Redington Shares Jump 25% in Two Days, Gain 5% Today

Redington shares are on a strong run. The stock has jumped 25% in just two days. Today, it added another 5%. Such fast moves always make us stop and ask why.

Redington is not a new player in the market. It is one of the largest distributors of IT and mobility products in India and abroad. From laptops and printers to enterprise cloud solutions, it connects global brands with local markets. That role has grown more important as digital adoption rises across industries.

When a stock shows such momentum, investors look for triggers. Were they strong quarterly results? Was it new partnerships with tech leaders? Or was it heavy buying from big institutions? Each factor tells part of the story.

We also need to place this rally in a bigger context. The IT distribution sector is changing fast. Demand for devices, cloud, and digital services is strong. At the same time, competition and global risks remain.

This rally gives us a chance to explore Redington’s journey, the reasons for its sudden surge, and what it could mean for investors.

Company Overview

Redington Limited is a major distributor of technology products. The company moves laptops, phones, printers, cloud solutions, and services. Its network spans India, the Middle East, Africa, and other regions. Redington works with global brands and local retailers.

The firm reports revenues in the multi-billion dollar range and serves hundreds of brands. Its role is to connect global vendors to local markets through logistics, sales, and after-sales support. The recent strategy has focused on adding cybersecurity, cloud, and services to the product mix to lift margins and stickiness.

Recent Stock Performance

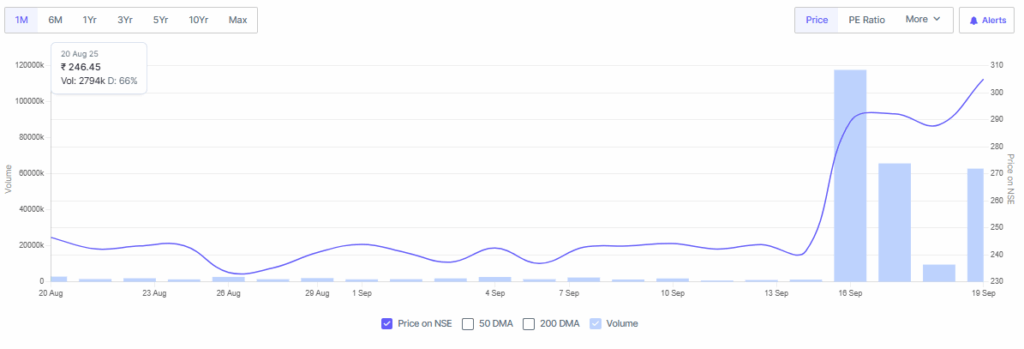

Redington shares rose nearly 25% in two trading sessions and then added about 5% on the next day. The stock hit upper circuits and recorded heavy volumes in those sessions. Intraday highs moved from mid-200s to near 300 rupees on the BSE/NSE in a short span. Trading volumes spiked many times over the two-week average, showing strong market interest. The company also appeared on lists of the most active stocks and saw large delivery volumes, signalling real buying rather than just intraday churn.

Key Triggers Behind the Rally

Several clear triggers pulled the stock higher. First, the launch and local sale of the iPhone 17 in India lifted sentiment. Redington is a key distribution partner for Apple in many markets. Anticipation of high iPhone 17 demand and early pre-orders pushed traders to buy the stock ahead of retail sales.

Second, recent partnerships and deals added credibility to growth hopes. Redington signed distribution and technology pacts, including a tie-up to distribute CrowdStrike’s cybersecurity platform in India and local HP digital printing collaborations. Such alliances point to higher-margin services and recurring revenue streams.

