Nvidia Stock Price Today Nears $5 Trillion as GTC Momentum Builds

Nvidia Stock is charging higher as excitement from the company’s GTC (GPU Technology Conference) fuels investor demand. Shares jumped after Jensen Huang’s keynote, pushing market value close to $5 trillion.

Traders and analysts say the rally reflects huge demand for Nvidia’s AI chips, data-center products, and software stack.

Nvidia Stock: Why GTC matters now

What was announced at GTC?

At GTC, Nvidia showcased new AI chips, data-center advances, and tools for agentic AI and robotics. Jensen Huang’s keynote gave investors a clear roadmap for deeper AI adoption across industries, which sparked buying interest across the US market.

Why is Nvidia Stock rising so fast? Investors see GTC as proof that Nvidia’s hardware and software are central to the next wave of AI. The event showed both product depth and real enterprise adoption, lifting confidence in long-term revenue growth.

Nvidia Stock: Market moves and numbers

How close is Nvidia to $5 trillion?

Nvidia’s market cap briefly approached ~$4.9–$4.94 trillion on heavy trading days after the GTC announcements. Intraday moves have pushed the company nearer the $5 trillion mark, a level few firms have ever reached.

What did the market do today? Shares surged roughly 5% on a key day, reaching all-time highs and adding tens of billions in market value as traders priced in accelerated demand for AI GPUs. Financial outlets reported the jump and the near-$5T milestone.

Social reaction: a market trader noted the surge on

A quick example of retail and quant sentiment that drove heavy flows.

Nvidia Stock: What GTC revealed about chips and data centers

Which products pushed sentiment?

Nvidia (NVDA) highlighted new Blackwell-generation chips and server references aimed at datacenters and large AI training clusters. The company also outlined advances in software and AI stacks that reduce cost and speed up model training. These moves directly support higher demand from cloud providers and enterprises.

How big is the data-center opportunity? Analysts see Nvidia’s GPUs as the backbone for AI data centers. With bookings and orders from hyperscalers growing, forecasts expect data-center revenue to remain a major growth engine for years.

Nvidia Stock: Investor and analyst reaction

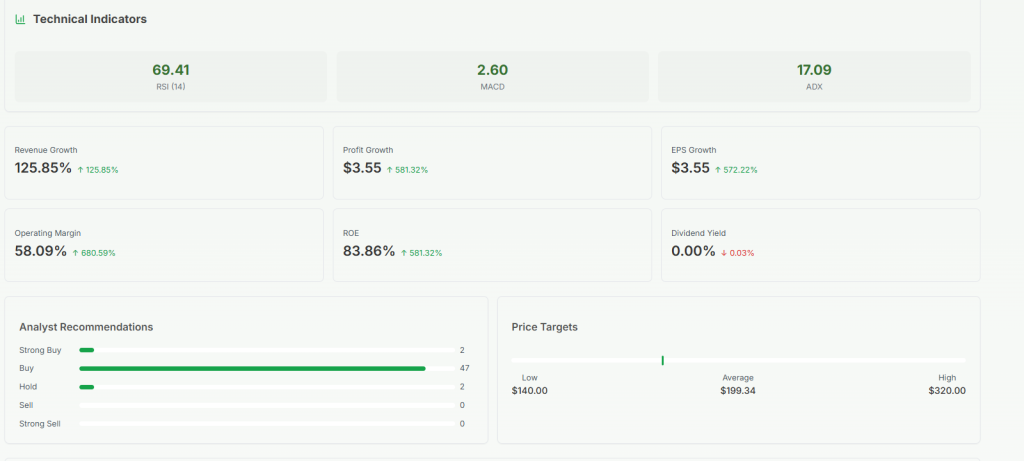

What are analysts saying?

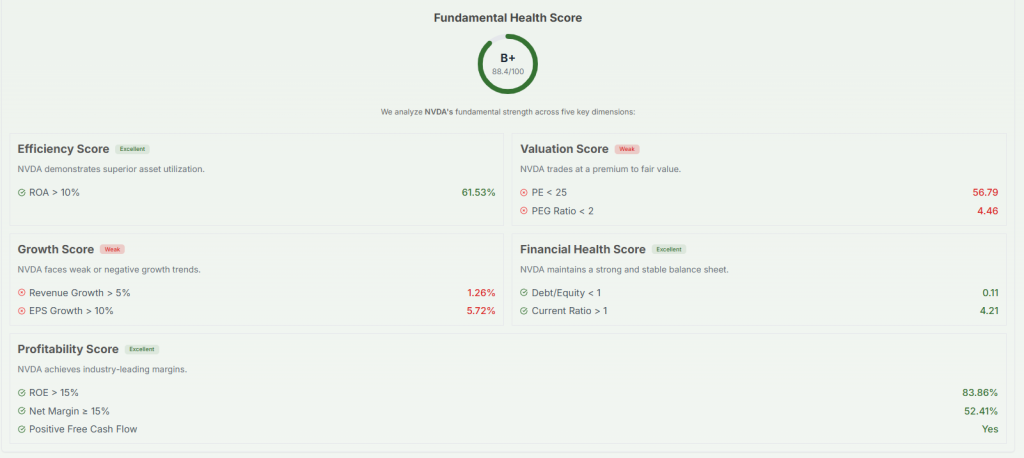

Wall Street and independent analysts are split between enthusiasm for structural growth and caution about valuation. Many note that near-term catalysts, product rollouts, data-center implementations, and partnerships could justify higher prices if execution stays strong.

