Ørsted Shares Tumble After U.S. Offshore Wind Farm Suspension

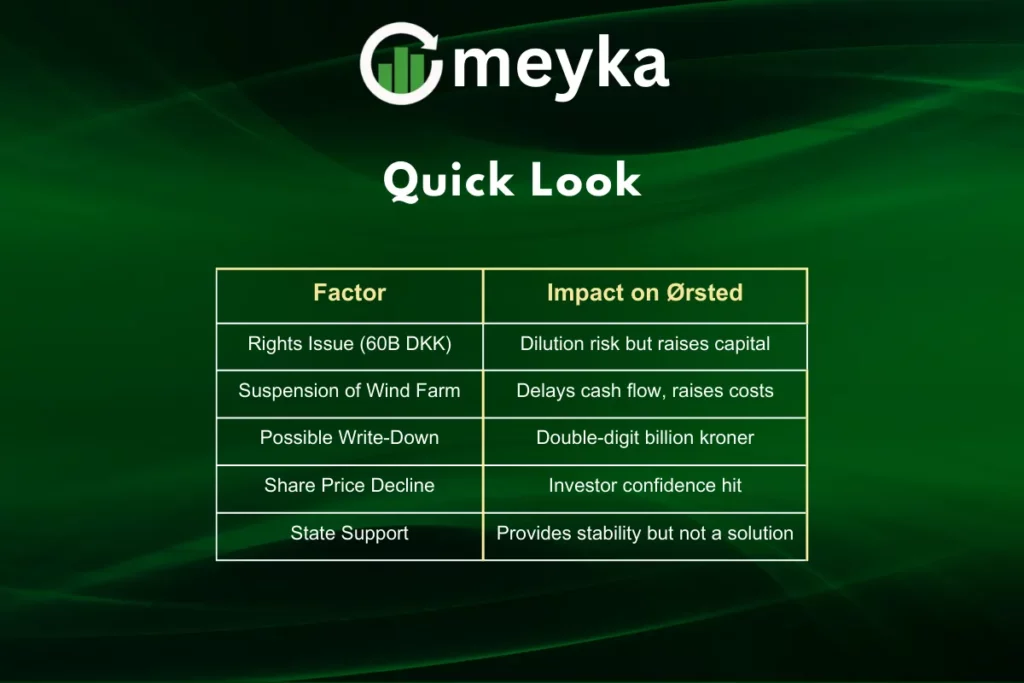

Ørsted shares have taken a sharp hit after the U.S. Bureau of Ocean Energy Management stopped the Revolution Wind Project as a result of issuing the stop-work order. The project, located off Rhode Island, was nearly complete with 45 of 65 turbines installed. Despite years of planning and full approval of construction, the suspension has cast doubt on the future of the project.

The news sent Ørsted’s stock down by nearly 17 percent, hitting record lows. Investors reacted strongly, fearing heavier financial burdens, possible write-downs, and increased capital needs.

At the center of the storm lies a 60 billion Danish kroner rights issue, scheduled to be discussed at an extraordinary general meeting in September 2025.

Why Ørsted Shares Plunged

Stop-Work Order Details

- Issued by the U.S. Bureau of Ocean Energy Management (BOEM)

- Affects Ørsted’s Revolution Wind Project

- Project was 80 percent complete

- 45 of 65 turbines installed before suspension

The order cited national security interests and interference with economic zones as reasons. Despite all required permits, including a Construction and Operations Plan approved in November 2023, work has been forced to stop.

Market Reaction

Ørsted stock fell 16.7 percent on Monday following the order. This marked the lowest level in the company’s trading history. The sharp drop reflects concerns about the company’s ability to recover its investment and manage future obligations.

Financial Pressure on Ørsted

Rights Issue

Orsted has already announced the 60 billion Danish kroner ($9.4 billion) rights issue. The Danish state backs the plan, but analysts warn it may not be enough.

Jacob Pedersen, head of equity research at Sydbank, highlighted the risk of a double-digit billion write-down. If the worst-case scenario unfolds, Ørsted may need to raise even more capital.

Potential Impact Table

The Future of Revolution Wind

Project Overview

- Designed to deliver 400 MW to Rhode Island

- 304 MW to Connecticut

- Powering over 350,000 homes

- Based on 20-year power purchase agreements

The suspension casts uncertainty over these plans. The halt interrupts not only construction but also future revenue flows critical to Ørsted’s financial recovery.

Legal and Strategic Options

Ørsted is now reviewing legal measures. The company may challenge the suspension, citing its prior approvals and lengthy compliance history. However, national security concerns complicate the path forward.

Ørsted and the Stock Market

The stock market reaction to Ørsted shows how sensitive renewable energy projects remain to regulatory and political risks. Investors often expect predictable returns from long-term power contracts. Unexpected suspensions erode confidence, leading to swift share price corrections.

Ørsted’s fall also raises questions about the broader offshore wind sector. Other companies in the space face similar risks tied to government policy, security concerns, and financing pressures.

Investor Outlook

For investors, several points stand out:

- Ørsted’s financial stability depends on the rights issue outcome.

- Shareholders face dilution risk, especially if further capital is needed.

- National security issues could delay or derail future projects.

- State support offers some confidence but does not remove financial strain.

Investors will be watching the September 2025 extraordinary general meeting closely. Decisions made there will shape both Ørsted’s balance sheet and its future role in offshore wind.

Final Thoughts

Ørsted faces one of the most serious challenges in its history. The suspension of the Revolution Wind Project not only disrupted progress but also triggered a steep fall in share value. With billions at stake and investor confidence shaken, the September 2025 meeting will be crucial for its future.

The situation underscores how fragile renewable energy projects can be when regulatory risks collide with financial pressures. For Ørsted, the stock market’s verdict has been swift, and the road to recovery may be long.

Frequently Asked Questions

Ørsted shares fell after the U.S. suspended its nearly finished Revolution Wind Project due to national security concerns.

The company’s shares declined 16.7 percent, reaching record lows.

Ørsted aims to raise 60 billion Danish kroner through the rights issue to shore up finances.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.