Pi Network’s Q4: Major Protocol Upgrade and ISO 20022 Move Fuel Token Recovery Hopes

We believe that Pi Network is entering a pivotal phase as it heads into the fourth quarter (Q4) of 2025, driven by a major protocol upgrade and alignment with the global payment messaging standard ISO 20022. Analysts and community members alike are pointing to these changes as potential triggers for token recovery after an extended period of sideways or weak performance.

Background: Pi Network’s evolution and current standing

Pi Network launched with a vision to make cryptocurrency mining accessible on mobile phones for everyday users. Unlike many crypto projects focused purely on trading, Pi emphasised community, accessibility, and mass adoption.

The project has been in a phased roadmap: from Beta to Testnet to an “Enclosed Network” stage, and finally the planned “Open Network”. Pi Network

Despite its promise, Pi Network’s native token (often referred to as PI) faced challenges: limited liquidity, unclear listing details, long development timelines, and uncertainty around when the token would become truly tradable. In that context, the upcoming Q4 developments are getting extra attention as possible inflection points.

Protocol v23 Upgrade: What’s changing and why it matters

In recent updates, Pi Network has confirmed that it is working on a significant upgrade: Protocol version 23 (v23). The upgrade aims to deliver the following:

- Enhanced scalability and transaction efficiency through integration of the Stellar Core v23.0.1 architecture.

- Introduction of smart contract functionality and developer tools, such as a Rust SDK, to open the ecosystem for decentralized applications.

- A transition from Testnet to Testnet2 and then onto full Mainnet deployment in Q4 2025 (or potentially early 2026), depending on testing outcomes.

- Embedding KYC (Know Your Customer) verification and compliance features into the protocol which improves regulatory readiness.

For the Pi Network community, this upgrade is meaningful because it moves the project from a “mobile-mining app” phase into a true blockchain infrastructure phase, where token utility, apps, and real-world usage become possible.

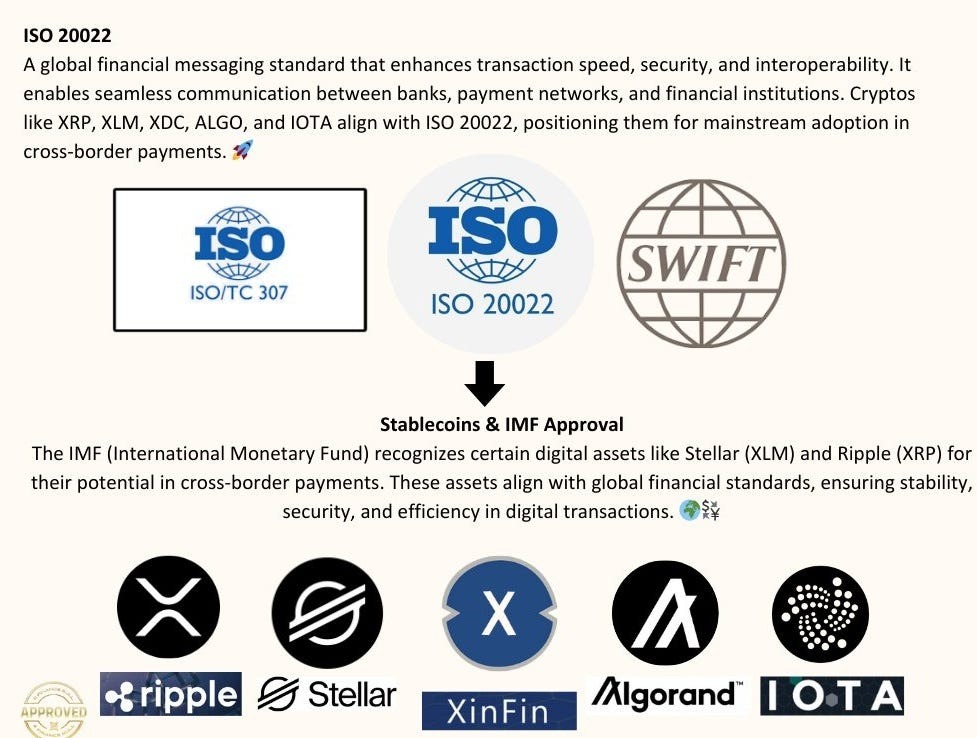

ISO 20022 Alignment: Bridging crypto and traditional finance

Another headline driver for Pi Network is the move toward compliance with ISO 20022, the global standard for financial messaging used by banks, payment networks, and clearing systems.

