OPEN Stock Slips 8.61% on October 8 – Can It Rebound This Week?

On October 8, 2025, Opendoor Technologies (OPEN) shocked investors when its stock fell 8.61% in a single trading session. The drop was sharper than the overall market and raised fresh questions about the company’s future in the challenging real estate sector. Opendoor is known as one of the largest “iBuying” platforms, using data and technology to purchase and sell homes. However, its business is highly sensitive to housing demand and interest rates.

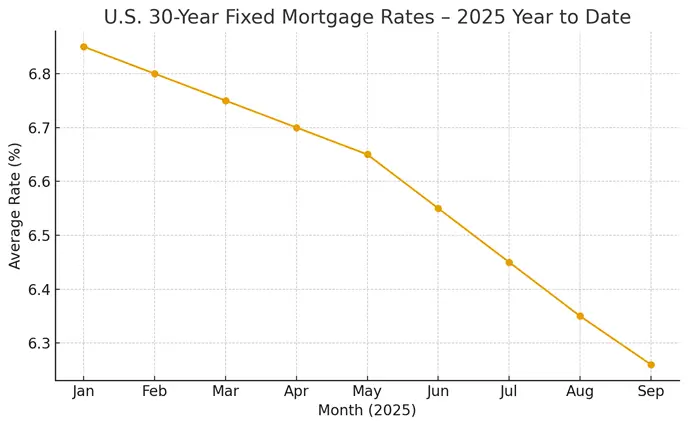

When a stock falls this fast, investors want to know one thing: Is this just short-term panic, or a warning sign of deeper problems? In recent months, the housing market has struggled with high mortgage rates, slower sales, and cautious buyers. At the same time, Opendoor has been trying to cut costs and improve profitability.

This sudden decline could also create an opportunity if the company shows signs of recovery. Let’s break down what caused the drop, study the company’s fundamentals, and explore whether OPEN stock can rebound in the coming week or if more downside is ahead.

Opendoor (OPEN): Company Snapshot and Recent Moves

Opendoor buys and sells homes using digital tools. The company acts as an iBuyer. It makes money from buying homes, fixing them, and then selling them. The model needs high transaction volume. Profit depends on steady home demand and healthy margins. Opendoor filed an 8-K on October 1, 2025, that investors watched closely for guidance and financing details.

Recent Price Action and the October 8 Drop

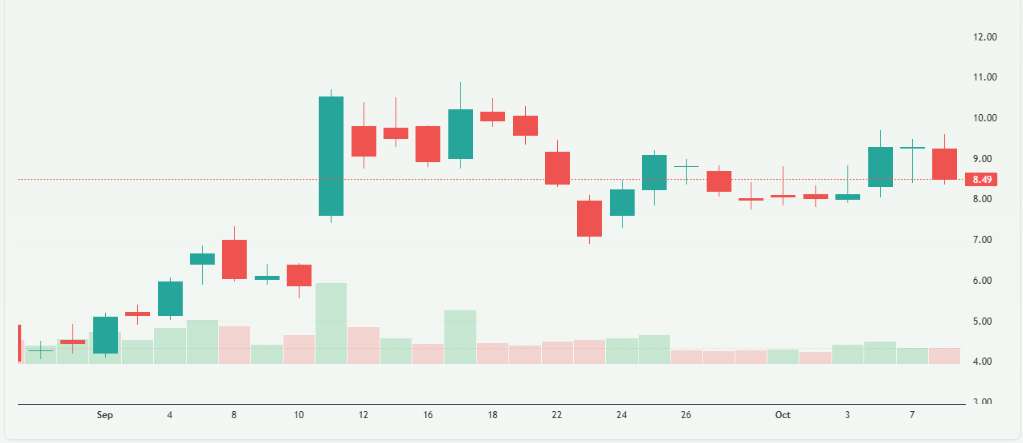

OPEN rose sharply during parts of 2025. The stock rallied hard in late summer and early fall. Still, on October 8, 2025, trading showed a sharp reversal. The share price fell 8.61% that day, sliding from about $9.29 to $8.49 on heavy volume. This move was bigger than the market’s average shift and grabbed headlines.

Why Shares Fell on October 8?

Several forces likely combined to push the stock lower. First, profit-taking followed a big run-up in 2025. Many traders booked gains after rapid rallies. Second, housing data and rate talk kept investors nervous. Even small moves in mortgage rates hit iBuyers hard. Third, recent insider filings and large stake reports added noise. Market participants read these filings closely for signs of insider confidence or selling. The mix of profit taking and news flow can create steep daily losses.

