Oracle Stock: PineStone Offloads $41.1 Million Stake After Recent Rally

Oracle has become one of the most-watched tech stocks in 2025. The company has gained strong momentum thanks to its growing cloud and AI services. Its stock recently rallied to new highs after upbeat earnings and stronger guidance. However, on October 18, 2025, PineStone Investment Management sold $41.1 million worth of Oracle shares. This move surprised many investors because PineStone had been a long-term holder.

When a major institutional investor sells, people start asking questions. Is it just profit-taking after the rally? Or do they see risks ahead? At the same time, Oracle continues to expand its customer base, build data centers, and compete with giants like Microsoft and Amazon.

This mix of growth and selling activity makes the situation even more interesting. Investors now want to know if Oracle is still a strong long-term bet or if the stock is becoming overvalued. Let’s break down what happened, why it matters, and what it could mean for the future of Oracle stock.

About Oracle and its Business Today

Oracle has transformed from a database firm into a major cloud and enterprise software player. The company now sells cloud infrastructure, software subscriptions, and AI-enabled services. Leadership changes in September 2025 signaled a stronger focus on cloud growth. Oracle’s cloud push fuels revenue and lifts investor expectations. Recent announcements at investor events have reinforced that narrative.

What drove the Recent stock Rally?

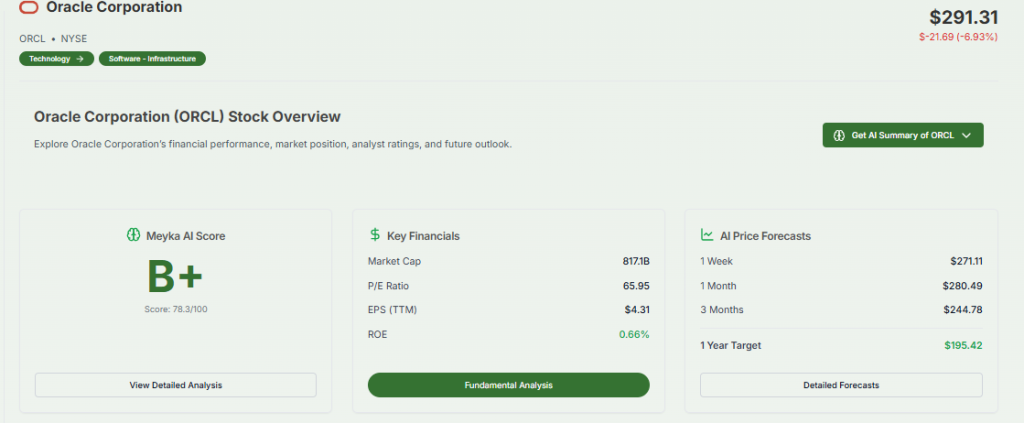

Oracle’s share price rose sharply in 2025. Strong demand for AI compute and new large customer commitments were key drivers. The company presented aggressive cloud revenue targets and disclosed large infrastructure bookings at its October analyst meetings. These updates helped push the stock higher and add substantial market value. Public reports place the year-to-date market-cap gain in the hundreds of billions.

Who is PineStone, and what Happened?

PineStone Asset Management is an institutional investor with sizeable US equity holdings. In filings for the quarter ended September 30, 2025, PineStone reported trimming 161,430 Oracle shares. The sale was valued at about $41.11 million based on the quarter’s average price. The trim reduced but did not eliminate PineStone’s large stake; the firm still held millions of Oracle shares at quarter-end. The disclosure appeared in SEC filings released on October 19, 2025.

Why PineStone may have been sold?

Profit-taking after a big rally is the simplest explanation. Large gains often trigger disciplined rebalancing. Portfolio managers may also free up cash to buy other opportunities. Some trims reflect risk management when a holding becomes a larger share of assets. Another reason could be tactical rotation away from near-term valuations to safer or more cyclical bets. The move was not a full exit; PineStone kept a major position. That pattern points more to trimming than to loss of faith.

