Oracle’s 2025 Q2 Earnings Report: Which AI Partners Saw Their Stocks Affected?

On December 10, 2025, Oracle released its Q2 fiscal 2026 earnings report after the U.S. market closed. The numbers showed solid growth in cloud and AI infrastructure revenue. Still, some key figures fell short of what Wall Street expected.

Investors did not cheer. Instead, Oracle’s stock slid and dragged down other tech shares with it. This reaction was about more than Oracle alone. It hit the AI trade hard. Stocks tied to artificial intelligence rallied earlier in 2025. But after Oracle’s report, confidence wavered. Big names like Nvidia, AMD, Palantir, and others saw sharp moves.

Even firms linked indirectly through AI projects, like those connected to OpenAI, felt the impact. This article explores how Oracle’s earnings shaped stock prices across the AI landscape. Let’s break down who moved, why it happened, and what it could mean next.

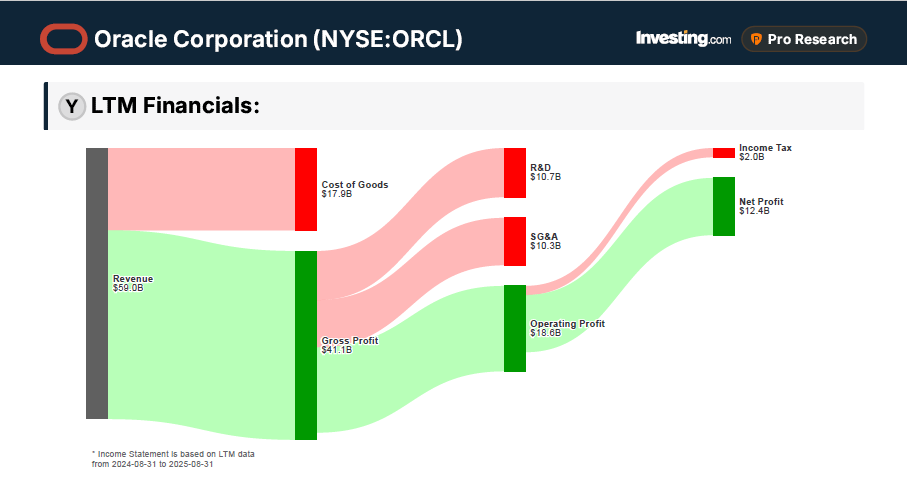

Oracle’s Earnings in Context

On December 10, 2025, Oracle published its Q2 fiscal 2026 results. Revenue rose to $16.1 billion, and non-GAAP EPS beat expectations. The report also showed cloud revenue growth and a large jump in contract backlog.

However, the company raised capital spending sharply and guided for far higher build-out costs. That surprise spending plan and a swollen remaining performance obligation figure changed how investors read the quarter. The details moved markets because the numbers suggested big near-term cash outlays. Investors tightened risk calls and sold into the news.

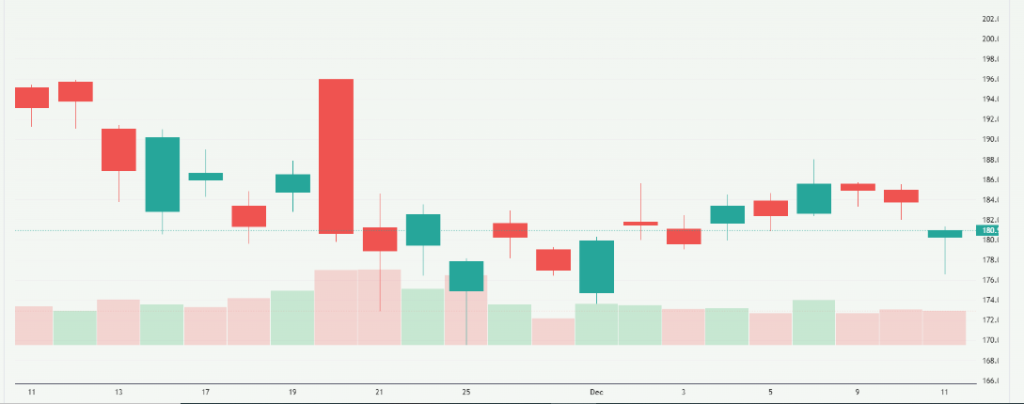

Nvidia (NVDA): Dominance Tested

Nvidia still sits at the center of AI hardware. Its data-center GPUs power most large models. After Oracle’s report, Nvidia shares dipped. Traders questioned whether a single vendor can retain pricing power as hyperscalers diversify. Oracle’s plan to mix suppliers for its superclusters created talk about margin pressure for GPU makers.