Why this matters:

- If Pi Network becomes compatible with ISO 20022, it can more easily integrate with traditional financial infrastructure: banks, remittance networks and global payments.

- It lends institutional credibility. For crypto tokens to break into mainstream finance, aligning with a messaging standard that banks already use removes a barrier.

- It opens cross-border payment and remittance use cases: Pi could become a bridge between fiat and crypto transactions, particularly in emerging markets where mobile adoption is high.

A recent report states that Pi “achieves ISO 20022 compliance” and is positioning itself for global acceptance. The upgrade is expected by 22 November 2025.

Together, the protocol upgrade + ISO standard alignment form a dual catalyst: one for technology, the other for finance & adoption.

Recovery hopes for the PI token and why now

Given the above developments, many stakeholders see Q4 as a window for potential token recovery for PI. Here’s how the logic plays out:

- Improved utility: With smart contracts, dApps, developer tools, and increased ecosystem activity, the token moves toward real use rather than speculative mining credits.

- Institutional interest: With ISO 20022 alignment, institutional players and payment systems might view Pi Network more seriously, which could increase demand.

- Narrative shift: Moving from “mining mobile app” to “blockchain platform + payments rail” rewrites the story around Pi, which may attract new users and developers.

- Scarcity and release timing: As migration completes, and network utility begins, market attention often spikes. Analysts point to Q4 as that moment.

Of course, this does not guarantee immediate price jumps, but in the high-volatility crypto world, narrative shifts often matter as much as technical details.

Key challenges and risks to monitor

While the momentum is strong, we must balance with caution. Here are the main risks:

- Token liquidity and supply pressure

The transition to Mainnet may unlock large quantities of tokens. If many holders sell quickly, price pressure could emerge. - Execution risk

Upgrading blockchain protocols, introducing smart contracts, and integrating ISO 20022 are non-trivial. Delays or bugs could erode confidence. - Regulatory uncertainty

Crypto regulation around the world varies. While ISO alignment helps, regulatory headwinds (especially in emerging markets) may limit adoption. - Competition and differentiation

Many blockchains already offer smart contracts, DeFi tools, and payment rails. Pi Network must show unique value (mobile-first, massive user base, global inclusion) to stand out. - User base conversion

Pi has a large user base of “miners” (Pioneers), but converting them into active users, dApp participants, or token holders is a journey, not guaranteed.

What to watch over the coming weeks

Investors, developers, and community members should keep an eye on:

- Official announcements from the Pi Core Team regarding exact dates for Protocol v23 Mainnet rollout.

- Milestones around ISO 20022 integration and formal banking or payment network partnerships.

- Developer activity: number of dApps, smart contracts deployed, network usage metrics.

- Token metrics: unlock schedule, liquidity pool announcements, exchange listings.

- Market sentiment: renewed interest, social chatter, wallet activity and use-case traction.

Final thoughts

We believe that Pi Network stands at a meaningful crossroads. With a major protocol upgrade targeting Q4 2025 and alignment with ISO 20022 standards, the project is positioning itself to shift from promise to delivery. These changes may fuel token recovery hopes for PI by improving utility, boosting credibility and potentially opening institutional pathways.

However, success is not assured, real adoption, execution and market conditions still need to align. For anyone researching crypto projects, getting a clear understanding of the upgrade timeline, the tokenomics and the ecosystem activity will be essential to assessing Pi Network’s potential.

Our takeaway: Pi Network is no longer just a mobile-mining experiment. It’s aiming to become a global blockchain and payments platform. If it succeeds, Q4 could be a turning point. If it falters, the waiting game continues.

FAQs

The Protocol v23 upgrade refers to the major technical overhaul of Pi Network’s blockchain. It includes integration of Stellar Core v23.0.1, smart contract capabilities via a Rust SDK, better transaction performance, and optimized node infrastructure.

ISO 20022 is the global standard for financial messaging used by banks, payment processors and clearing systems. By aligning with it, Pi Network can better integrate with traditional finance, support richer transaction data, and potentially open pathways to bank and institutional adoption.

Not automatically. While upgrades and narratives can boost sentiment and demand, token prices still depend on liquidity, listing availability, actual adoption, market environment and execution success. Investors should evaluate all factors, not assume guaranteed gains.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.