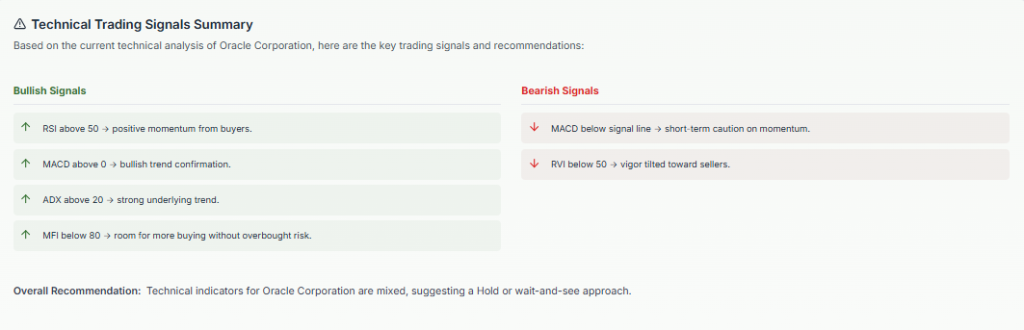

Market Reaction and Short-term Trading Signals

Markets showed mixed responses. Headlines about the sale drew attention, but trading volumes and price action were dominated by broader cloud and AI news. Oracle’s announcements about cloud bookings and partnerships tended to have a larger, immediate impact on the stock than single-fund filings. Short-term volatility increased around analyst meetings and chip-deal news. Active traders viewed the PineStone filing as a data point, not a market-moving shock.

Oracle’s Long-term Growth Case

Oracle aims to capture AI-driven cloud spending. Management projects strong multi-year growth in cloud infrastructure revenue and described large multi-year commitments from customers. Recurring software subscriptions plus expanding cloud margins form the backbone of the bull case. Oracle’s database franchise and enterprise relationships provide sales leverage for new cloud offerings. Investments in data centers and chip partnerships strengthen capacity to serve AI clients at scale.

Valuation, Risks, and the Bear Case

High growth expectations raise valuation risk. Rapid capacity buildouts require heavy capital spending. Some reports flagged thin margins on AI server rentals using certain GPUs. Those margin pressures can compress near-term profits even if revenue grows fast. Competition from hyperscalers is intense. If cloud bookings fail to convert into durable profit expansion, the stock could retreat. Investors should weigh price relative to realistic margin recovery timelines.

Analyst Views and Practical Signals to Watch

Look for guidance updates at quarterly reports and investor meetings. Track cloud bookings, measurable revenue recognition, and gross margins for AI infrastructure. Monitor insider trades and large 13F filings for shifts in institutional positions. Use an AI stock research analysis tool as one input among many to spot pattern changes in filings and holdings. Also watch customer wins and chip-supply partnerships for signs of a durable competitive advantage.

What should Individual Investors Consider Now?

Institutional trimming does not equal a sell signal on its own. The sale reduced exposure but left PineStone heavily invested. For long-term investors, fundamentals matter more than single-quarter filings. Short-term traders should expect noise from news events and earnings. Consider risk tolerance, time horizon, and portfolio allocation before acting. Confirm any trade idea with up-to-date filings and company disclosures dated October 16-19, 2025, and later.

Conclusion and Key Dates

PineStone disclosed the Oracle sale in SEC filings published on October 19, 2025. Oracle made major cloud and AI announcements around October 13-16, 2025. Both the investor filing and the company’s guidance matter. Institutional moves can offer clues. The larger story remains Oracle’s execution on cloud contracts and margin recovery over the next several quarters. Investors should follow earnings, bookings, and filing updates closely.

Frequently Asked Questions (FAQs)

PineStone sold $41.1 million of Oracle stock on October 18, 2025, likely to take profit after the rally, rebalance its portfolio, or reduce risk exposure.

Oracle may still interest investors because of strong cloud and AI growth, but some worry about high valuation, so checking earnings and guidance before buying is smart.

AI and cloud demand could support Oracle’s revenue in 2026, but results depend on customer growth, profit margins, and how well the company competes with larger rivals.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.