Oil Prices Climb on Russia Supply Fears and Stalled Ukraine Peace Efforts

Oil prices rose again on 4 December 2025. Traders woke up to news about fresh attacks on Russian oil infrastructure. At the same time, talks meant to end the war in Ukraine stalled once more.

The spike has little to do with demand. Instead, it reflects worry. Worries that Russian supply might shrink. And that peace may stay out of reach. Markets don’t like uncertainty. For oil, uncertainty means risk. And risk pushes prices up.

Let’s explore why today’s oil rally isn’t about more barrels. It’s about fear of disrupted supply, of broken diplomacy, and of a world still locked in conflict.

Russia’s Oil Supply threat isn’t “New” but why this time hits harder?

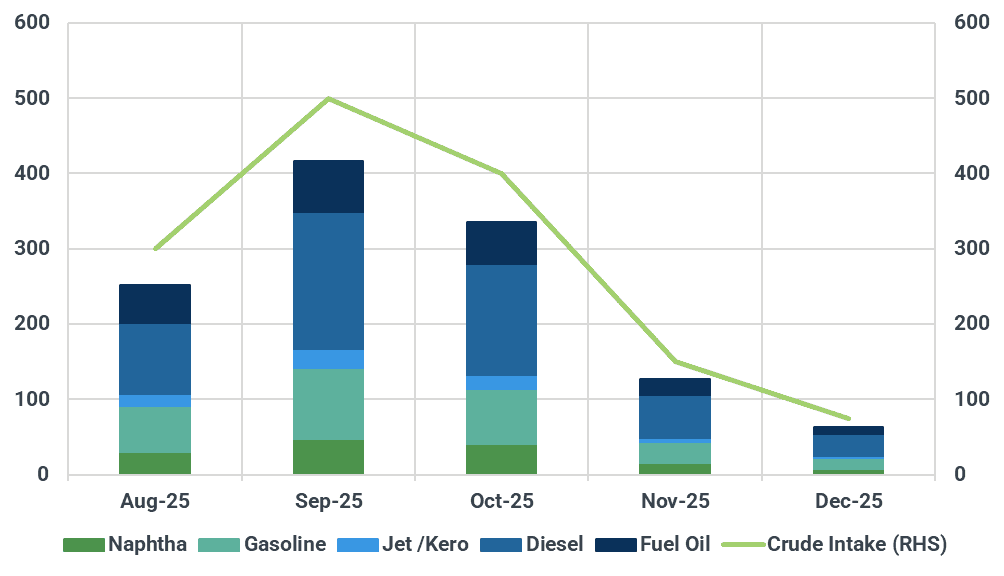

Russia has long been a wild card for oil markets. What changed in late 2025 is the pattern. Attacks on pipelines and refineries have become more frequent. That keeps crude flows less certain. Traders are not just counting barrels. They are pricing the chance that some Russian cargoes will be delayed or diverted. Analysts at Kpler noted sustained drone strikes have cut refining throughput, lowering available refined product and lifting risk premiums.

At the same time, shipping and insurance costs rose as tankers faced more risk near the Black Sea. Higher freight and cover costs add to the delivered price of crude. Turkey’s call to shield energy routes highlights how fragile transit has become.

The Ukraine Peace Track: Why Diplomatic Stagnation Re-ignites Risk Premiums?

Peace talks offer the clearest path to restoring some Russian oil to global trade. When talks stall, that hope fades fast. In early December, U.S.-Russia talks failed to produce a breakthrough. Markets quickly re-priced the chance that sanctions and trade frictions will stay in place. That feeds a geopolitical premium on top of normal supply-demand math.

Put simply: a deal would lower the premium. No deal keeps it high. Traders treat the diplomatic calendar like an economic variable.

New Winter Dynamics for Oil Products

Winter changes how Europe buys energy. Even with ample oil stocks, buyers often top up inventories before deep cold arrives. In 2025, Europe also faces gas tightness. That can push some demand into oil products, for heating or power switching. The seasonal push means markets react more strongly to any sign of supply trouble now than they might in summer. The IEA’s November reports show supply growth globally, but seasonal and regional risks still matter.

OPEC+ Calculus: Why Russia’s Moves Complicate the group’s Strategy

OPEC+ has tried to smooth markets by pacing output changes. But when Russia signals tighter flows, the coalition faces a dilemma. Do members pump more to offset risk? Or hold steady to keep prices supported? In late 2025, OPEC+ signaled a pause in large output hikes, showing caution. That stance gives traders another reason to expect price swings if Russian flows wobble.

U.S. Market Reaction: Shale Restraint and Strategic Reserve Signals

U.S. shale can respond to higher prices, but not instantly. Many drillers are cautious after years of tight capital discipline. That lowers the near-term supply response. Meanwhile, markets watch U.S. Strategic Petroleum Reserve moves. Any SPR withdrawals or refills are read as policy signals. Traders interpret those moves as hints about how much the U.S. will lean on strategic stocks to calm spikes.

Financial trades: How Hedge funds are Positioning for a Prolonged Premium

Speculators are a key part of modern oil markets. When risk rises, many funds move net long in crude futures. But 2025 has seen twists. CFTC reporting was interrupted in parts of 2025, leaving traders with gaps in positioning data. Even so, the latest available figures show a pull-back from very large net longs, while some macro funds treat oil as an inflation hedge. This mix can amplify moves in either direction.

Shipping Risks: Reroutings, Insurance, and a Stealth Price Driver

Rerouting tankers away from high-risk zones raises voyage times and costs. Insurers charge more for voyages near conflict areas. Those extra costs get passed into prices for delivered barrels. Recent incidents and attacks near Turkey’s Black Sea coast have made underwriters and ship operators far more careful. That raises the floor for price moves when supply looks tight.

Price Outlook: Short-term Rally vs. a Medium-term Volatility Trap

Two clear scenarios sit in front of markets now.

- Bullish: Continued attacks, stalled diplomacy, and higher shipping costs keep a risk premium in place. Prices could stay elevated or spike on news.

- Bearish: A surprise diplomatic opening, stronger global supply growth, or demand softness could cut the premium quickly.

The IEA and many forecasters still see global supply growing into 2026. That argues against a structural bull market now. Yet the market’s mood is fragile. Traders who ignore geopolitics risk sharp losses.

Final Words

Oil is tumbling and rising on the same theme: politics. In early December 2025, strikes on Russian infrastructure and stalled talks pushed traders to pay for risk. Even with supply growth projected for 2026, the road there may be bumpy. As long as transit routes look unsafe and talks do not revive, markets will price a geopolitical buffer into every barrel. That buffer can vanish fast or stick around. Either way, investors and buyers must watch both pipelines and peace rooms.

Frequently Asked Questions (FAQs)

Oil prices are rising in December 2025 because traders fear lower supply from Russia and see no progress in Ukraine peace talks. These worries add a risk premium to each barrel.

The Russia-Ukraine conflict affects supply by creating uncertainty around exports, shipping routes, and energy infrastructure. When these risks grow, markets expect possible delays, which often pushes global oil prices higher.

Winter demand can push prices up because countries buy more fuel for heat and transport. If supply stays uncertain, even normal winter needs may lift prices this season.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.