Reasons for Oracle Dip: Forecasts Miss Wall Street Expectations, Triggering 12% Drop

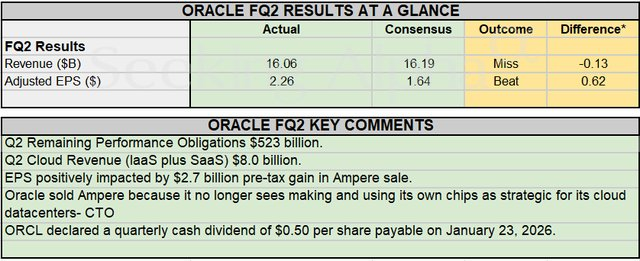

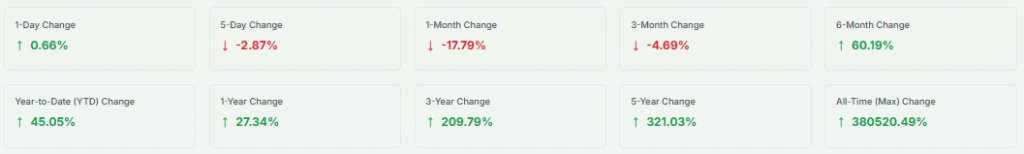

On December 11, 2025, Oracle’s stock slid sharply. Oracle’s shares dip about 12% after the company gave a forecast that missed Wall Street expectations. Investors reacted fast. Traders had hoped for strong growth. Instead, the outlook fell short. This created a big gap between what analysts predicted and what Oracle guided.

Oracle is a major tech company. It sells software, cloud services, and business systems worldwide. Its cloud business has been a key focus in recent years. Many investors were watching for signs of faster growth there. But the numbers did not match up with high hopes. That surprise pushed the stock down quickly.

This drop is more than a single-day wobble. It tells a story about shifting investor expectations. Markets now expect clear growth, not just promises. Oracle’s earnings update did not satisfy that demand. Let’s explore the real reasons behind the drop, what it means for the company, and what might come next.

The Oracle’s Forecast Miss: Exact Guidance vs. Expectation

On December 11, 2025, Oracle issued guidance that fell short of analyst forecasts. The company warned that sales and profit would not meet Wall Street’s consensus. That shortfall sparked a swift sell-off. The stock opened down about 12% in European trading and fell sharply in U.S. after-hours trading. This gap between guidance and market expectation proved costly.

Analysts had grown hopeful about Oracle’s cloud momentum. The market had already priced in strong growth from AI workloads and large cloud deals. When Oracle signaled higher near-term spending and slightly softer profit outlooks, investors revised those rosy assumptions. The result was a fast and deep re-rating of the stock.

Oracle Cloud Growth Slows: Where Strain Appeared?

Oracle reported continued cloud growth. But the pace did not match investor hopes for immediate, margin-friendly AI revenue. Cloud revenue rose, yet cloud infrastructure margins are thinner than legacy software. Rapid capital spending to expand data centers added pressure. Investors wanted cloud growth that quickly translated into higher operating profit. That did not happen in the latest guidance.

Certain OCI (Oracle Cloud Infrastructure) segments showed strong demand. However, revenue recognition for big AI deals often lags. Many contracts are booked as backlog. That backlog looks large on paper. Yet conversion into near-term cash and profit takes time. This timing mismatch hurt sentiment after the forecast miss.

Immediate Red Flags Highlighted by Analysts

Several issues jumped out to analysts immediately after the release. First, capital expenditure plans rose by about $15 billion versus earlier estimates. That increase suggested Oracle is committing aggressively to AI data centers. Second, margins compressed. Heavy spending and lower-margin cloud revenue squeezed operating margins. Third, the backlog-to-revenue timing raised doubts about how fast those deals will generate profit. These concerns combined to weaken confidence.

Analyst notes also flagged rising debt and cash flow strain from the investment push. Some firms stayed positive on Oracle’s long-term prospects. Others trimmed near-term price targets. The tone moved from unquestioned optimism to cautious realism.

Why the Market Reaction Was Disproportionate?

Oracle’s stock rallied strongly in prior months. That rally priced in near-perfect execution on cloud and AI initiatives. When guidance was missed, the fall was magnified. Elevated valuations make any forecast more damaging.

Quant funds and momentum traders intensified the selling. Many algorithms use forward guidance as a key input. A negative surprise triggered rapid position unwinds. The result was the steep 12% plunge on December 11, 2025.

Internal Challenges Oracle Must Address

Scaling data centers faster than customer revenue materializes is risky. Oracle chose to accelerate capital spending. That move may secure future capacity. But it raises near-term margin risk. Oracle must also offer more clarity on how booked AI commitments turn into recognized revenue. Investors want clear timelines. Cerner integration and other legacy transitions remain a watch point. If these pieces drag, overall growth will feel uneven.