Market sentiment shifted from “runaway growth” to “prove the earnings.” The move was not a knockout blow. It was a reset of near-term expectations. Many investors used an AI stock research analysis tool to reprice short-term risk and volume.

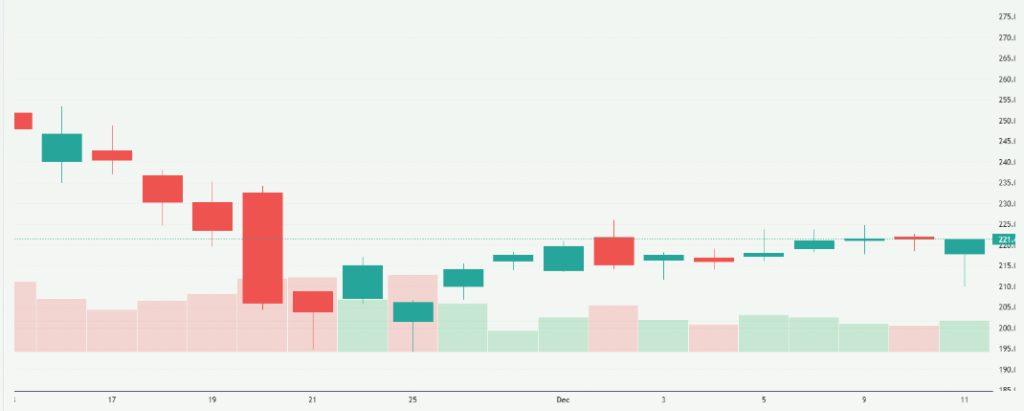

AMD: The Alternative Gains Nuance

AMD got fresh attention because Oracle signaled multi-vendor deployments. Oracle and AMD have public partnership steps that point to large AMD GPU installations in Oracle Cloud Infrastructure. Announcements earlier in October 2025 made clear that Oracle will deploy huge AMD Instinct clusters over the next year. That plan gives AMD a structural growth story inside hyperscaler builds.

Still, AMD’s stock moved down with the broader selloff. The reason is simple: sector sentiment and liquidity dominated stock moves the day after earnings. Longer term, the Oracle tie strengthens AMD’s case as a credible Nvidia alternative.

OpenAI: Big Partner, No Public Ticker

OpenAI itself is private. Its influence appears in partner contracts and revenue expectations. Oracle has invested around $300 billion in OpenAI projects, which added pressure on its finances. Oracle’s reported backlog and some headlines tied large deal volumes to OpenAI-related work. That link intensified scrutiny of Oracle’s debt and capital plan. Investors asked if Oracle is overexposed to one partner’s fast rollout.

On December 10, 2025, the market reaction showed how a private firm can still sway public stocks via service and infrastructure commitments. Analysts flagged counterparty risk and asked for clearer cash-flow math, highlighting that even top AI partners face investor scrutiny when large investments take time to pay off.

