Post-PPI Market Condition: S&P 500, Nasdaq Edge Toward Records

The Post-PPI Market shifted quickly after the latest Producer Price Index showed softer inflation. Traders pushed the S&P 500 and Nasdaq nearer to record territory as they reassessed the path for interest rates.

Corporate earnings added fuel to the session, and a strong report from Oracle captured investor attention, leaving all eyes on ORCL as market participants asked whether renewed enterprise spending could sustain the rally. The day brought mixed relief over inflation, with selective optimism about company results.

Post-PPI Market: Why Producer Price Data Moved Stocks Higher

A weaker-than-expected PPI reading reduces near-term inflation risk, which lowers the odds of aggressive Federal Reserve action. For equities, that often translates into a lower discount rate on future earnings and reduced margin pressure for companies that buy raw materials. In the Post-PPI Market, softer producer prices can tilt the balance toward risk assets, and Reuters noted that futures and equities extended gains after the data (Reuters).

Why did the weaker PPI spark optimism? Because inflation is a primary driver of monetary policy, and any sign of cooling can support higher equity valuations.

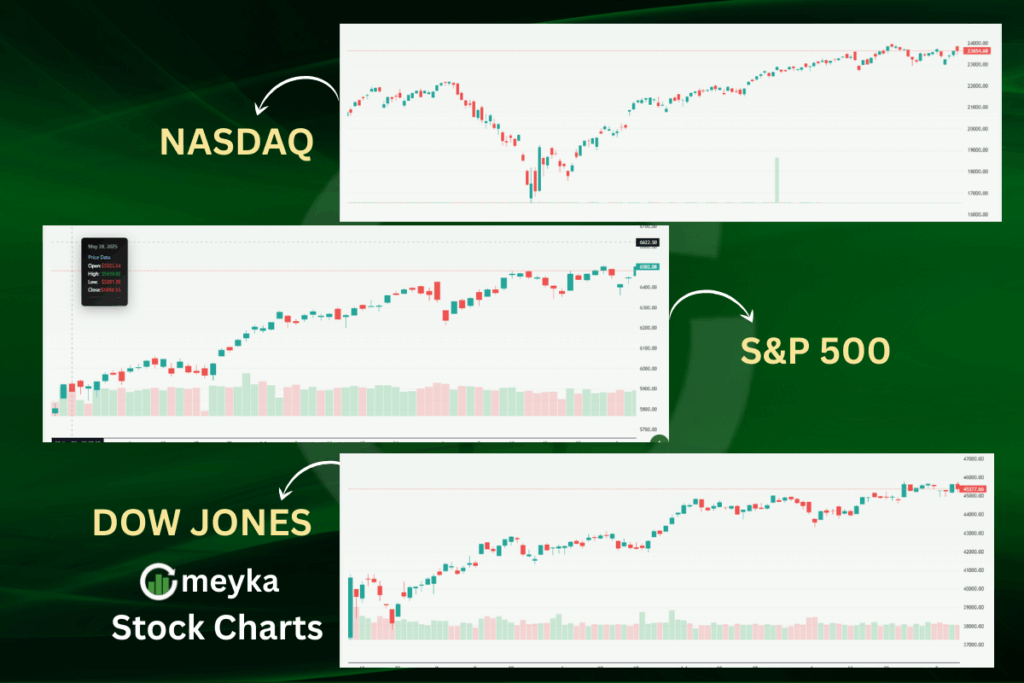

Post-PPI Market: S&P 500 and Nasdaq approach record territory

The S&P 500 and Nasdaq recorded modest advances as money rotated back into growth and technology names, pushing both indexes toward prior highs. MarketWatch reported that intraday moves left both benchmarks testing record levels, driven by the mix of macro relief and corporate beats.

Large-cap tech leadership helped lift the broader market and gave the indices a genuine chance at fresh record closes if momentum continues.

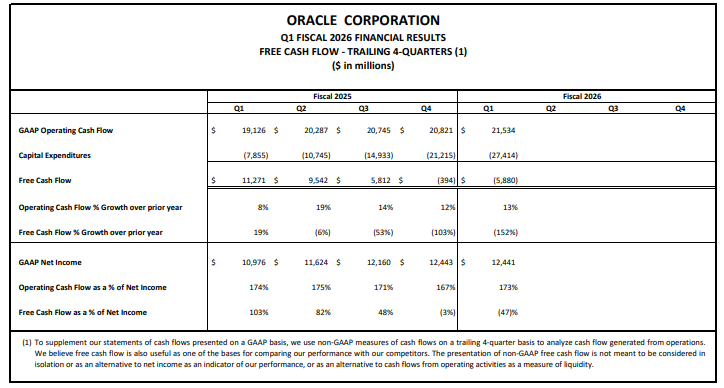

Post-PPI Market: All Eyes on ORCL after earnings and guidance

Oracle was a defining mover of the session. The company reported solid cloud revenue and issued guidance suggesting enterprise IT spending may be stabilising. ORCL shares rallied, and all eyes on ORCL summed up the market focus as traders debated whether Oracle’s strength is company-specific or a signal that corporate tech budgets are improving.

A strong report from a major software vendor in a post-PPI market can be interpreted as evidence that corporate investment is less constrained by inflation concerns.

Can Oracle sustain its momentum? That will depend on follow-through in bookings, contract wins, and whether the broader tech sector posts similar resilient results in the coming reporting cycle.

