Oracle Stock 10% Slides After Rising Spending and Weak Forecasts

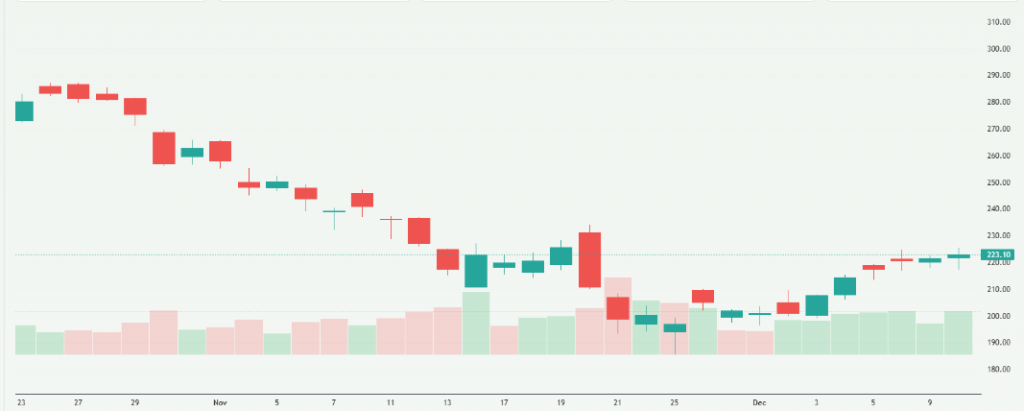

On December 10, 2025, Oracle stock plunged more than 10%. The fall came after the company revealed higher-than-expected spending on AI cloud data centers and issued a weaker forecast for the next quarter.

Investors had hoped for cloud revenue growth and clear signs that Oracle’s big investments would pay off soon. Instead, results showed revenue just below estimates.

The sharp drop reflects growing doubts. Many now ask: Is Oracle’s heavy spending a smart long-term bet or a risky bet that might not pay off? Let’s dig into what triggered the stock slide. We’ll look at the spending decision, the weak guidance, and what it all means for Oracle’s future.

What Actually Caused Oracle’s 10% Stock Slide?

On December 10, 2025, Oracle shares fell about 10% after the company released its fiscal Q2 results and guidance. The market reacted to two things. First, cloud revenue and total revenue missed some analyst estimates. Second, management raised planned capital spending sharply to build AI-ready data centers.

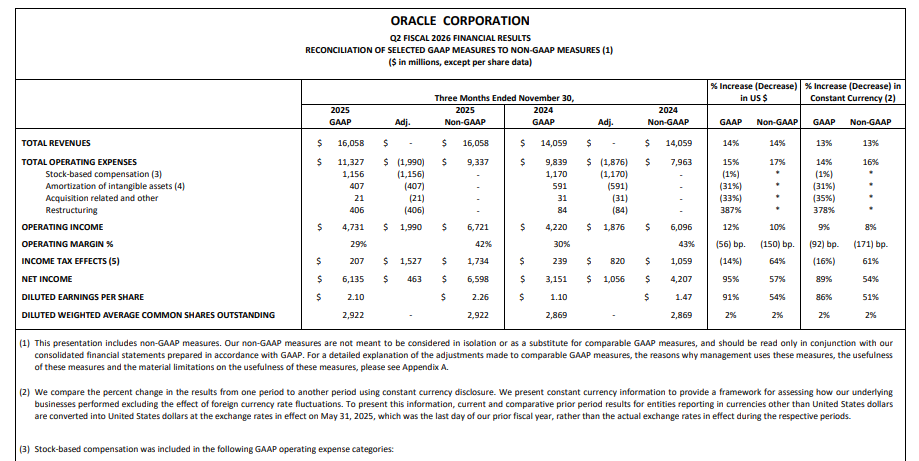

The numbers mattered. Total revenue for the quarter was $16.1 billion. Cloud revenue was reported at $8.0 billion. The firm’s remaining performance obligations, a measure of contracted future revenue, rose to $523 billion. These facts triggered investor concern about near-term profits and capital needs.

The earnings beat on adjusted EPS did not calm markets. A large one-time gain from selling a stake in Ampere helped profit. That gain masked a weaker underlying cash flow. Traders focus on the path ahead. The outlook and big spending plans mattered more than a single tidy quarter.

Oracle’s Rising Spending: Smart Long-Term Bet or Costly Overreach?

Oracle says the extra spending funds data centers for AI workloads. Management described deals with major AI clients and plans to add hundreds of megawatts of capacity. The company now plans far higher capital expenditures for fiscal 2026 than it had earlier guided. The new capex outlook ranges near $50 billion for the year, compared to lower prior estimates. That jump surprised investors and rating agencies.

Higher spending can win customers. It also erodes margins now. Oracle’s cloud growth is real. But cloud customers often demand discounted, long-term contracts. Those deals postpone full profit. Building data centers costs cash up front. Interest and debt effects make the move riskier if revenue ramps slower than planned. Analysts warned that the balance between growth and profitability will be decisive.

Weak Forecasts: The Real Red Flag

Forward guidance was the chief worry. Oracle’s outlook for the next quarter and fiscal year showed slower expansion than many had hoped. Management signaled that the revenue mix and timing of large AI contracts might lead to uneven near-term results. Markets price firms on expected growth. When guidance slips, stock prices often drop sharply.