Palantir (PLTR): Data Plays under Pressure

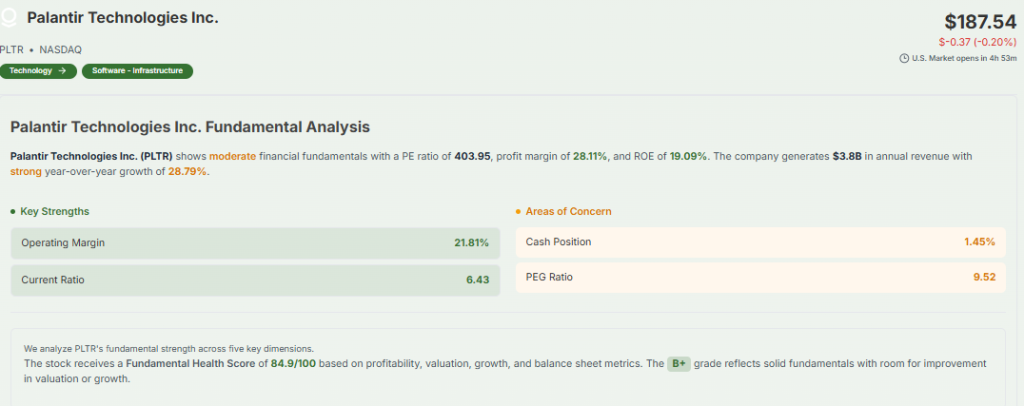

Palantir sits on the data and software layer that feeds AI models. After Oracle’s report, Palantir faced the same risk-off tone. Short-term price action compressed as investors rotated out of high-multiple AI names.

Palantir’s fundamentals remain strong in many analytics contracts and government work. But the broad thawing of AI froth pushed traders to demand visible revenue conversion. For data-centric firms like Palantir, the bar is now more execution and less promise.

Broader Sector Impact: A Recalibration Moment

Oracle’s quarter acted like a mirror for the entire AI trade. The surprise was not only big capex. It was the implication that hyperscalers must spend huge sums before AI gets fully monetized. The news knocked down chips, servers, and cloud-provider stocks in one session. Headlines noted multi-percent declines across prominent AI and data-center names.

The episode felt like a test of patience. Investors shifted from expectation of instant returns to a recognition that infrastructure scale takes time and cash. Analysts called it an AI valuation reset rather than a technology failure.

Why These Moves Matter for Investors?

Earnings that spotlight spending change the risk equation. A big cloud build means growth, but also heavier near-term cash burn. That tradeoff favors companies with strong margins and clear paths to positive free cash flow. For chip makers, it matters which vendors hyperscalers choose at scale.

For software firms, it matters how quickly customers pay and how contracts convert into cash. The Oracle episode raised questions about counterparty concentration, contract timing, and leverage. These are the practical metrics that now drive valuations.

Oracle Impact on Sector: What to Watch Next

Watch actual deployment cadence. Track data-center completion updates and GPU shipment schedules. Follow contract revenue recognition in earnings calls. Monitor Oracle’s capital spending updates and any clarifying language about which contracts drive backlog. Watch hyperscalers’ public statements on supplier mix. Also watch macro liquidity and credit costs, because heavy debt and rising cost of capital make long build-outs riskier.

Long-Term Implications for the AI Narrative

This is not the end of the AI cycle. It is a refinement. Large cloud investments are essential for high-scale models. But markets now demand clearer execution proof. Firms that can show revenue conversion and margin improvement will attract capital.

Chip vendors that secure long multi-year supply deals stand to gain. Data and software platforms that convert pilot work into steady contracts win credibility. The market will reward tangible milestones more than vision statements.

Closing Note

Oracle’s Q2 figures on December 10, 2025, changed the tone of the AI trade. The quarter highlighted two truths. One, building AI at hyperscale costs a lot. Two, markets now require clearer returns on that spending.

Nvidia, AMD, Palantir, and other partners felt the swing. The next few quarters will test which companies can turn scale into steady profit. Readers should track deployment milestones, capitalization moves, and any change in partner mix to see who benefits and who struggles.

Frequently Asked Questions (FAQs)

On December 10, 2025, Nvidia shares fell after Oracle reported higher AI spending and slower revenue growth. Investors worried it could limit short-term profits for AI chip makers.

Yes. AMD, Palantir, and other AI-related stocks also dropped. Oracle’s big spending and cautious guidance on December 10, 2025, made investors rethink growth expectations across the AI sector.

Oracle’s deal with OpenAI shows strong AI demand but high spending. On December 10, 2025, investors were cautious, affecting the stocks of Oracle partners in AI and cloud technology.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.