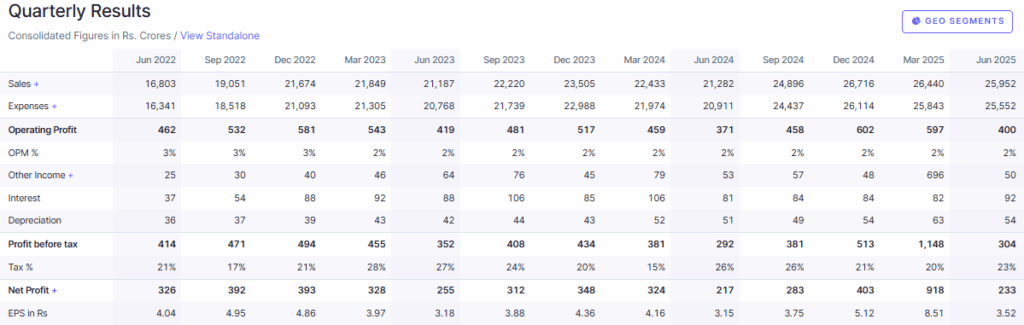

Third, quarterly results from prior periods showed pockets of strong profit growth. Recent earnings beats and higher margins in some quarters gave the market a reason to re-rate the stock. Past quarterly jumps in net profit drew attention from brokers and retail traders alike.

Fourth, institutional interest and high delivery volumes pushed prices. Reports highlighted large block trades and a sharp rise in delivery percentages on the exchange. Momentum traders and short-covering likely amplified the move once the stock started climbing.

Sector and Market Context

The IT distribution sector is cyclical. Device cycles, product launches, and enterprise IT spending drive demand. When a major consumer product like a new iPhone lands, distributors often see a sharp but time-bound revenue boost. At the same time, demand for cloud, security, and services is lifting the long-term industry structure. Markets such as India show steady device demand, but other regions remain volatile. Macro conditions and global supply chains will shape future performance for distributors like Redington.

Analyst Views and Brokerage Reports

Brokerage notes point to a mixed view. Some analysts flagged the upcoming iPhone sale as a sensible short-term catalyst. Others cautioned that rallies driven by product launches can fade after the initial sales week. Broker targets vary.

A few house reports upgraded the stock on improved margin outlook and partnerships. At the same time, technical analysts warned of overbought signals and the chance of a near-term pullback after a sharp run. Investors should check explicit target prices and the assumptions behind them.

Investor Sentiment and Retail Buzz

Social media and stock forums are filled fast with chatter. Retail traders often chase momentum. Search interest and watchlist additions rose. Stories about the iPhone 17 and distribution wins circulated quickly. In such situations, retail fear of missing out (FOMO) can add fuel to the move. However, retail buzz can reverse just as fast if earnings or sales fail to match expectations.

Risks and Challenges Ahead

Several risks could temper gains. First, device demand can be lumpy. A strong launch week can be followed by slow months. Second, international markets remain uneven. Past quarters showed weak demand in some regions, which can drag consolidated profits.

Third, margin pressure from higher freight costs or component price swings could hit profits. Fourth, elevated valuation after a big rally raises the chance of a sharp correction if growth misses expectations. Finally, global macro shocks or currency swings could hit overseas revenue.

What does this mean for Investors?

Short-term traders may find opportunity in momentum, with liquidity and volume making Redington tradeable. Long-term investors should separate hype from growth by using AI stock research and AI stock analysis tools. These can help track partnerships, margins, and region-wise sales. Always diversify risk, avoid chasing rallies blindly, and rely on verified company updates, quarterly results, and broker notes before adding exposure to any AI stock strategy.

Wrap Up

The recent surge in Redington shares reflects a mix of product-cycle optimism, strategic partnerships, and heavy trading volumes. The iPhone 17 launch and recent distribution deals appear to be the main drivers.

Strong short-term moves carry both upside and higher risk. Close attention to sales data, quarterly results, and corporate announcements will be critical to judge if the rally has real staying power. Investors should balance growth hopes with measured caution.

Frequently Asked Questions (FAQs)

Redington shares jumped in September 2025 after strong iPhone 17 demand, new tech deals, and heavy buying interest. High trading volumes added momentum and lifted prices further.

The stock gained sharply by September 19, 2025. Future moves depend on sales, earnings, and market news. Investors should study fundamentals and risks before making any decision.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.