Oil Prices, Nov 28: Investors Watch Russia-Ukraine Diplomatic Moves

Oil prices stayed in focus on November 28, 2025, as traders watched every new signal coming from the Russia-Ukraine conflict. Markets moved with caution today. Small price swings showed that investors were alert and ready for fast changes. This reaction is not surprising. Global oil often shifts when major geopolitical events take a new turn.

Russia remains one of the world’s largest energy suppliers. Ukraine sits close to key transport routes. So even a small diplomatic move, whether hopeful or tense, can push prices up or down. Investors know this well. That is why they closely track any update from talks, warnings, or military messages.

At the same time, traders are looking beyond the conflict. They are also watching OPEC+ plans, U.S. stockpile data, and signs of demand from Asia. These extra factors add more pressure and make daily pricing less predictable.

Today’s market feels fragile. It is shaped by fear, hope, and fast news cycles. And that is why oil prices on November 28 matter so much.

Current Oil Price Movement and Market Tone

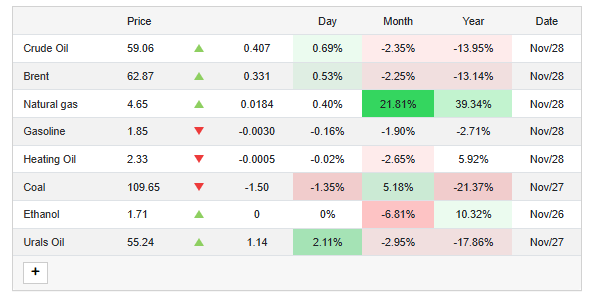

Brent and WTI showed mixed moves on November 28, 2025. Brent traded around the low $60s per barrel. WTI slipped near the high $50s. Prices moved in small steps. Traders reacted to new diplomatic signals and data releases. Volatility rose during Asian and European sessions. Thin liquidity ahead of key meetings amplified swings.

A technical outage at a U.S. exchange also caused short disruptions in WTI trading. Overall, the market looked cautious. Short-term sentiment shifted between risk-on and risk-off as headlines arrived.

Latest Russia-Ukraine Diplomatic Developments

Diplomatic activity increased this week. Reports said talks between Kyiv, Moscow, and U.S. envoys were producing proposals. Some brief optimism emerged about possible frameworks to reduce fighting. At the same time, officials warned that major concessions had not been agreed upon.

Markets parsed every line from statements. Hints of a ceasefire triggered talk of reopening some Russian oil flows. That possibility pushed prices down on hopes of easing supply tensions. But any rollback of sanctions would need time and legal steps. Until then, market participants treated the situation as fluid.

How Diplomacy Changes Supply Expectations?

Russia remains a top global exporter. Any easing of sanctions could add millions of barrels back to the market. Pipelines, shipping routes, and insurance arrangements would also need adjustment. Traders price both the likelihood and the speed of such changes. A sudden diplomatic breakthrough could remove a premium that has supported oil since the conflict began. Conversely, stalled talks or new sanctions would keep that premium in place.

Analysts emphasize that partial relief, limited buyer changes, or faster exports to some markets could still shift balances materially. The difference between full and partial easing is large for global inventories and trade flows.

Broader Market Forces Counter Geopolitical Moves

Geopolitics is only one part of the picture. OPEC+ policy remains crucial. The group agreed to modest increases in recent months while pausing larger hikes into early 2026. That decision tends to keep a cap on downside risk from higher supply.

At the same time, the International Energy Agency sees global supply rising through 2026, driven by non-OPEC growth. U.S. inventory reports and rig counts matter too. Recent data showed both draws and unexpected builds on different weeks. Currency moves and forecasts for U.S. interest rates also influence demand expectations. In short, supply growth forecasts and central bank paths add counterweights to diplomatic headlines.

Market Positioning and Investor Reactions

Hedge funds and commodity traders adjusted exposure this week. Some cut long positions after the ceasefire signals. Others kept hedges, citing the uncertain implementation of any deal. Long-only managers were cautious about adding exposure ahead of the OPEC+ meeting scheduled for November 30, 2025.

Analysts noted that speculative positioning has been lighter compared with prior years. Institutional desks used algorithmic scans to reprice risk. Some traders used an AI stock research analysis tool to scan headlines and rebalance orders faster. Short-term traders looked for intraday momentum, while longer-term investors focused on structural supply forecasts.

Effects on Related Energy Markets and Refining Margins

Changes to crude flows ripple across the energy complex. Natural gas and LNG markets reacted to shifting European import needs. If Russian crude returns gradually, some refiners might alter crude slates. That can change refining margins across regions.

