OpenAI Valuation Surges to $500 Billion After Secondary Share Sale

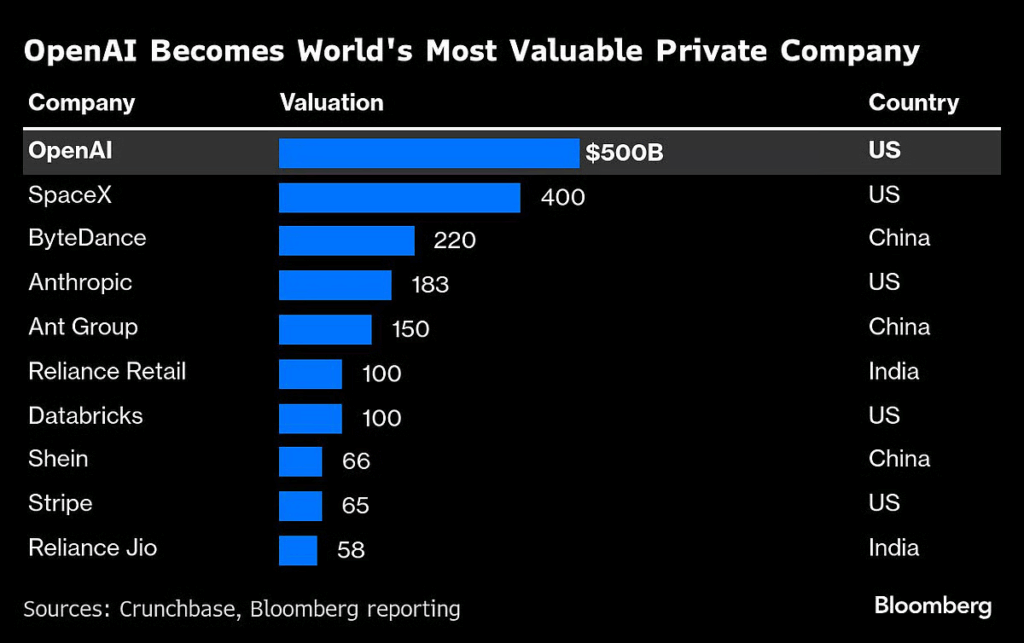

OpenAI reached a major milestone, hitting a $500 billion valuation on October 2, 2025. This followed a secondary share sale where employees sold about $6.6 billion in stock to investors like SoftBank, Thrive Capital, Dragoneer, Abu Dhabi’s MGX, and T. Rowe Price. This valuation now places OpenAI ahead of SpaceX as the world’s most valuable startup.

The jump from a $300 billion valuation earlier this year shows strong investor confidence in AI. OpenAI’s innovations, especially in generative AI through ChatGPT, are impacting fields like healthcare and education. Its ability to earn revenue from these technologies, along with key partnerships, has strengthened its financial position.

Let’s explore the factors contributing to OpenAI’s soaring valuation, the implications for the tech industry, and the potential challenges that lie ahead.

Background on OpenAI

OpenAI was founded in December 2015 by Elon Musk, Sam Altman, Greg Brockman, Ilya Sutskever, John Schulman, and Wojciech Zaremba. Initially established as a nonprofit organization, OpenAI’s mission was to ensure that artificial general intelligence (AGI) benefits all of humanity.

In 2019, OpenAI transitioned to a “capped-profit” model, allowing it to raise capital while maintaining its commitment to safety and broad benefit. This shift enabled OpenAI to attract significant investments, including a notable partnership with Microsoft. Over the years, OpenAI has developed groundbreaking technologies such as GPT-3, DALL·E, and ChatGPT, which have revolutionized natural language processing and AI applications.

Details of the Secondary Share Sale

On October 2, 2025, OpenAI finished a secondary share sale that valued the company at $500 billion, making it more valuable than SpaceX and the world’s top startup. About $6.6 billion in shares were sold by current and former employees.

Key investors in the sale included Thrive Capital, SoftBank, Dragoneer Investment Group, Abu Dhabi’s MGX, and T. Rowe Price. This followed a $40 billion primary funding round earlier in 2025, also led by SoftBank. The secondary sale gave employees liquidity while keeping OpenAI private, allowing the company to focus on long-term goals without the pressures of public markets.

Factors Contributing to OpenAI’s Massive Valuation

Several factors have driven OpenAI’s rapid ascent to a $500 billion valuation:

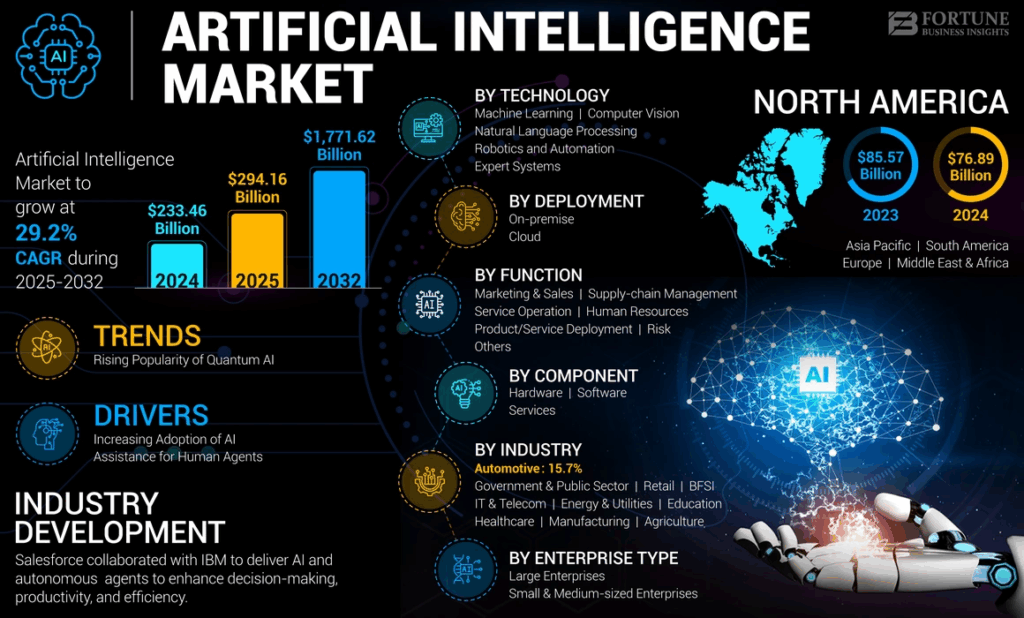

The global demand for AI is growing rapidly, placing OpenAI at the center of this revolution. Its products, especially ChatGPT, are widely used in industries like education and healthcare.

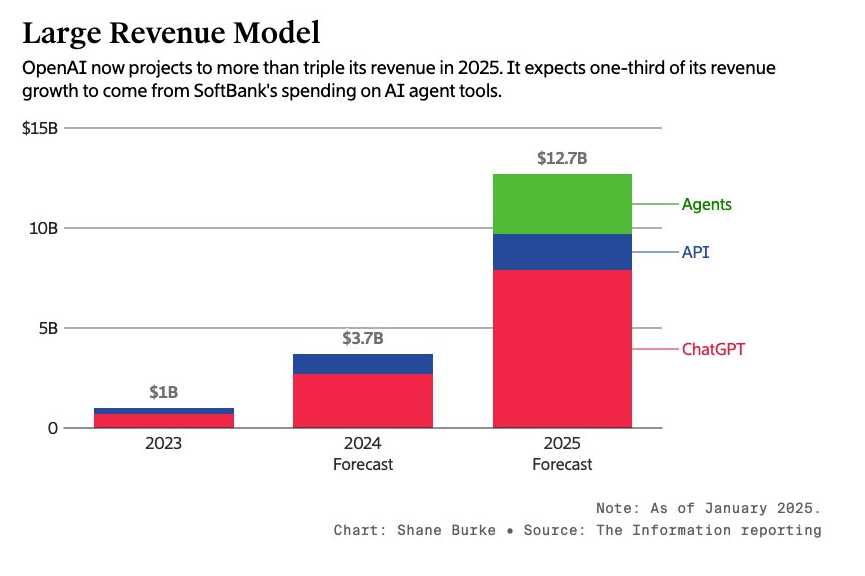

OpenAI’s innovations have created new ways to earn revenue. In the first half of 2025, it made $4.3 billion, up 16% from all of 2024. Annual revenue could reach $12 billion by the end of 2025 and may exceed $20 billion soon.

Partnerships with companies like Microsoft have strengthened OpenAI’s position. Microsoft has invested nearly $14 billion, integrating OpenAI’s AI models into its products and services. OpenAI keeps pushing AI research forward. Its $1.1 billion acquisition of Statsig shows a focus on building tested, practical AI applications beyond experimental models.

High-profile investors, including SoftBank and Thrive Capital, show strong confidence in OpenAI’s future. Their support provides resources to scale operations and increase OpenAI’s influence in the AI industry.

Implications of the $500 Billion Valuation

OpenAI’s $500 billion valuation has significant implications:

For the AI industry, OpenAI’s $500 billion valuation sets a new benchmark. It shows the huge growth potential of AI and highlights opportunities for innovation and investment worldwide.

For investors, the milestone signals strong profit potential in AI. At the same time, it raises questions about whether such fast growth can continue and the risks involved.

For competitors, OpenAI’s success increases pressure in the AI market. Companies like Anthropic and Anduril are also seeing rising valuations, showing a competitive and active industry landscape.

In terms of market perception, this achievement strengthens OpenAI’s role as a tech leader. It challenges traditional ideas of company value and shows how AI is transforming technology globally.

Challenges and Risks Ahead

Despite its rapid growth, OpenAI faces several challenges. Governments are paying more attention to AI rules. They want to protect privacy, security, and ethics. OpenAI must follow these rules to keep trust.

The AI field is very competitive. Many companies are trying to lead. OpenAI must keep creating new ideas and stay different to remain on top. AI services need strong systems and infrastructure. OpenAI must grow its operations carefully to meet the rising demand worldwide.

People worry about AI affecting jobs, privacy, and decisions. OpenAI needs to be clear and responsible to address these concerns and keep public support.

Wrap Up

OpenAI reaching a $500 billion valuation is a major milestone for artificial intelligence. The company has done very well, but it must keep innovating and handle challenges carefully. Staying ahead in the AI world will be key to its growth. OpenAI also needs to ensure that advanced AI benefits everyone. The next few years will show if it can continue this path and set new standards in the AI industry.

Frequently Asked Questions (FAQs)

A secondary share sale is when existing shareholders sell their shares. On October 2, 2025, OpenAI’s sale raised $6.6B, valuing the company at $500B and showing strong investor confidence.

Major investors included SoftBank, Thrive Capital, Dragoneer, Abu Dhabi’s MGX, and T. Rowe Price. The sale on October 2, 2025, reflects growing interest in AI and OpenAI’s potential.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.