Fundamentals: Growth, Cash, and Profitability

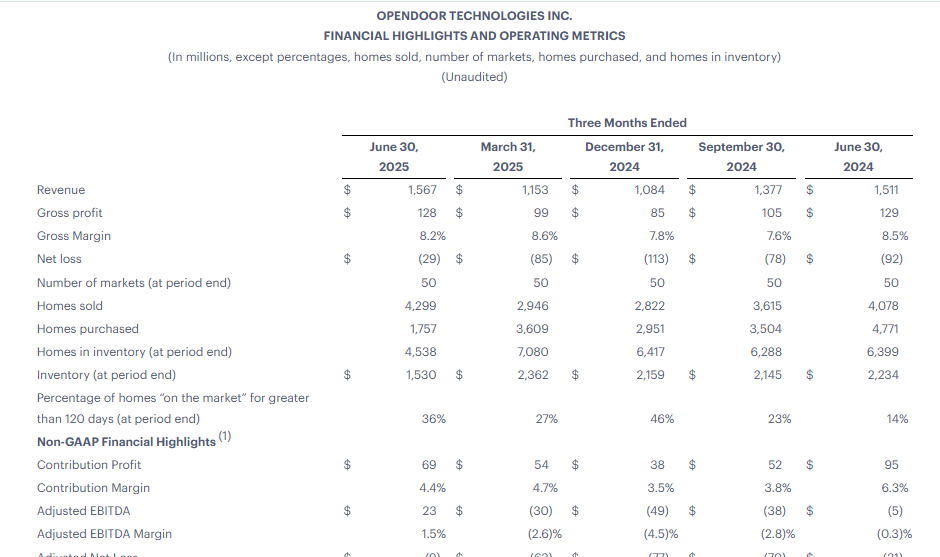

Revenue recovered in 2025 as housing activity edged up. Opendoor reported revenue guidance and said it expects higher volumes in later quarters. The company also built a larger capital base. Recent reports highlighted a roughly $1.1 billion liquidity cushion created by new financing. That cash gives the company room to buy homes during slow patches. Yet losses remain a concern. Opendoor still needs to prove consistent margins and long-term profitability.

Technical Picture and Market Structure

The price drop on October 8 broke some short-term support levels. The large volume that day shows active traders were exiting. At the same time, the stock has a very high short interest by some measures. Heavy short positions can push prices lower quickly. They can also fuel sharp rebounds if shorts cover. That dynamic makes the stock volatile and sensitive to news.

Key Tailwinds that could Spark a Rebound

Falling mortgage rates could lift buying demand. Recent data showed mortgage rates easing slightly in late September 2025, which tempted some homeowners to refinance. Any clear sign of further rate declines would help Opendoor. Institutional buying or a new financing deal would also calm markets. Positive earnings or firm guidance can reverse panic quickly. Tools like an AI stock research analysis tool might flag subtle shifts in volume or sentiment that precede a bounce.

Major Risks to Watch

Housing demand is still fragile. If interest rates rise again, demand could stall. Competition from other online buyers and traditional brokers can squeeze margins. Insider sales or big block trades could trigger more selling. Finally, any negative guidance or surprises in future SEC filings would likely worsen sentiment. Opendoor’s business also depends on accurate home price forecasting; errors here hurt profit fast.

Analyst Views and Market Sentiment

Analysts show mixed views. Some point to the company’s strong revenue rebound and improved liquidity as reasons for optimism. Others warn that the stock is still speculative and that margins must improve to justify recent gains. The wide range of price targets reflects those opposing views. Recent press coverage has emphasized both the rapid 2025 rally and the risks that come with high short interest.

Short-term Outlook: Can OPEN Rebound this Week?

A rebound within a single week is possible but not guaranteed. Short-term moves will depend on headline news. Watch for comments from the Fed or any new housing data. Also, watch company announcements and SEC filings. If mortgage rates ease more, buyers may return. If insiders or big holders sell more shares, the stock could fall again. Active traders should track volume and intraday support.

Longer-Term View

Long term, Opendoor’s fate is tied to the housing market and its own unit economics. If the company keeps improving margins, the business could scale into lasting profits. If housing demand weakens or the cost structure stays high, the stock may struggle. The recent liquidity increase reduces short-term funding risk. Still, long-term returns will rely on steady improvement in contribution profit and lower transaction costs.

Practical Signals to Watch Next

Look for any new SEC filings or 8-Ks. Track mortgage rate trends and weekly housing starts or pending home sales. Note volume spikes and short interest updates. Monitor insider trading reports for unusual moves. Also, follow analyst note changes. These items often drive big moves in volatile names.

Conclusion

The October 8, 2025, drop was a clear sign of short-term profit-taking and market sensitivity. The stock can rebound quickly if housing conditions improve or if positive company news appears. The path forward will depend on rates, liquidity, and execution. Investors should read filings and watch market data before acting.

Frequently Asked Questions (FAQs)

Opendoor stock fell 8.61% on October 8, 2025, due to profit-taking, housing market worries, and investor concerns about interest rates and future growth.

A rebound is possible if housing data or market news turns positive, but the stock may keep falling if rates rise or investor sentiment stays weak.

Yes, it is risky because Opendoor depends on home prices, buyer demand, and mortgage rates, which can change quickly and affect profit and stock performance.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.