Can Nvidia sustain this massive valuation? Some analysts warn about execution risk, competition, and macro factors that could cool sentiment. Others point to long lead times for training clusters and continued GPU scarcity as bullish drivers. The balance of evidence currently favors momentum, but investors are watching closely.

Market commentary and analysis tools amplified the data after the event, see an AI-data take at

For a sample of how analytics bots and services parsed the headlines.

Nvidia Stock: Broader market impact

Who else moved with Nvidia?

Nvidia’s rally helped lift many semiconductor and AI-adjacent stocks. Big tech names tied to AI demand, including cloud providers and chip-ecosystem suppliers, saw follow-on gains as investors rotated into correlated plays. The rally widened to global tech indices in U.S. trading sessions.

What about concentration risk? Nvidia’s surge further concentrates value in a few mega-cap names. That raises questions about market breadth and how leadership changes the risk profile of broad indexes. Investors should consider diversification if single-stock exposure grows large in a portfolio.

Social media also tracked the GTC announcements in real time; an example post reflecting event highlights is:

which captured headlines and investor interest around the keynote.

Nvidia Stock: Historical path and outlook

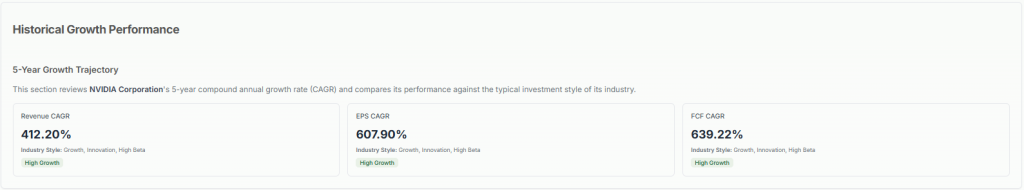

How does this rally compare with earlier gains?

Nvidia’s 2025 run was built on a multi-year surge where shares rose manyfold as AI demand accelerated. The GTC momentum is a fresh catalyst but follows earlier gains tied to data-center sales and product cadence. That historical context helps explain why markets responded so strongly.

What should investors watch next? Key near-term signals include: quarterly results and guidance, cloud orders and “bookings” growth, GAAP revenue vs. bookings trends, and concrete customer rollouts for new chips. Execution on these fronts will determine whether the near-$5T valuation is sustained.

Nvidia Stock: Risks and red flags

What could derail the rally?

Risks include macro selloffs, slower cloud spending, competitive GPU offerings, regulatory pressures (trade controls), and any supply chain hiccups. High valuation also means even small misses can trigger sharp price corrections. Investors should weigh both upside and downside scenarios.

Multimedia & deeper reading

For a direct look at the GTC keynote and product demos, Nvidia’s official GTC keynote video is a useful primary source. Watch Jensen Huang’s presentation to see the product roadmap and demos in full.

Quick checklist for investors watching Nvidia Stock

- Track GTC follow-ups: technical papers, partner deals, and trial results.

- Watch quarterly bookings and cloud orders; these show real demand.

- Monitor valuation metrics and hedge for downside given concentration risk.

Conclusion

Nvidia Stock is approaching an extraordinary milestone as GTC momentum drives investor optimism. The company’s new chips and data-center plans are central to the AI boom, and the market is pricing a future of sustained AI infrastructure growth.

That said, execution, competition, and macro risks matter, so watch product rollouts, bookings, and quarterly reports closely. For now, GTC has given Nvidia another lift, and markets will be watching whether the company can turn keynote promises into real, long-term revenue gains.

FAQ’S

Analysts predict Nvidia’s stock could range between $120 and $150 by 2025, depending on AI chip demand and data center growth. However, forecasts vary based on market conditions and tech sector performance.

Many experts consider Nvidia a strong long-term buy due to its leadership in AI chips, GPUs, and data center technology. Still, investors should assess market volatility before investing.

Yes. Nvidia reportedly lost about $279 billion in market value in a single trading day in 2024, following a sharp tech sell-off, despite its long-term AI growth outlook.

Price forecasts for Nvidia suggest continued growth, driven by AI, cloud computing, and partnerships like the US Energy Department supercomputer project. Analysts expect gradual upward momentum through 2025.

Nvidia AI powers advanced supercomputers, data centers, and AI models used in research, healthcare, and autonomous systems, making it a cornerstone of global tech innovation.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.