Nvidia Stock (NVDA) Hits $4.5 Trillion Valuation as AI Deals Drive Gains

On September 30, 2025, Nvidia’s stock hit an all-time high, pushing its valuation to $4.5 trillion.: That number is staggering. We rarely see companies cross into the trillion-dollar league, let alone climb so fast. But Nvidia has done just that.

We are in the middle of an AI revolution. The hardware and infrastructure behind artificial intelligence are now as critical as the software itself. That puts Nvidia squarely in the spotlight. Its chips power the giant data centers and models behind tools like ChatGPT and image generators.

This surge is not by accident. Nvidia’s deep ties with big tech, its strong product pipeline, and its software ecosystem have all played a part. Let’s explore how Nvidia reached this valuation, what deals are fueling its rise, and what risks lie ahead. We will look at the role of AI deals and investor confidence and ask, Is $4.5 trillion just the beginning?

Nvidia Stock: Journey to $4.5 Trillion

Nvidia’s rise looks swift. The stock crossed a $4.5 trillion market cap on September 30, 2025. That milestone followed years of steady growth. Nvidia moved from gaming GPUs to data-center chips. The shift allowed the company to tap big cloud customers and AI startups. Investors noticed rising demand for AI compute. That demand pushed the share price higher and lifted market value into rare territory.

AI Deals Fueling Growth

Several large deals and partnerships drove recent momentum. Nvidia announced plans in late September 2025 to invest up to $100 billion in OpenAI, tied to hardware sales and non-controlling equity stakes. The move aims to secure long-term demand for Nvidia systems and to lock in a major AI customer. At the same time, hyperscalers and cloud providers signed big capacity deals with AI cloud firms that rely on Nvidia GPUs. These deals increased revenue visibility for Nvidia and helped justify higher valuations.

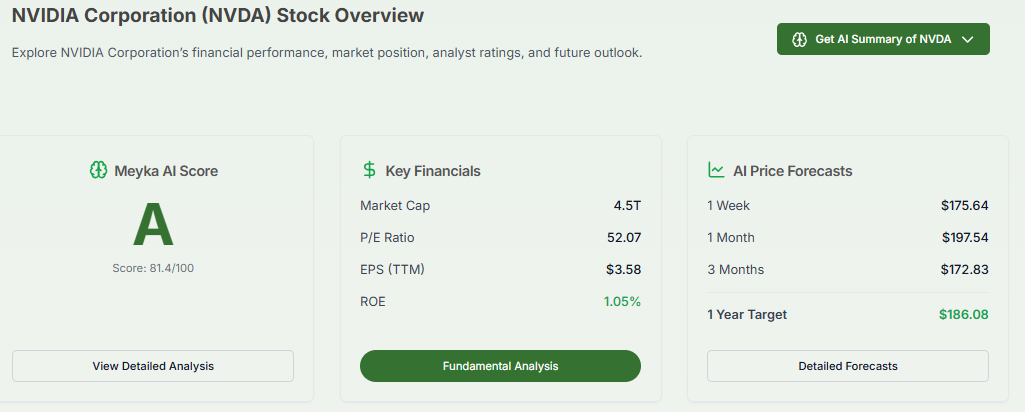

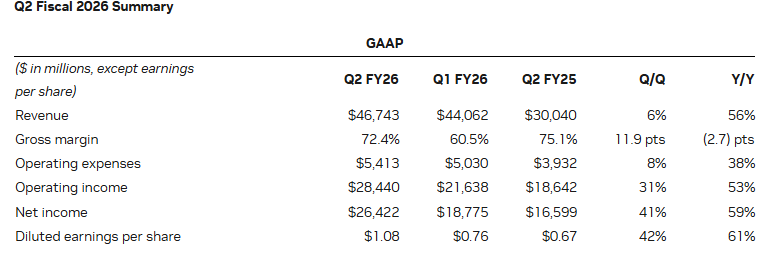

Financial Performance and Market Confidence

Financials show strong demand. For the quarter ended July 27, 2025, Nvidia reported revenue of about $46.7 billion, a jump of 56% year-over-year. Data-center sales led growth, with Blackwell systems and H100/H200 class GPUs in heavy use. Top customers accounted for a large share of sales, which both boosts margins and raises concentration risk. Wall Street reacted with upbeat analyst notes and price-target increases after the earnings release.

Competitive Landscape

Competition is intensifying. AMD and Intel push new accelerators. Cloud giants build custom chips, too. Still, Nvidia keeps a software edge. The CUDA ecosystem and developer tools remain highly used. This software moat makes switching harder for many customers. Startups and chip rivals aim to narrow the lead, but scaling hardware and software together is difficult and costly.

Risks and Challenges

Big rewards bring big risks. Geopolitical rules on chip exports to China can limit markets. Supply bottlenecks and high component costs could slow shipments. Concentrated revenue from a few large customers raises exposure if one reduces orders. Valuation is another risk. At $4.5 trillion, expectations are high. Any slowdown in AI spending or model training demand could lead to sharp price drops. Analysts warn of froth in AI stock prices and the potential for a market correction.

Broader Market Impact

Nvidia’s surge reshaped markets. The chip rally lifted the Nasdaq and helped other AI plays gain value. Vendors that supply data centers and cloud services also saw gains. Financial models that track sector weightings had to adjust. The excitement pushed some investors to use an AI stock research analysis tool to screen for related opportunities and risks. Big banks also revised forecasts for AI infrastructure spending, citing faster-than-expected capital outlays by hyperscalers.

Nvidia Stock: Future Outlook

Demand for AI compute should remain strong near term. Adoption of large language models and multimodal systems keeps data-center orders high. Nvidia’s roadmap includes new chips, networking gear, and software stacks. The OpenAI arrangement could secure multi-year purchases and give Nvidia stable demand. Yet execution matters. New competitors, regulatory hurdles, or weaker enterprise spending could slow growth. Investors will watch product rollouts and quarterly bookings closely.

Wrap Up

Nvidia’s climb to $4.5 trillion on September 30, 2025, marks a major moment in tech markets. The rise came from strong data-center demand, major AI deals, and a deep software ecosystem. The path forward contains both large opportunities and clear risks. Careful tracking of earnings, customer concentration, and regulatory news will be key for anyone watching Nvidia or the wider AI hardware market.

Frequently Asked Questions (FAQs)

The surge came from massive demand for AI compute. Big deals with AI firms, cloud providers, and infrastructure commitments pushed sales. Nvidia’s strength in GPUs and software (CUDA, ecosystem) added to investor confidence.

Key risks include export restrictions (especially to China), supply chain crunches, overreliance on a few major customers, and whether future AI spending will stay strong. Valuation correction is also a real concern.

Yes, if AI adoption accelerates across industries (healthcare, robotics, edge computing) and if Nvidia can stay ahead in innovation. But growth will depend heavily on execution and market conditions.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.