Post-PPI Market: How the Dow Jones reacted to inflation data

The Dow Jones had a mixed session as industrials and cyclical names partially offset gains in tech. Some Dow constituents benefited from the prospect of lower borrowing costs, while others that are sensitive to commodity prices traded cautiously.

This split underlines a familiar Post-PPI Market pattern: growth-oriented sectors can lead, even as economically linked names reflect longer-term demand and input cost considerations.

Post-PPI Market: investor sentiment and trading patterns

After the PPI release, investors adjusted positioning with a blend of tactical buying and selective profit taking. Short-term traders sought exposure to software and semiconductor stocks, while longer-horizon funds monitored macro data and corporate guidance for confirmation.

Real-time feeds showed these rotations play out intraday, with Investing.com posting an immediate snapshot of flows and sector moves:

Traders emphasised that company-level beats, like Oracle’s, amplified the post-PPI market rally.

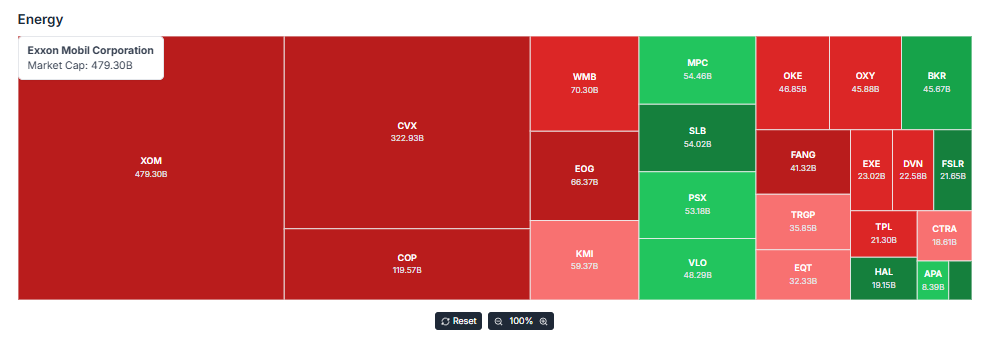

Post-PPI Market: sector-wise performance, tech leads while banks and energy follow

Technology led the advance as the Nasdaq benefited from gains in major names, while banks and energy tracked bond yields and commodity trends. Banks traded cautiously because their profitability depends on the path of interest rates, and energy firms moved on oil price signals.

In the Post-PPI Market, companies with pricing power and recurring revenue profiles tended to outperform, while those exposed to raw material costs or heavy capital expenditure demand lagged.

Post-PPI Market: global implications and bond yields

Global markets also reacted, with European and Asian equities recording gains on the US data spillover. Bond yields eased modestly as traders pushed back the probability of near-term rate hikes, which provided further support for equity multiples.

FXEmpire highlighted the sensitivity of equities to yield moves, emphasising that sustained lower yields would be constructive for the current post-PPI market mood.

Post-PPI Market: social media insights and analyst commentary

Analyst and market feeds amplified the moves, with NDTVProfitIndia offering an early snapshot linking the PPI print to market rallies, and MarketJournalX posting tactical sector reads for traders:

PivotalProfits flagged ORCL as a key watch, underlining how one strong corporate report can dominate attention in a Post-PPI Market day:

Post-PPI Market: What Investors Should Watch Next

Looking ahead, investors will focus on the upcoming Consumer Price Index and any Federal Reserve commentary for confirmation that inflation is cooling across the pipeline and consumer prices. Key indicators include wage growth, core inflation measures, and the trajectory of five and ten-year bond yields.

The market will test whether the current Post-PPI Market rally matures into a sustained upswing or proves to be a short-lived relief bounce ahead of mixed data and guidance.

Why is the market so sensitive to these readings? Because inflation data directly shapes expectations for interest rates, which in turn determine the discount rates applied to corporate earnings and the valuation of growth stocks.

Conclusion: bullish tone, Oracle’s pivotal role, and risks ahead

The Post-PPI Market displayed a constructive tone as the S&P 500 and Nasdaq inched toward records, with all eyes on ORCL underscoring the power of company-specific catalysts in a data-driven rally.

The move reflects optimism that inflation pressures may be easing, yet important risks remain: the upcoming CPI print, further Fed guidance, and the durability of corporate earnings will determine whether the upswing endures.

Investors should diversify, manage exposure to yield-sensitive positions, and watch corporate guidance closely as the market digests the implications of the Post-PPI Market shift.

FAQ’S

The PPI stock market refers to how equity markets react to Producer Price Index data, which signals inflation trends.

PPI measures the average change in selling prices received by domestic producers, often affecting market sentiment.

PPI stands for Producer Price Index, a key economic indicator of wholesale inflation.

Both indexes often move in the same direction, though Nasdaq is more tech-heavy and volatile compared to the S&P 500.

The S&P 500 record high is the highest level the index has reached, signaling peak investor confidence and valuation.

Stocks usually rise as index funds are required to buy them, boosting demand and liquidity.

Historically, the Nasdaq has delivered higher returns due to its tech exposure, while the S&P 500 is more balanced.

It depends on risk appetite; Nasdaq offers growth potential, while S&P 500 provides diversification and stability.

The S&P 500 is generally considered more reliable for long-term investing due to its broad sector exposure.

Disclaimer

This is for information only, not financial advice. Always do your research.