Qualcomm Clash Continues as Arm Moves to Challenge Ruling

On October 1, 2025, Arm announced that it would appeal a recent court ruling that favored Qualcomm. The decision handed Qualcomm a full victory in a long, tangled licensing fight over chip designs. We now find ourselves at a turning point not just in a courtroom, but in how the tech world handles patents and architecture licensing.

This clash began when Qualcomm acquired Nuvia in 2021 and used its chip designs under ARM’s architecture. Arm claimed that Qualcomm breached licensing rules by doing so. In December 2024, a jury sided mostly with Qualcomm. Then, in September 2025, a judge dismissed Arm’s remaining claims, confirming Qualcomm’s win.

Now, Arm is moving to challenge that ruling. We will explore how this legal battle has grown, what each side is arguing, and why the outcome could change the future of chip design and licensing.

Background of the Dispute

Qualcomm bought Nuvia in 2021 for about $1.4 billion. At the time, Qualcomm said the deal would boost its server and PC chip plans. Arm licensed CPU designs to many firms, including Nuvia. Arm later said Nuvia had violated its architecture license. The disagreement turned into a long legal fight over how Arm’s licenses apply when a startup is bought by a big chipmaker. Reuters and earlier trial reporting document the 2021 deal and how it triggered the dispute.

The Recent Ruling and ARM’s Challenge

A U.S. federal court recently dismissed Arm’s last remaining claim. The judge’s decision confirmed the jury’s December 2024 findings that Qualcomm did not breach the license. The final judgment was entered on September 30, 2025. Arm said it will appeal that decision. The news has moved fast since the judge denied Arm’s post-trial requests. Reuters, Bloomberg, and Qualcomm’s own release reported the developments on October 1, 2025.

Qualcomm’s Position

Qualcomm says the ruling validates its right to use and develop Nuvia technology under existing Arm agreements. Company statements frame the outcome as a win for innovation and for Qualcomm’s design path. Qualcomm argues that its integration of Nuvia cores fits within the licensing terms. The firm also points to the December 2024 jury findings as proof that its products were properly licensed. Qualcomm’s press release spells out that view and calls the judgment final.

Arm’s Position and Motivation

Arm maintains that its licensing model must be protected. The company argues that allowing broad reuse of licensed designs after a takeover could weaken its business. Arm has said it plans to appeal because the legal questions remain important for its future revenue and control over architecture use. Arm’s leadership also sees this as a matter of principle. The appeal seeks to reverse parts of the court’s rulings and to clarify how licenses work after acquisitions. Reporting shows Arm is preparing to press its case further.

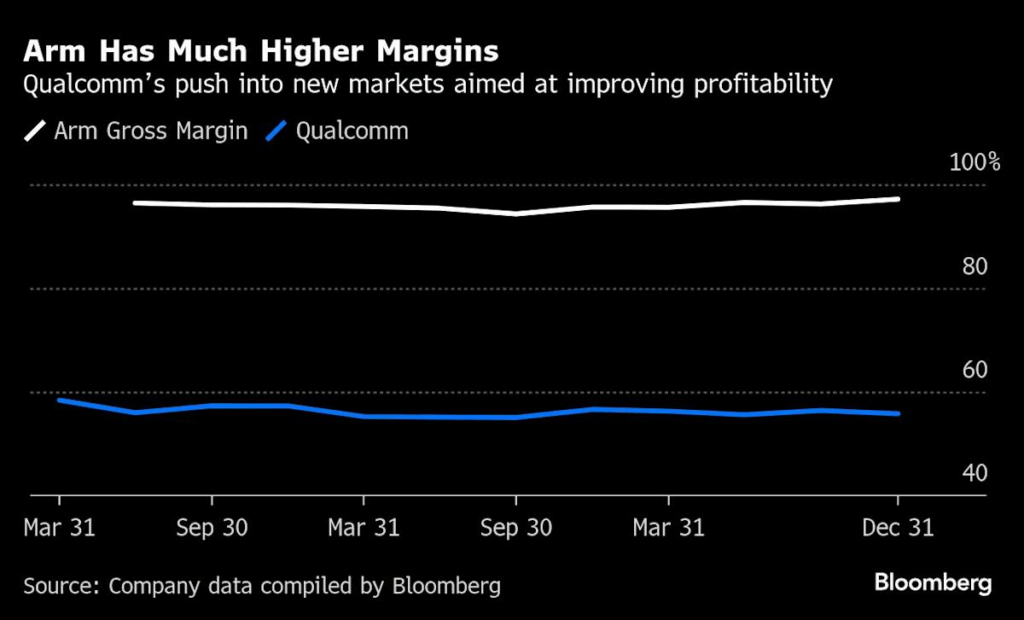

Industry Implications

The ruling matters beyond the two companies. Many chipmakers, phone makers, cloud firms, and PC vendors rely on Arm’s architecture. If the judgment stands, firms that buy startups may face fewer limits when they reuse designs. That could change how acquisitions are valued. Conversely, if Arm wins on appeal, license terms could tighten and increase costs for buyers. The decision also affects rivals such as MediaTek, Apple, and Nvidia in how they plan future chips. Analysts note that the outcome could shift where innovation happens and who pays for it.

Regulatory and Global Context

Regulators are watching the case. Antitrust and licensing rules in the U.S., Europe, and Asia could feel the ripple effects. The dispute also plays into broader talks on chip sovereignty and supply chains. Policymakers in multiple regions want stable access to key designs. A legal precedent that favors licensors or buyers could influence trade and local chip strategies. The case, therefore, has both legal and geopolitical dimensions.

What’s Next? Outlook for the Case

Arm has said it will file an appeal soon after the September 30, 2025 judgment. The appeals process could take many months. Possible outcomes range from a full reversal to a partial change or a narrow ruling that only clarifies one point of license law. Settlement remains possible but seems unlikely in the short term, given the firmness of recent court rulings and public statements. Market reaction was immediate: investors priced the news into shares, and industry watchers adjusted forecasts for licensing revenue and chip roadmap timelines.

Broader Lessons for Tech and IP Licensing

The case shows how thin the line can be between cooperation and conflict in tech licensing. Contracts must be clear about transfers, buyouts, and downstream use. Firms should plan for legal risk when they acquire startups that sit under complex license webs. The ruling also suggests that courts can play a decisive role in shaping tech business models. Tools such as an AI stock research analysis tool are now being used by investors to model how legal outcomes affect company value and licensing forecasts.

Wrap Up

The Qualcomm-Arm dispute is not just corporate drama. It tests how modern chip licensing works in practice. The September 30, 2025, judgment favors Qualcomm for now. Arm’s appeal keeps the legal story alive. The outcome could change the deal math and licensing rules across the industry. Companies and regulators will keep watching as the appeal moves through the courts.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.