Park Avenue Securities Trims Stake in Johnson and Johnson Stock

On September 22, 2025, Park Avenue Securities cut back its holdings in Johnson & Johnson by about 15.9%. The firm sold 15,906 shares. After the sale, it held 84,401 shares, worth roughly $12.9 million.

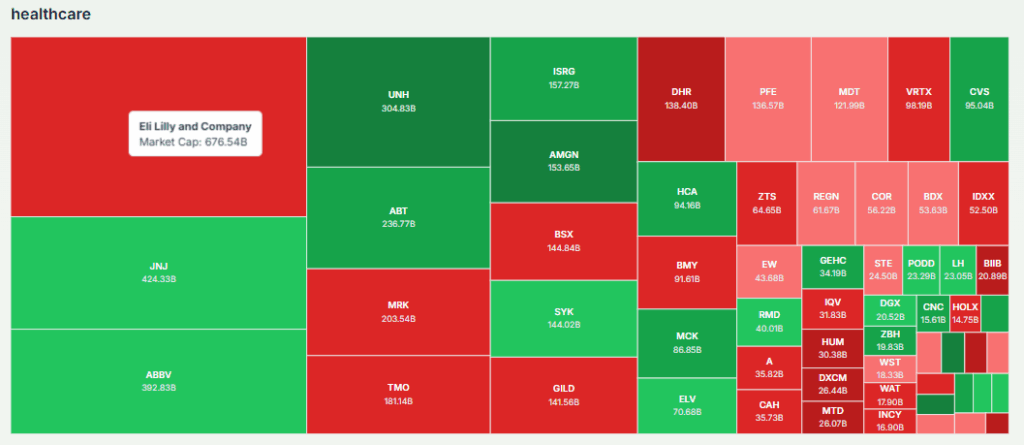

We need to understand why this matters. Johnson & Johnson (JNJ) is a major name in healthcare. It makes medicines, devices, and consumer health products. Many investors see it as stable. So when a big investor like Park Avenue trims its stake, it raises questions.

Did they lose confidence? Or is this just routine rebalancing? What does this mean for JNJ stock? We want to see what this change tells us about the firm’s view of risk. And we want to explore what it could mean for shareholders.

Let’s look at the facts. We will also explore the broader market context. And we will think about what comes next for Johnson & Johnson.

About Johnson & Johnson

Johnson & Johnson is a global health company. It sells pharmaceuticals, medical devices, and consumer health products. The company spun off its consumer-health unit, Kenvue, in 2023 to focus more on medicines and medical devices. That split changed how investors value J&J. The firm now leans more on drug development and MedTech for growth.

Park Avenue Securities: the Stake Reduction

On September 22, 2025, Park Avenue Securities reported a cut in its Johnson & Johnson holding. The firm sold 15,906 shares. That reduced the position by about 15.9%. After the sale, Park Avenue held 84,401 JNJ shares worth roughly $12.9 million. The filing did not offer a public narrative for the sale. Institutional moves like this are often routine. Yet they draw attention because big holders can shape market sentiment.

Details of the Stake Reduction and Likely Motives

The SEC filing shows the numbers. It does not show the motive. Common reasons for a trim include portfolio rebalancing, tax planning, or shifting exposure to other sectors. Another reason could be profit-taking after recent gains. Some advisors sell to reduce single-stock risk. Institutional selling does not always mean the firm lost faith in the company’s long-term story. Market watchers should check if other large investors also sold. Tools and scanners can flag related moves quickly. Many traders now use technologies like the AI stock research tool to scan filings for such patterns.

Broader Market Context

Healthcare stocks have seen mixed flows in 2025. Drug makers gained from strong drug pipelines. MedTech did well as elective procedures recovered. At the same time, legal worries and potential tariff costs created caution. Macro issues also matter.

Rising interest rates and worries over consumer demand can make dividend stocks less attractive compared with high-growth names. This backdrop helps explain why a portfolio manager might rebalance away from a single healthcare giant.