The forecast also hinted that some AI-related deals may not convert into immediate cash. Oracle’s remaining performance obligations are large but may be unevenly recognized. That gap between contracts and cash drives short-term nervousness. Analysts parsed the commentary for any sign of delayed customer deployments or softer enterprise IT budgets.

The AI Angle: Oracle’s Most Important Battlefield

Oracle is positioning OCI as a lower-cost option for AI training and inference. The company touts partnerships and custom hardware choices. Those moves aim to attract big AI labs and enterprises that need predictable pricing and close integration with Oracle databases. However, AI clients demand massive compute. They also pick suppliers that match their speed and cost needs.

That means Oracle must scale quickly. The initial ramp requires more servers, power, and networking. Revenue from multi-year AI deals often lags the spending spike. The mismatch between heavy capex now and revenue later explains part of the market’s reaction. Mention of an AI stock research analysis tool in market commentary has also increased scrutiny of modelled forecasts versus company guidance.

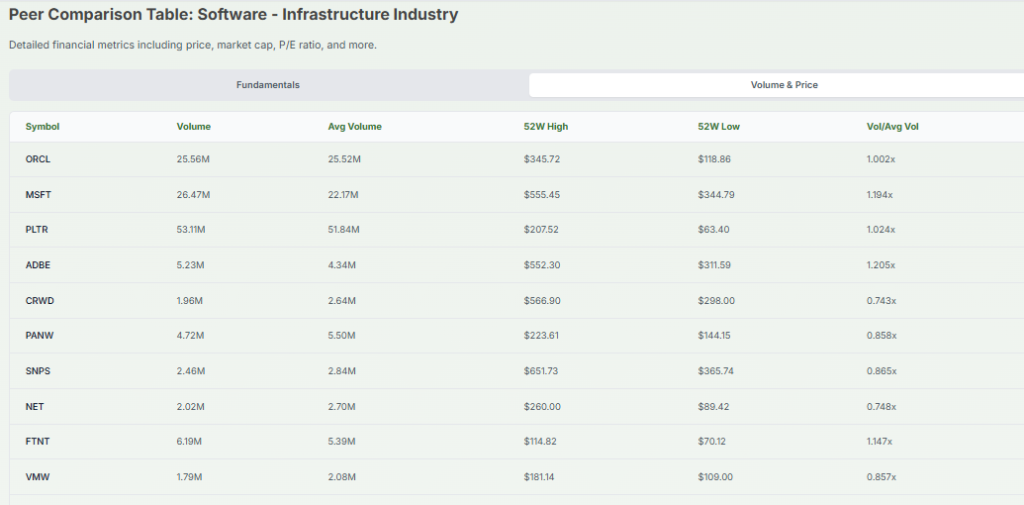

Oracle vs. Competitors: The Real Comparison Investors Made

Investors compared Oracle to the hyperscalers. Amazon Web Services, Microsoft Azure, and Google Cloud have bigger installed bases and longer AI track records. Those firms also show different margin mixes. Oracle’s cloud growth rate is healthy, but it starts from a smaller base. Hyperscalers enjoy scale benefits that lower incremental costs.

Oracle’s advantage is deep enterprise ties and database integration. For some clients, that connection matters more than raw scale. If Oracle can prove a lower total cost for AI workloads, it could win share. But the market doubts whether that proof will come quickly. The company must demonstrate both stronger cloud revenue and margin recovery to catch up to investor expectations.

Oracle Stock: What does this mean for Investors Now?

The stock drop is a wake-up call about timing. Long-term investors who believe in Oracle’s strategy may see the fall as a buying chance. Short-term traders react to guidance and cash-flow signals. Key metrics to watch in the coming quarters include cloud gross margins, data-center utilization, and free cash flow. Any sign that large AI contracts convert into steady cash could shift sentiment.

Risk remains. Higher debt and heavy capex raise the bar for execution. If enterprise IT spending chills or if AI customers delay projects, Oracle could face margin pressure for multiple quarters. Conversely, a steady report of new AI deployments and improved margins would validate the strategy and could restore investor confidence.

Final Outlook: Can Oracle Rebound?

Oracle’s plan is bold. The company bets that scale and enterprise trust will win AI workloads. That path could be lucrative if Oracle converts contracts into recurring cash. But success depends on execution and timing. Markets care about the speed of payoff. For now, the stock drop reflects skepticism over when profits will follow the spending.

Watch the next two quarters closely. Strong cloud revenue growth, improving margins, and steady free cash flow would ease pressure. If those do not appear, the market may continue to discount Oracle’s long-term thesis. The company’s strategic move into AI infrastructure remains plausible. Yet the present value of that promise is in question until more concrete results arrive.

Frequently Asked Questions (FAQs)

Oracle stock fell 10% on December 10, 2025, because the company shared weak forecasts and higher spending plans. Investors worried the new costs could slow profit growth in the near future.

Oracle’s heavy cloud spending is raising costs and lowering short-term profits. The company says it needs this investment to support future AI demand, but the payoff may take more time.

The recovery depends on the coming quarters. If cloud revenue grows and costs slow, the stock may improve. If spending stays high and demand stays weak, the rebound could take longer.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.