Puma Sale on the Table as Pinault Family Explores Options

Puma has once again captured the spotlight in the global stock market. The French billionaire Pinault family, owners of Artemis are in talks to divest their 29 percent holdings in Puma SE. This move comes after a dramatic fall in Puma’s market value, which plunged by nearly 50% over the past year, leaving the brand valued at just €3.2 billion ($3.7 billion).

The decision to seek buyers signals a pivotal moment for one of the world’s most recognized sportswear brands. Apparently, discussions have already started with front-running firms which include Anta Sports Products Ltd., Li Ning Co., sportswear companies from the United States, and sovereign wealth funds from the Middle East.

Following the news, Puma shares surged by as much as 20%, marking their steepest climb since October 2001.

Why the Pinault Family is Considering a Sale

The Pinault family, through its investment company Artémis, has held its stake in Puma for years. However, the brand’s steep decline in value has pressured the family to weigh new strategies.

Key points include:

- Puma’s valuation has dropped by half in just 12 months.

- A current market cap of about €3.2 billion is far from past highs.

- Shifting global demand in sportswear has challenged Puma’s growth compared to rivals.

The family’s search for buyers underscores the need to preserve long-term value while freeing up capital for other ventures.

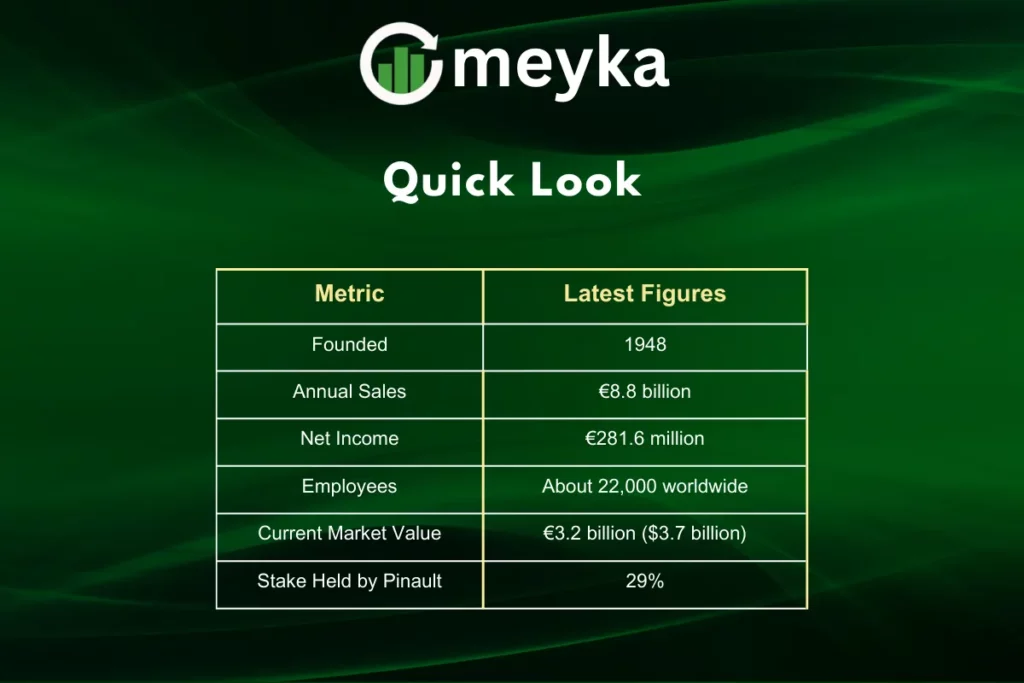

Puma’s Performance in Numbers

Understanding Puma’s performance helps explain the family’s decision.

Despite strong revenues, profit margins remain under pressure. Competitive pricing and rising costs have squeezed earnings, leaving investors wary.

Stock Market Reaction to the Sale News

The stock market quickly reacted when reports of a possible sale broke. Shares in Puma climbed 20%, their sharpest rise in over two decades.

The rally reflects:

- Investor optimism about potential strategic buyers.

- Hopes of new leadership and capital driving growth.

- Speculation on possible acquisitions by global rivals.

For traders, Puma has become one of the most watched names on European exchanges this quarter.

Potential Buyers in Focus

Interest in Puma stretches across continents. Potential bidders bring different strengths:

- Anta Sports Products Ltd.: China’s leading sportswear company with global ambitions.

- Li Ning Co.: Another Chinese brand seeking international expansion.

- US sportswear firms: Possible strategic plays to challenge Adidas and Nike.

- Middle Eastern sovereign wealth funds: Long-term investors seeking strong global assets.

Each potential buyer offers Puma a different path forward, from global growth to financial stability.

What a Sale Could Mean for Puma

If a deal materializes, Puma could see major changes.

- New Investment: Fresh capital could strengthen product development and marketing.

- Global Reach: Buyers from Asia or the Middle East may expand Puma’s presence in new regions.

- Competitive Shift: Puma could reposition itself against Adidas, Nike, and Under Armour.

- Stock Market Impact: Investor sentiment will hinge on the buyer’s strategy and long-term vision.

Challenges Puma Faces

Even with a sale, Puma must navigate obstacles:

- Intense competition from Nike, Adidas, and newer brands.

- Falling profitability despite strong sales numbers.

- Changing consumer demand, particularly in Asia and North America.

- Supply chain pressures affecting margins.

Without addressing these, ownership changes alone may not guarantee growth.

Future Outlook for Puma and Investors

Looking ahead, Puma’s path depends on whether a sale goes through. A strong buyer could reposition the brand, improve efficiency, and re-ignite growth. However, risks remain if the sale drags on or fails to bring the right strategic vision.

For investors, the stock remains volatile. While the recent surge is promising, long-term performance will depend on Puma’s ability to deliver consistent earnings in a crowded sportswear market.

Final Thoughts

The potential sale of Puma by the Pinault family is one of the most significant developments in the stock market this year. With strong interest from global bidders and a surge in share price, the outcome could reshape Puma’s future in sportswear. Whether the brand thrives under new ownership or continues to struggle will depend on how well the next chapter is managed.

Frequently Asked Questions

The family is exploring options after Puma lost nearly half its market value in the past year.

They hold a 29% stake through their investment company Artémis.

Interested parties include Anta Sports, Li Ning, US-based sportswear firms, and Middle Eastern wealth funds.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.