Johnson & Johnson’s Recent Performance

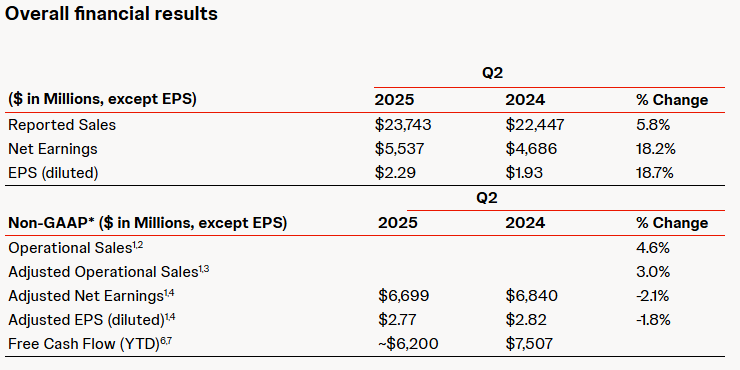

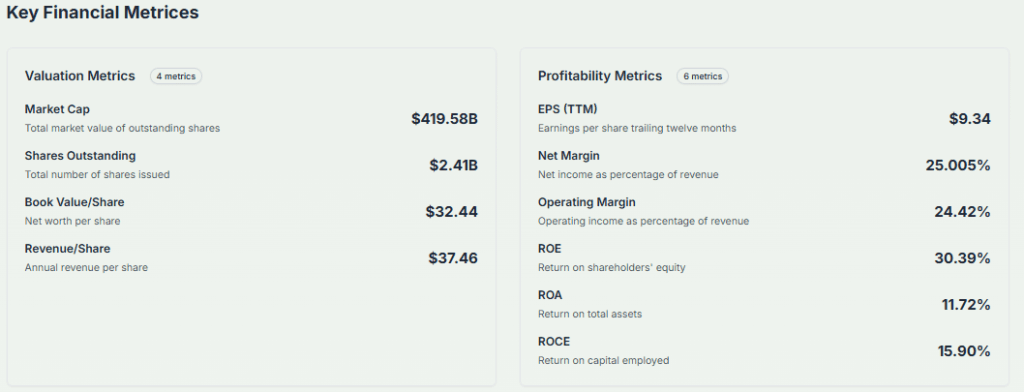

J&J reported second-quarter 2025 sales of about $23.7 billion. That was a 5.8% rise year over year. Adjusted EPS came in at $2.77 for the quarter. The company lifted its full-year outlook after the results. Management cited strength in Innovative Medicines and MedTech. MedTech sales rose, helped by higher procedure volumes. The firm also reiterated a multibillion-dollar plan to boost U.S. manufacturing. These wins help explain why many analysts remain positive on the stock.

Legal and Regulatory Risks

J&J still faces major legal fights over talc-related claims. In early 2025, a judge rejected a proposed settlement plan tied to those suits. The decision forced J&J to prepare for cases to proceed in civil courts rather than use the bankruptcy route. That outcome can raise near-term costs and increase headline risk. Investors watch these developments closely because legal losses or large settlements can hit earnings and cash flow.

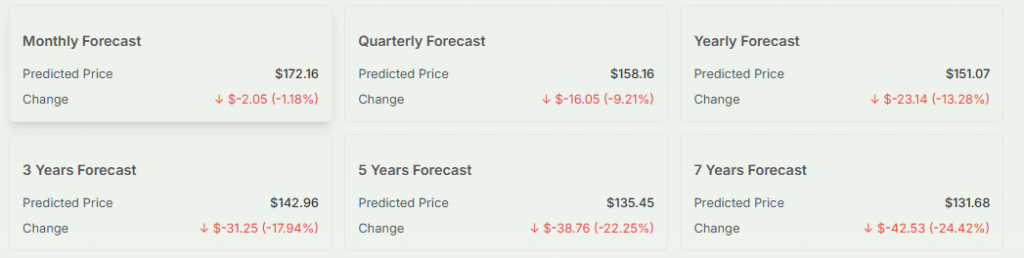

Analyst Views and Price Targets

Analysts remain broadly constructive on J&J after the Q2 beat. Several firms nudged their price targets higher in September 2025. The consensus 12-month target sits near the high-$170s. Some banks show higher upside based on pipeline success and MedTech recovery. Still, price targets vary depending on how analysts discount legal exposure and future drug wins. Investors should read recent research notes and not rely on a single headline.

Short-term vs. Long-term Impact of the Park Avenue Trim

In the short term, an institutional sale can add selling pressure. That might nudge the stock price lower for a day or two. But J&J is a large, liquid name. A single manager’s sale of 15,906 shares is unlikely to change the company’s fundamentals. Over the long term, the business depends on drug approvals, MedTech growth, and how the talc saga resolves. A small trimming by one investor is not the same as a broad shift away by many institutions. Monitor 13F filings and other fund disclosures to see whether more managers are reducing exposure.

What Retail Investors Should Consider?

Retail investors should avoid knee-jerk moves based on one filing. Focus on fundamentals. Look at revenue trends and pipeline milestones. Check cash flow and payout ratios if seeking dividends. Consider the legal reserve and any changes in guidance. If risk tolerance is low, trimming exposure or layering purchases can reduce timing risk. Use reliable research tools to track filings and analyst updates.

Strategic Outlook for Johnson & Johnson

J&J’s strategy now rests on drugs and MedTech. The company aims to push its pipeline in oncology, cardiovascular care, and neuroscience. MedTech growth should continue as procedures recover globally. The company’s large R&D budget and deal-making ability are advantages. Legal risks remain the main wildcard. If the legal picture improves, the stock may rerate higher. If not, increased legal costs could limit capital available for buybacks and investment.

Bottom Line

Park Avenue’s trim on September 22, 2025, is a notable, but not decisive, development. The sale sheds light on active portfolio moves. Yet J&J’s near-term path depends more on earnings, drug approvals, and legal outcomes. Investors should track corporate updates and regulatory rulings. Read filings and analyst notes before making changes. Use trusted research tools to stay informed.

Frequently Asked Questions (FAQs)

On September 22, 2025, Park Avenue Securities sold part of its J&J shares. The filing did not explain the reason, but such sales often mean portfolio balancing or a routine strategy.

Johnson & Johnson’s stock in 2025 shows steady sales growth and ongoing legal risks. Whether it is a good buy depends on investor goals, risk tolerance, and long-term outlook.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.