RDDT Stock Drops 7.44% Amid Deepening Tech Sector Selloff

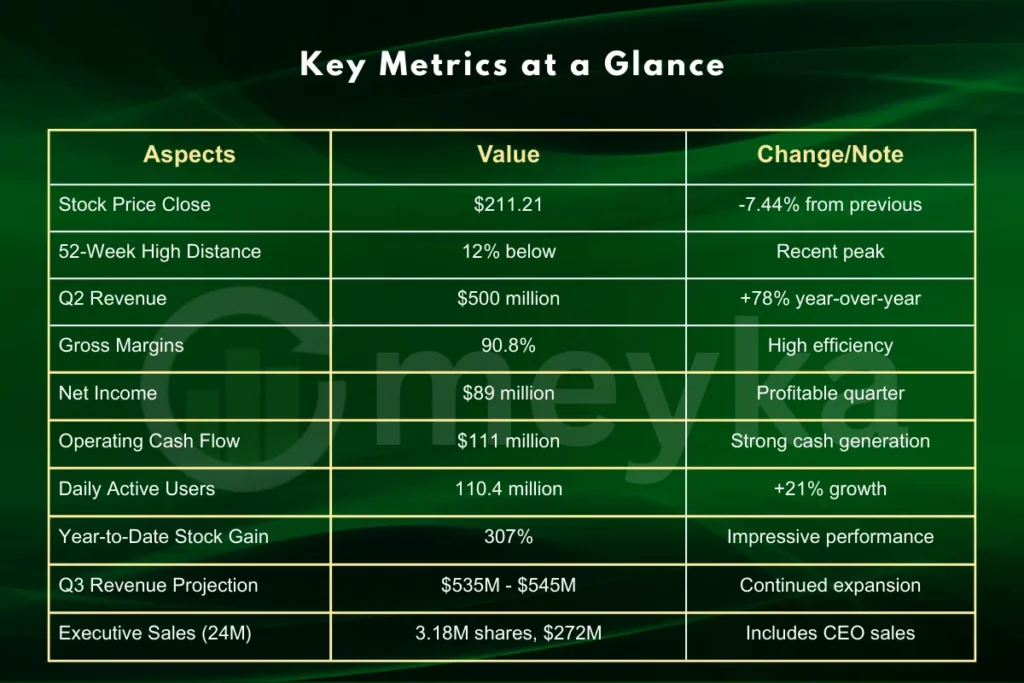

We watch RDDT stock closely in the stock market. On Wednesday, RDDT stock fell 7.44% to $211.21. This drop places it about 12% below its recent 52-week high.

The decline happens during a broad tech sector selloff. Many tech companies face pressure. Yet, Reddit shows strong results in its latest quarter.

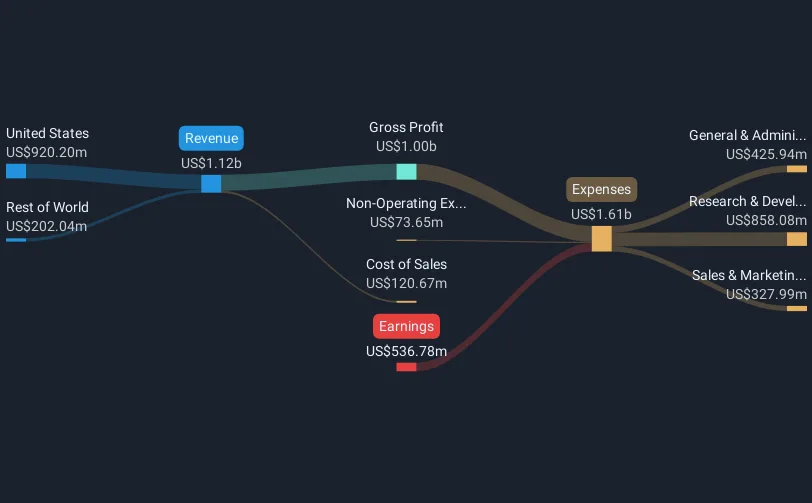

We see revenue jump 78% to $500 million in Q2 2025. Gross margins hit 90.8%. Net income stands at $89 million, with operating cash flow at $111 million.

Why RDDT Stock Fell in the Stock Market

We note the tech sector selloff as a key factor. Investors sell shares across tech firms. This creates downward pressure on RDDT stock.

Economic worries add to the mix. Interest rates and inflation concerns rise. These affect the entire stock market.

RDDT reacts to these trends. It drops amid wider market fears. Traders adjust positions quickly.

Details of the Recent Drop

The close at $211.21 marks a sharp fall. It follows a strong run earlier. The 52-week high sits higher.

We compare this to past drops. Tech selloffs often hit social media stocks hard. Reddit fits this group.

Market data shows volume increased. More shares traded during the dip. This signals active interest.

Reddit’s Strong Financial Performance

We highlight Reddit’s Q2 2025 results. Revenue grew 78% year-over-year. It reached $500 million.

Gross margins impress at 90.8%. This shows efficient operations. Costs stay under control.

Net income totals $89 million. Operating cash flow hits $111 million. These numbers build confidence.

User Growth and Engagement

Daily active users rose 21%. They now number 110.4 million. This drives ad revenue.

We see this growth as key. More users mean more value. It supports long-term stock strength.

Year-to-date, RDDT stock surged 307%. This outperforms many peers. The recent drop seems temporary.

Executive Share Sales and Market Patterns

Executives sold 3.18 million shares in 24 months. This totals $272 million. CEO Steve Huffman sold 720,041 shares in Q2.

We view this with context. Sales often fund personal needs. They do not always signal weakness.

Wyckoff accumulation patterns appear. These suggest institutional buying. Big investors may scoop up shares.

Future Outlook

Q3 revenue projects between $535 million and $545 million. This continues the growth streak. We expect steady progress.

User metrics improve. Engagement rises with new features. This bolsters the platform.

Tech sector recovery could lift RDDT stock. Broader market gains help. Watch for economic signals.

Key Metrics at a Glance

Strategies for Monitoring RDDT Stock

We suggest watching earnings calls. They provide insights. Listen for guidance updates.

Track user growth metrics. They predict revenue. Monthly reports help.

Follow tech sector news. Selloffs spread fast. Stay ahead with alerts.

Tools for Stock Market Analysis

Use free charts from sites like Yahoo Finance. They show trends.

Apps offer real-time quotes. Set notifications for RDDT stock.

Join forums for discussions. Share ideas with others.

Final Thoughts

We wrap up with key points. RDDT stock shows resilience despite the drop. Strong fundamentals back it.

The stock market remains volatile. Tech selloffs come and go. Reddit’s growth story continues.

Look at the big picture. User increases and revenue projections matter. RDDT stock holds potential.

Disclaimer:

This content is for informational purposes only and is not financial advice. Always conduct your research.