia’s stock and shows how AI infrastructure is becoming more important for technology and global trade. Let’s discuss further details.

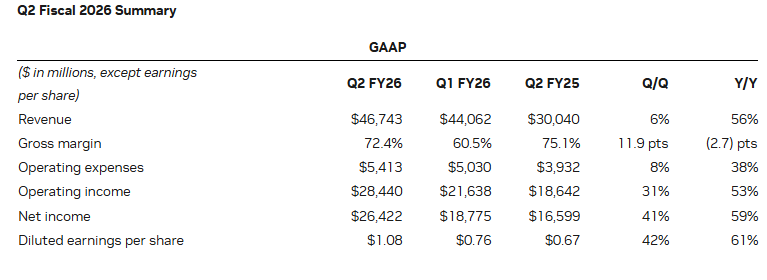

Nvidia Stock Earnings Report Highlights

In Q2 2026, Nvidia reported revenue of $46.7 billion, marking a 6% increase from the previous quarter and a 56% rise year-over-year. The company’s data center revenue reached $41.1 billion, up 5% from Q1 and 56% from the same period in the previous year. Notably, revenue from Nvidia’s Blackwell data center GPUs grew 17% sequentially, underscoring the strong demand for its advanced AI hardware.

Impact of Fresh Export Approval

On October 9, 2025, the U.S. government approved Nvidia’s export of AI chips to the United Arab Emirates (UAE). This approval allows Nvidia to export up to 500,000 of its most advanced AI chips annually, starting in 2025 and extending through at least 2027, with the possibility of an extension to 2030. The deal is part of a broader bilateral agreement in which the UAE has committed to investing $1.4 trillion into the U.S. economy over the next decade.

Stock Market Reaction

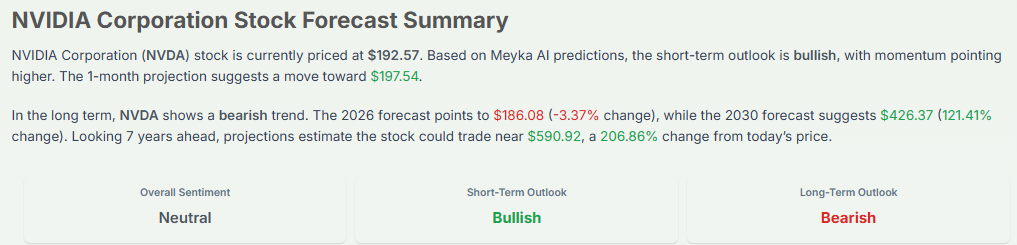

Following the export approval, Nvidia’s stock surged to a record high. On October 9, 2025, the stock closed at $192.57, up 1.8% from the previous day, after reaching an intraday high of $195.30. Analyst C.J. Muse of Cantor Fitzgerald raised Nvidia’s price target. It went from $240 to $300. He cited the early stages of a multitrillion-dollar AI infrastructure expansion.

Broader Industry Context

The demand for AI hardware is experiencing exponential growth, driven by advancements in generative AI and the increasing need for powerful computing infrastructure. Nvidia’s position as a leader in the AI chip market, coupled with strategic partnerships and investments, positions the company to capitalize on this expanding market. Competitors such as Advanced Micro Devices (AMD) and Intel are also vying for market share, but Nvidia’s comprehensive AI stack, including chips, networking, and software, gives it a competitive edge.

Analyst Opinions and Future Outlook

Analysts remain bullish on Nvidia’s prospects. Cantor Fitzgerald’s analyst C.J. Muse raised the price target to $300, emphasizing the company’s leadership in AI infrastructure and the potential for significant earnings growth. Other analysts have also adjusted their price targets upward, reflecting confidence in Nvidia’s growth trajectory.

Investor Takeaways

For investors, Nvidia presents a compelling opportunity in the AI sector. The company’s strong financial performance, strategic partnerships, and leadership in AI hardware position it well for continued growth. However, potential risks include increased competition and geopolitical factors that could impact international trade and investment. Investors should monitor these developments closely and consider diversifying their portfolios to mitigate potential risks.

Bottom Line

Recent Nvidia stock earnings report and the approval of AI chip exports to the UAE underscore the company’s pivotal role in the global AI infrastructure landscape. With strong financial performance and strategic initiatives, Nvidia is well-positioned to capitalize on the growing demand for AI technology. However, investors should remain vigilant to potential risks and market dynamics that could influence the company’s future performance.

Frequently Asked Questions (FAQs)

The Nvidia stock earnings reported revenue of $46.7 billion in Q2 2026, up 56% from last year. Net income was $26.4 billion, and earnings per share were $1.05 on October 9, 2025.

NVIDIA’s stock hit a record $192.57 on October 9, 2025, after the U.S. approved AI chip exports to the UAE. This boosts investor confidence and growth expectations.

The U.S. allowed Nvidia to export AI chips to the UAE on October 9, 2025. It supports trade partnerships and may increase demand for Nvidia’s AI technology globally.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.