Transparency on the customer contract structure would help. Investors want line-by-line visibility on large commitments. That kind of reporting reduces uncertainty. It also lowers the chance of surprise in future quarters.

The One Bright Spot: Pockets of Strength

Despite the miss, some segments performed well. Database renewals stayed robust. Cloud application sales showed durability in several verticals. Oracle’s backlog, though criticized for timing, signals strong demand for future cloud services. Large enterprise deals continue to favor providers that can host and train big language models. Oracle’s architecture and pricing for heavy compute workloads remain competitive. These strengths could form the base for recovery if execution improves.

Market Context: Why Investors Now Punish Forecast Slips

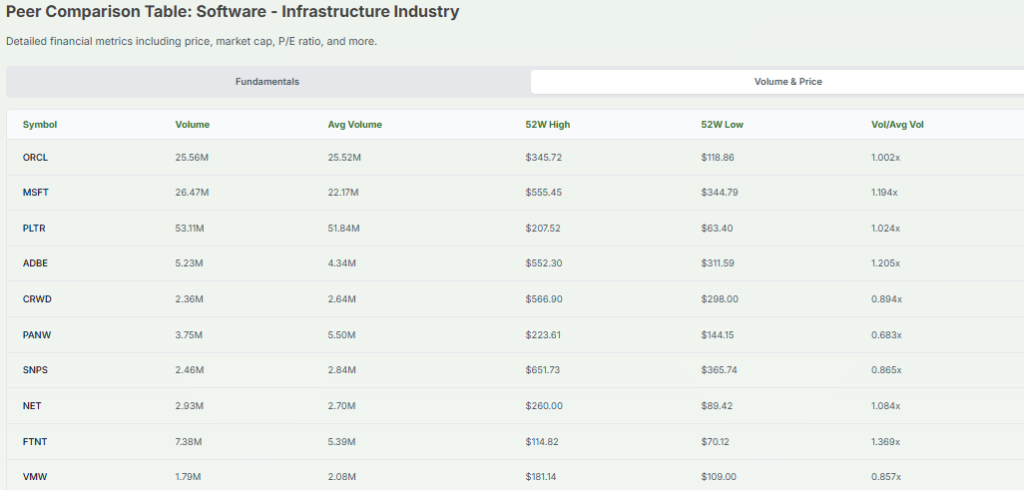

The tech market has shifted. The era of growth-at-all-costs is over. Investors now demand clearer paths to profitable scale. AI remains a huge opportunity. But it also requires massive capital. Companies that spend heavily without short-term profit proof face fast re-rating. Competition is more intense. AWS, Microsoft Azure, and Google Cloud are all pursuing enterprise AI deals. That competition compresses margins and forces faster investments. Oracle’s aggressive capital plan put it squarely in that crossfire.

Oracle Dip Short-Term Outlook: What to Watch Next?

Watch three key items in the coming quarters. First, cloud revenue growth rates and especially IaaS margins. Second, the pace of backlog conversion into recognized revenue. Third, quarterly free cash flow and capital spending cadence. Management commentary on customer deployment timelines will be crucial. Any sign that large AI commitments are accelerating revenue recognition could calm nerves.

Some investors will look to third-party signals too. Independent analysts and an AI stock research analysis tool may provide faster, data-driven clarity on capacity utilization and GPU demand. Positive third-party checks could shorten the recovery window.

Long-Term View: Structural Upside Remains

Oracle still has deep enterprise relationships. Database dominance and middleware market share provide a steady revenue base. The company’s push into high-performance computing for AI could pay off if the industry consolidates around fewer, large cloud hosts.

If Oracle can translate backlog into sustained, margin-accretive revenue over 2026-2027, the long-term thesis remains intact. Execution risk is high. But the upside for a successful transition is meaningful.

Conclusion: A Market That Now Demands Proof

The December 11, 2025, Oracle dip shows how fragile sentiment can be when lofty expectations meet reality. Oracle faces a classic scaling problem: win big AI deals, then turn capacity into profit. That path takes time and precise execution. Short-term pain is possible. Long-term reward is possible, too. The next few quarters will decide which path Oracle follows.

Frequently Asked Questions (FAQs)

Oracle stock fell 12% on December 11, 2025, after the company gave a weaker sales forecast. Investors expected stronger cloud growth, so the lower outlook caused fast selling.

Oracle’s cloud business is still growing in 2025, but the pace is slower than investors hoped. Some large AI deals take more time to turn into real revenue.

Analysts say Oracle must show clearer cloud growth and faster profit improvement. They remain cautious but note that long-term demand could improve if big AI workloads scale as planned.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.