Q2 Results 2025 LIVE: Key Earnings Announcements from 62 Companies Today

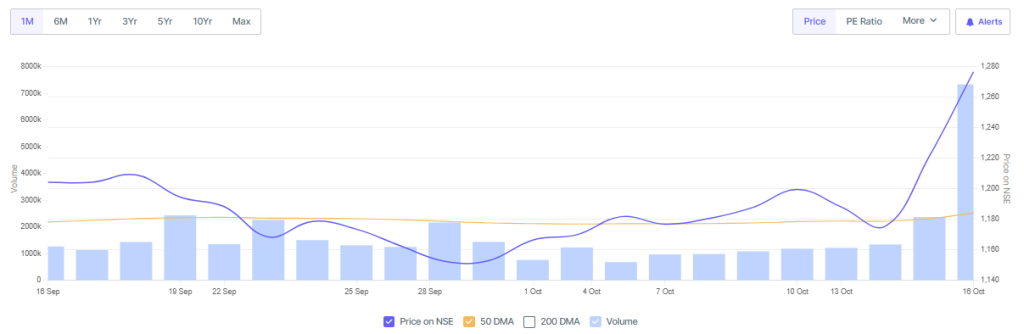

On 16 October 2025, the market took center stage as 62 companies reveal their Q2 earnings, making it one of the busiest result days of the year. Investors are closely watching because earnings season often sets the tone for the next quarter. One strong or weak report can move entire sectors. That is why today’s announcements matter.

This quarter comes at a tricky time. Interest rates remain high, consumer demand is shifting, and global trade tensions are rising again. Companies are under pressure to prove they can still grow. Some firms are expected to post strong profits from cost control and digital expansion. Others may struggle with slower sales or rising expenses.

What makes today unique is the mix of sectors reporting IT, banking, consumer goods, energy, manufacturing, and more. This gives us a clear snapshot of the wider economy. Investors want answers: Who is beating expectations? Who is warning about the future? And which stocks could react the most?

Let’s break down the key results, major surprises, sector trends, and what these earnings mean for the market ahead.

Quick Market Snapshot: 16 October 2025

Markets moved in small swings after early results. Benchmarks saw mixed trade as investors digested bank and consumer prints. Some stocks jumped on strong beats. Others fell after misses or weak guidance. The busy calendar kept volatility higher than usual.

Who’s Reporting Today?

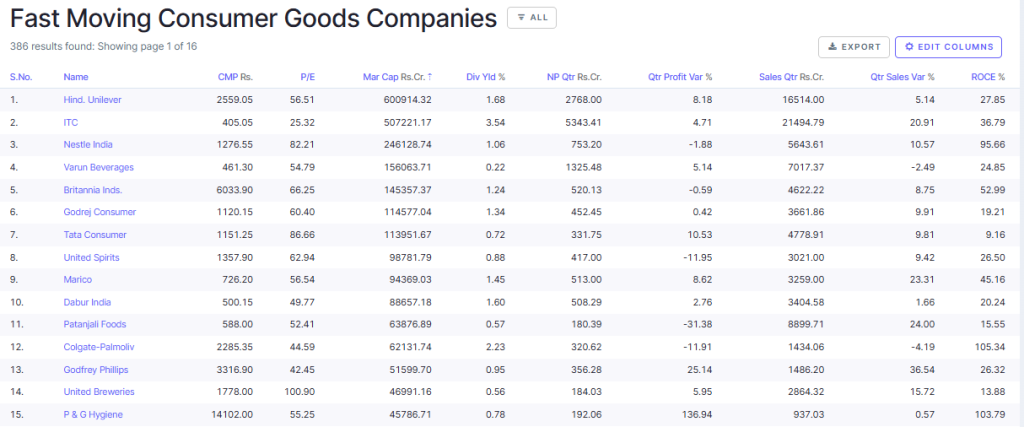

About 62 companies reported Q2 (July-September) numbers on 16 October 2025. Big names on the list included Infosys, Wipro, Nestle India, LTIMindtree, Jio Financial Services, Indian Bank, Indian Overseas Bank, Eternal (Zomato’s operator), Waaree Energies and Zee Entertainment. These names span IT, banking, FMCG, energy and media. That mix gives a read on both demand and cost pressure across the economy.

Top Winners Companies that Beat Expectations

Nestle India posted steady sales and beat estimates. Shares rose after the firm showed resilience in pricing and consistent margins. Nuvoco Vistas surprised with a strong EBITDA lift. The cement maker flagged better operational efficiency and demand recovery. Indian Overseas Bank recorded a large jump in net profit. Improved asset quality and higher net interest income helped its print. These beats pushed some sector leaders higher on 16 October 2025.

Big Disappointments and Red Flags

Some banks missed street estimates because of one-time provisions. Axis Bank reported a fall in net profit partly due to such charges. Other firms showed weak top-line growth or margin erosion. Zee Entertainment’s profit fell sharply as advertising revenue slid. That drop highlights the weak ad market for broadcasters this quarter. Several managements warned that demand trends remain uneven.

Sector-Level Takeaways

IT: The tech names reporting today showed mixed signals. Revenue growth stayed steady in some firms. Margins came under pressure from others due to wage and transition costs. Management commentary on large deals and visa-related headwinds remained a key focus.

