OpenAI Revenue Surges 16% to $4.3B in First Half, The Information Reports

OpenAI reached a major milestone in the first half of 2025. Its revenue grew 16%, hitting about $4.3 billion. This is more than the total revenue for all of last year. The growth comes mainly from ChatGPT subscriptions and new enterprise partnerships.

The company also faced challenges. It burned $2.5 billion in cash due to heavy spending on research and development. OpenAI aims to reach $13 billion in revenue by year-end. It is looking at options like stock sales and more partnerships to manage its finances.

This strong performance shows OpenAI is a key player in the AI industry. As AI becomes more important across industries, OpenAI’s innovations and strategies will shape the future of AI development and business use.

Open AI Revenue Overview

In the first half of 2025, OpenAI earned about $4.3 billion in revenue. This is a 16% rise compared to its total revenue from the previous year, according to The Information. The growth shows how quickly its AI tools are being adopted.

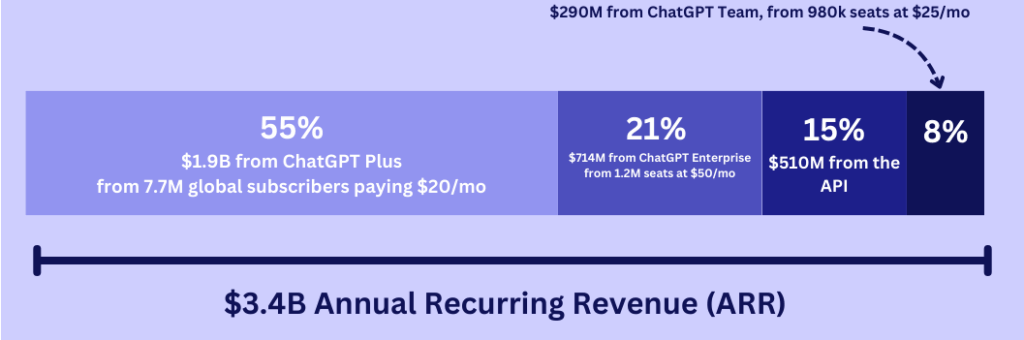

OpenAI makes money from several sources. ChatGPT subscriptions, API services, enterprise deals, and new commerce features all add to revenue. ChatGPT alone brought in $2.7 billion in 2024, around 75% of total revenue. Features like “Instant Checkout,” which lets users buy products through ChatGPT, are helping diversify income.

Even with strong growth, OpenAI spent heavily. The company burned $2.5 billion in cash during the period, mainly on research and development, including ChatGPT support. Total R&D costs hit $6.7 billion. OpenAI plans to reach $13 billion in revenue by year-end while keeping cash burn under $8.5 billion.

Key Drivers of Growth

OpenAI’s revenue growth comes from several key areas.

The adoption of ChatGPT across many sectors has played a major role. Millions of users interact with the platform daily, driving steady revenue. Enterprise partnerships also boost income. Deals with companies like Microsoft help integrate OpenAI’s tools into business solutions, adding more value. New product launches contribute too.

Features like the “Instant Checkout” system create extra revenue channels and improve the user experience. Global expansion is another factor. OpenAI plans to enter India by the end of 2025, tapping into a growing market for AI solutions. This move is expected to further increase revenue and strengthen its international presence.

Market Context

OpenAI operates in a competitive AI landscape, with key players like Anthropic and Google DeepMind vying for market share. While Anthropic has shown rapid growth, reaching a $3 billion annualized revenue by mid-2025, OpenAI maintains a leading position through its extensive product offerings and strategic partnerships. The company’s projected revenue of $12.7 billion for 2025 underscores its dominant role in the AI industry.

Strategic Implications, Challenges, and Considerations

OpenAI’s strong financial results make it a major force in the AI sector. The company earns large revenue while spending heavily on research and development, showing its focus on innovation. Plans for a stock sale, which could value the company around $500 billion, highlight investor confidence in its future.

Despite its success, challenges remain. Competition is intense, and regulations are strict. Managing finances carefully is essential to sustain growth. OpenAI must tackle these issues to maintain its position and continue leading in the rapidly evolving AI industry.

Bottom Line

OpenAI made huge revenue in the first half of 2025. This shows it is a key player in AI. The company grew by creating new products, forming partnerships, and expanding worldwide. These moves set it up for more success. Still, it faces challenges. Competition is tough. Rules and regulations are strict. Managing money carefully is important. OpenAI must handle these to stay strong in the fast-changing AI world.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.