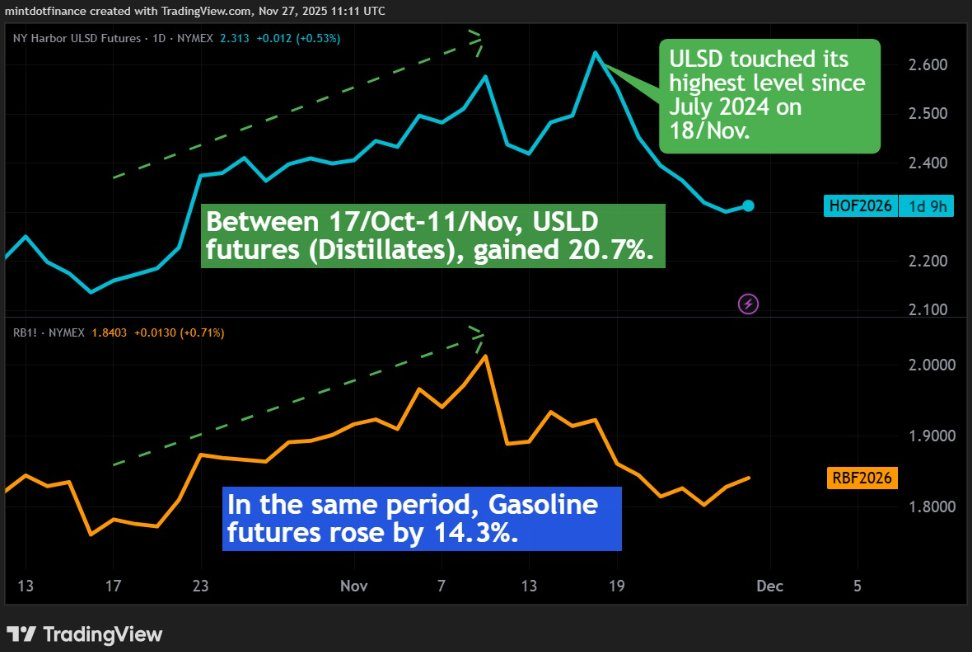

Shipping and insurance costs for tankers could fall if sanctions ease. Conversely, any new trade frictions would keep freight premiums high. Fuel spreads, such as diesel versus gasoline, also respond to regional demand patterns and refinery maintenance schedules. Traders watching crack spreads look for early signs of shifting regional balances.

Short-term Scenarios Traders Should Watch

One scenario is incremental diplomacy. In that case, partial easing of trade frictions could gradually add supply. That outcome would likely pressure prices lower over the weeks. A second scenario is stalled talks. That would sustain the current risk premium and permit price rebounds on any supply shocks or weather, or holiday-driven demand.

A third scenario is sudden escalation. That would spike prices quickly as buyers seek safety stocks and shipping routes reroute. Each scenario has a different speed and magnitude. Traders should follow official statements, sanction updates, and shipping data closely.

Oil Prices: What to Watch Next?

Watch the November 30 OPEC+ meeting for any change to stated production paths. Monitor weekly U.S. inventory data for unexpected draws or builds. Track official diplomatic communiques and directive language from Moscow and Kyiv. Follow tanker tracking and insurance notices for early signs of resumed shipments.

Also, watch the central bank commentary that may alter growth and fuel demand forecasts. These actions will determine whether the recent diplomatic optimism becomes a sustained factor or remains a headline that fades.

Conclusion and Near-term Outlook

On November 28, 2025, oil markets balanced on new diplomatic signals and persistent structural trends. Short-term price moves will likely remain choppy. The next few days could set a clearer path if talks produce verifiable changes to supply arrangements or if OPEC+ shifts policy.

Traders should expect volatility. The balance between faster Russian supply normalization and continuing global supply growth will shape prices into 2026. Follow official updates closely and use verified shipping and inventory data to confirm market moves.

Frequently Asked Questions (FAQs)

Russia-Ukraine talks on November 28, 2025, affect oil prices because traders watch for any change in supply risks. Even small diplomatic updates can raise or lower prices as markets react fast.

Sanctions can change supply because they limit how much oil Russia can sell. If rules ease, more oil may return to the market. If rules tighten, the supply becomes smaller.

OPEC+ matters because the group controls large oil output. When it raises or cuts production, oil prices move. Traders follow each decision to understand future supplies and market direction.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.