NZDUSD Recovery Attempt After Recent Losses – Analysis (29-09-2025)

As of 29 September 2025, the NZDUSD pair is trying to bounce back after facing a series of losses in recent weeks. The New Zealand dollar has struggled against the strong US dollar, reacting to mixed economic data and global market uncertainty. We have seen the pair dip below key support levels, causing concern for traders and investors alike.

However, the market is showing signs of a recovery attempt. Small rebounds in commodity prices and positive signals from New Zealand’s economic indicators are giving traders hope. We need to look at both fundamental and technical factors to understand if this recovery can hold or if it is just a short-term pullback.

Let’s explore what is driving the NZDUSD movement, examine key support and resistance levels, and analyze market sentiment.

Recent Performance Recap

As of September 29, 2025, the NZD/USD exchange rate stands at 0.5782, reflecting a 0.45% increase from the previous session. Over the past month, the New Zealand Dollar has depreciated by approximately 2% against the US Dollar. This decline follows a series of losses that saw the NZD/USD pair break through key support levels, including the 0.58 mark, reaching its weakest point since April 2025.

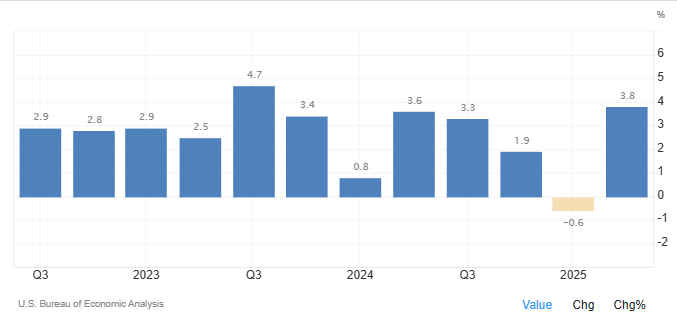

The recent downturn can be attributed to a combination of factors. Weak domestic data from New Zealand, such as a decline in manufacturing activity and a cautious outlook from the Reserve Bank of New Zealand (RBNZ), have weighed on investor sentiment. Additionally, the US Dollar has strengthened due to robust economic indicators, including a 3.8% annualized GDP growth in the second quarter of 2025.

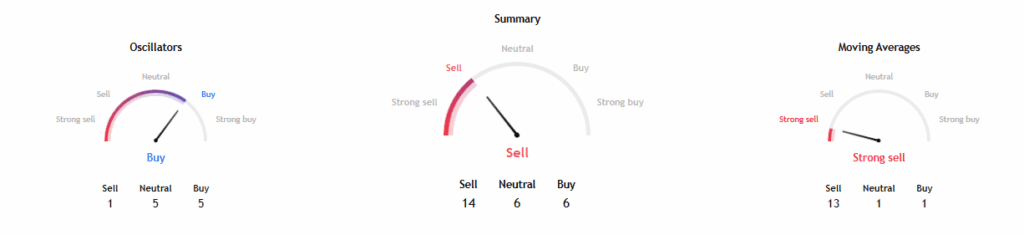

Despite these challenges, the NZD/USD pair is attempting a recovery. Technical indicators suggest a potential reversal, with the Relative Strength Index (RSI) showing oversold conditions and the price moving above the 50-day Exponential Moving Average (EMA). However, the sustainability of this recovery remains uncertain, as the pair faces significant resistance levels and ongoing economic pressures.

Fundamental Analysis

New Zealand Economic Indicators

In September 2025, New Zealand’s consumer confidence improved, with the ANZ-Roy Morgan consumer confidence index rising to 94.6 from 92.0 in August. While still below the 100 threshold that signals overall optimism, the increase suggests a shift towards a more positive outlook, partly attributed to the effects of easing monetary policy.

However, economic activity remained flat over the first half of 2025, with early indications signaling a return to growth in the September quarter. The Organisation for Economic Co-operation and Development (OECD) expects slower global growth, which could impact New Zealand’s export-driven economy.

US Economic Factors

The US economy grew at an annualized rate of 3.8% in the second quarter of 2025, the fastest pace in nearly two years. This robust performance was primarily driven by strong consumer spending, which rose 2.5%, significantly above earlier estimates. Despite this growth, hiring has slowed sharply in 2025 compared to the post-pandemic boom, with recent job creation averaging only 53,000 per month. Labor market softening and trade policy uncertainty are cited as key factors.

The Federal Reserve’s recent quarter-point rate cut and projections for at least two more cuts this year indicate a dovish stance to support the labor market. However, stronger-than-expected GDP and steady inflation have reduced market odds for aggressive additional cuts.

Technical Analysis

The NZD/USD pair has experienced significant volatility in recent weeks. After breaking key support levels, including the 0.58 mark, the pair reached its weakest point since April 2025. Technical indicators suggest a potential reversal, with the Relative Strength Index (RSI) showing oversold conditions and the price moving above the 50-day Exponential Moving Average (EMA).

However, the pair faces significant resistance levels, including the 0.5905 mark. A strong price increase and a breakout of this level would cancel out the downward trend, indicating a potential bullish reversal. Conversely, failure to break above this resistance could lead to further declines, with bears eyeing the 0.5730 level.

Market Sentiment & Trading Behavior

Market sentiment plays a crucial role in the NZD/USD’s performance. Recent data indicate a shift towards a more positive outlook in New Zealand, with improved consumer confidence. However, concerns over global growth and trade tensions, particularly with China, continue to weigh on investor sentiment.

In the US, the Federal Reserve’s dovish stance has influenced market expectations, with projections for multiple rate cuts this year. These expectations have contributed to a stronger US Dollar, impacting the NZD/USD exchange rate.

Short-Term and Medium-Term Outlook

In the short term, the NZD/USD pair faces significant resistance levels, including the 0.5905 mark. A breakout above this level could signal a bullish reversal, while failure to do so may lead to further declines. In the medium term, the outlook remains uncertain, with factors such as global economic growth, trade tensions, and central bank policies influencing the pair’s direction.

Bottom Line

The NZD/USD pair is attempting a recovery after recent losses, supported by improved consumer confidence in New Zealand and a dovish stance from the Federal Reserve. However, challenges remain, including global economic uncertainties and trade tensions. Traders should monitor key technical levels and economic indicators to assess the sustainability of the current recovery.

Frequently Asked Questions (FAQs)

As of 29 September 2025, NZD/USD is rising due to stronger New Zealand consumer confidence, a cautious US Fed policy, and technical signs of oversold conditions in the pair.

On 29 September 2025, traders watch 0.5845 and 0.5905 as resistance, 0.5800 as support, and RSI oversold signals to track possible upward or downward moves.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.