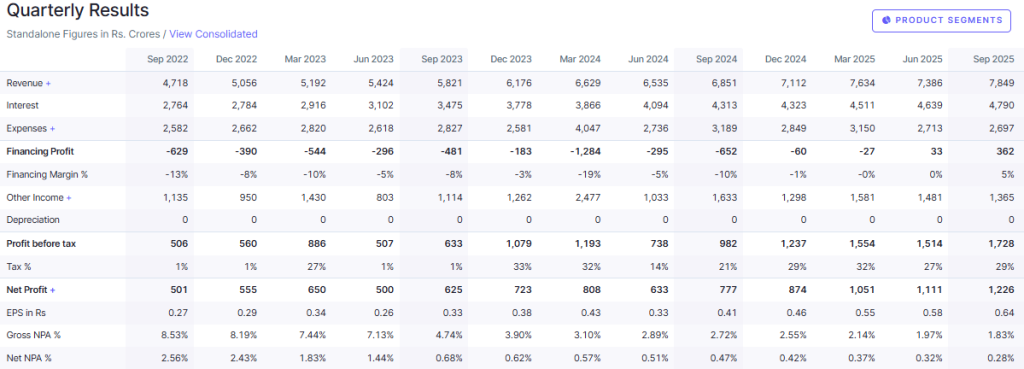

Financials: Banks showed varied results. Some lenders grew net interest income. Others took provisions that hit profit. Asset quality improved for a few public-sector banks. Capital and credit momentum will be the next watch point.

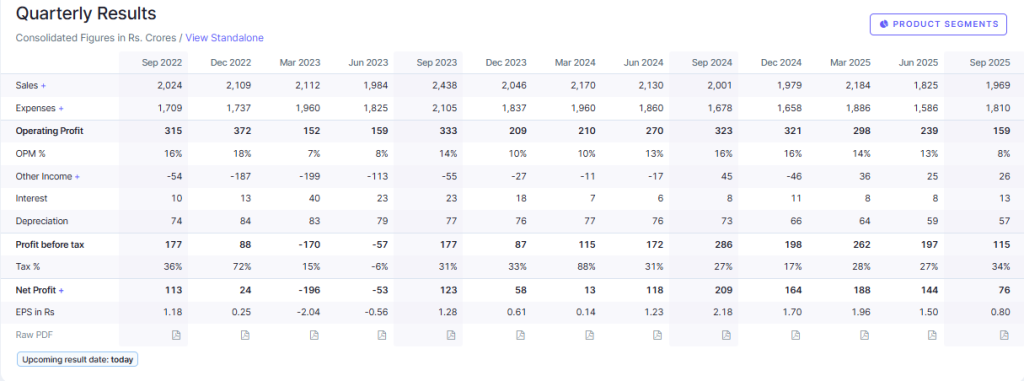

Consumer and FMCG: Nestle India’s beat underlined steady FMCG demand in key categories. Yet, GST changes and input-cost shifts created some headwinds. Volume recovery remains patchy across brands.

Industrials and materials: Cement and infra-related firms with better cost control posted healthier EBITDA. Companies that cut costs or raised prices saw clearer margin gains.

Management Commentary and Guidance

Several CEOs focused on cost control, digital investments and pricing power. IT chiefs spoke of deal pipelines but flagged near-term margin pressure. Bank chiefs pointed to steady credit growth but cautioned on credit cycles. FMCG leaders noted transient impacts from tax and supply changes. A few firms raised capital-allocation plans for buybacks or higher dividends. These comments shaped intraday moves on 16 October 2025.

Market and Analyst Reactions

Analysts updated models fast after the prints. Broker notes adjusted earnings and target prices for the most active names. Some houses used an AI stock research analysis tool to re-run forecasts and issue quick reports. A mix of upgrades and downgrades followed key beats and misses. Intraday volumes spiked in the most discussed stocks. Investors should read both the numbers and management Q&A to form a view.

What to Watch Next?

The rest of the week will bring another wave of results. Watch for more bank prints and a fresh set of IT updates. Also track macro cues such as central bank commentary and global trade news. Those factors can change how investors read the quarter. Focus on guidance, free cash flow and capital return signals.

Final Investor Takeaway

Today’s batch on 16 October 2025 showed a mixed picture. Some companies beat and signaled strong cost control. Others warned on demand or booked one-offs. For now, favor names with steady cash flow and clear guidance. Read the company commentary. Check cash flow and margins before trading. Short-term moves can be sharp. Long-term bets belong to firms with resilient business models and clear capital plans.

Frequently Asked Questions (FAQs)

On 16 October 2025, about 62 companies announced Q2 results. Big names included Infosys, Wipro, Nestle India, LTIMindtree, Jio Financial Services, Indian Bank, Zee Entertainment, and Waaree Energies.

Stocks reacted differently on 16 October 2025. Nestle India and Indian Overseas Bank gained after strong results. Zee Entertainment and some banks fell due to lower profits or one-time charges.

Q2 results on 16 October 2025 showed mixed signals. Investors watch guidance, profits, and cash flow. Strong results may boost confidence, while weak prints can make traders cautious short term.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.