Opendoor (OPEN) Co-Founder Boosts Stake With $2M Share Purchase

On September 30, 2025, news broke that Opendoor co-founder Eric Wu quietly acquired roughly 300,752 shares at about $6.65 each, spending around $2 million to raise his stake in the company.

This move stands out. We rarely see founders placing fresh money into their own public companies. It’s a strong signal of belief in the future. Opendoor isn’t just any tech firm. It’s a trailblazer in “iBuyer” real estate buying homes, making repairs, and reselling them via an online platform.

In today’s volatile markets, insider activity can shift sentiment fast. We’ll explore what this $2M purchase means for Eric Wu, for investors, and for Opendoor’s path forward.

Let’s walk you through the details of the purchase, why insiders like Wu decided to buy, and what the signals may be for the stock and real estate tech space.

About Opendoor Technologies

Opendoor is an online real estate company that buys and sells homes. The firm began as an “iBuyer.” It pays sellers fast. Then it fixes and resells houses. The business aims to simplify home sales with tech and logistics. Opendoor listed on public markets after merging with a SPAC. The company has faced wide swings in revenue as housing demand shifted and mortgage rates rose. Recently, management has focused on operational efficiency and returning to profitability.

Details of the Co-founder’s $2M Share Purchase

Opendoor co-founder Eric Chung-Wei Wu bought 300,752 shares at $6.65 per share. The purchase was made on September 26, 2025, under a private stock purchase agreement. The total outlay was about $2.0 million. After the deal, Wu’s direct holdings rose to about 1,950,636 shares, according to the Form 4 filing. The transaction used an offering exempt from registration, and the shares carried resale restrictions until registration or other qualifying events. The purchase was first reported publicly on September 30, 2025.

Why Insider Buying Matters?

Insider purchases can signal confidence. Executives and founders know the business better than most. Buying stock can show belief in the company’s future. However, insider buys are not proof of success. They must be read with other data, such as earnings and cash flow. Traders often use filings and market signals together. An AI stock research analysis tool can speed up checks of SEC filings and insider calendars for investors doing due diligence.

Opendoor’s Current Market Position

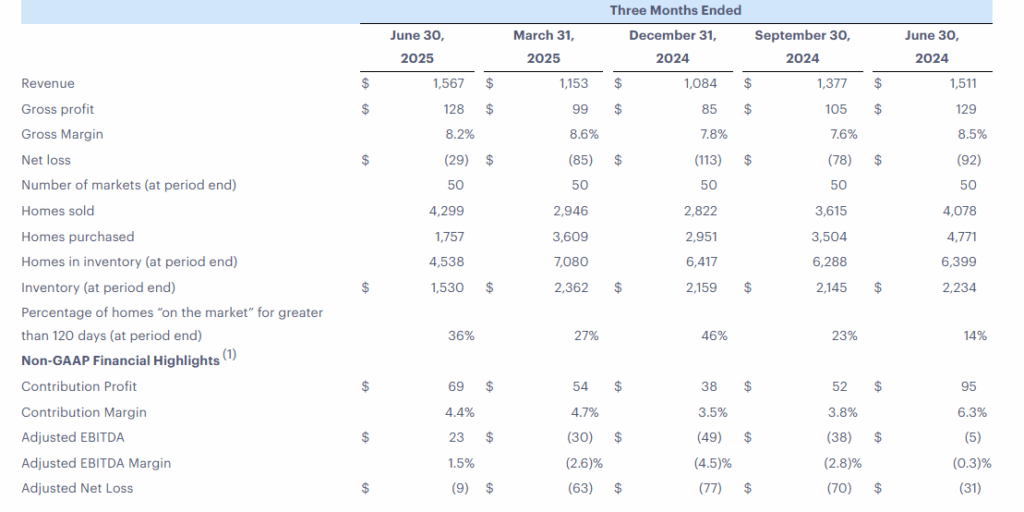

Opendoor returned to positive adjusted EBITDA in Q2 2025, a milestone after years of losses. The company gave guidance for Q3 revenue in the $800-$875 million range. Management also announced a $200 million buyback program and has moved to cut costs.

Still, Opendoor remains unprofitable on a net-income basis and faces margin pressure when home prices move or holding times lengthen. The stock has also seen strong retail interest in 2025, which has increased volatility.

Recent Market Moves and Outside Investors

In late September 2025, trading firm Jane Street disclosed a large stake in Opendoor. That filing showed about a 5.9% position. The disclosure pushed the stock higher and drew attention from both retail and institutional traders. The return of co-founders and new management hires has also driven investor excitement. Still, analyst sentiment remains mixed, given Opendoor’s long path to steady profits.

Potential Impact on Investors

A founder’s purchase can calm some nervous investors. It may also attract new buyers who follow insider moves. For short-term traders, the trade can add fuel to momentum. For long-term holders, the purchase is one signal among many. Key risks remain. The housing market can slow. Interest rates may stay high. Competition from other iBuyers and real-estate platforms could squeeze margins. Investors should pair insider filings with financial reports and market data before making decisions.

Broader Real Estate Market Outlook

U.S. housing in 2025 shows mixed signs. Sales volume slowed earlier in the year when rates rose. Affordability remains a major challenge for many buyers. Digital home-selling models like Opendoor benefit when sellers want speed. But profits depend on stable price spreads and fast turnover. If mortgage rates fall and demand rises, iBuyer margins could expand. If rates stay high, inventory and price moves could hurt returns. Analysts expect continued uncertainty for the rest of 2025 and into 2026.

Conclusion

Eric Wu’s purchase on September 26, 2025, is a clear vote of confidence. It adds a founder-level endorsement during a volatile stretch. The deal does not remove core risks for Opendoor. The firm must keep improving operations and grow revenue sustainably. Investors should watch upcoming earnings, the effects of the buyback program, and any further insider filings. Use official SEC filings and company reports as primary sources for any trading decision.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.