Reliance Industries Share Price Gains as Infra Stock Wins ₹41 Cr Project Order

On 23 October 2025, India’s industrial stalwart Reliance Industries Limited (RIL) saw its shares rise sharply after its infrastructure arm secured a ₹41 crore contract order. The news sparked fresh investor interest and added momentum to the company’s growth narrative. While RIL already commands a diverse business portfolio from oil refining to digital services, the new infrastructure win strengthens its footing in the high-growth infrastructure sector.

For shareholders, the project order sends a signal of confidence: the company is actively winning new business and expanding beyond its traditional base. Let’s look at what this contract means for RIL’s share-price movement, its infrastructure ambitions, and investor expectations going ahead.

Kurnool Project Details: ₹41 Crore Infrastructure Win

On 23 October 2025, Sathlokhar Synergys E&C Global announced a civil works order worth ₹41.88 crore from Reliance Consumer Products. The job is for a beverage plant at Kurnool, Andhra Pradesh. The contract covers civil works and site preparation. The work is expected to be completed within the timeline agreed between the contractor and Reliance Consumer Products. This order strengthens the vendor’s order book. It also shows Reliance’s ongoing investments in its consumer and manufacturing footprint.

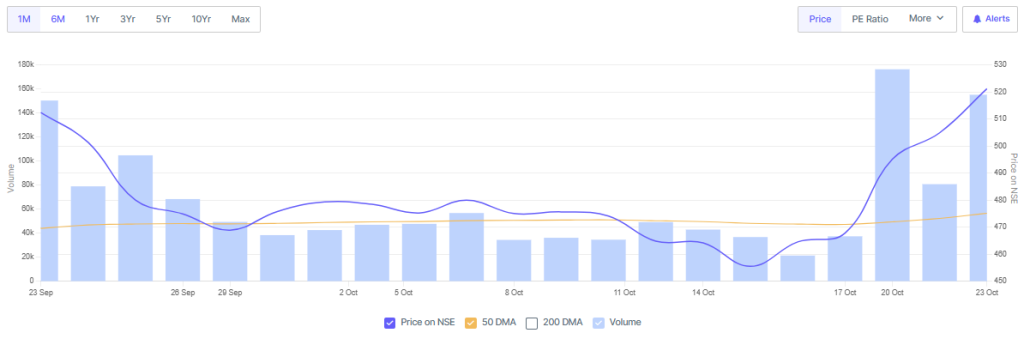

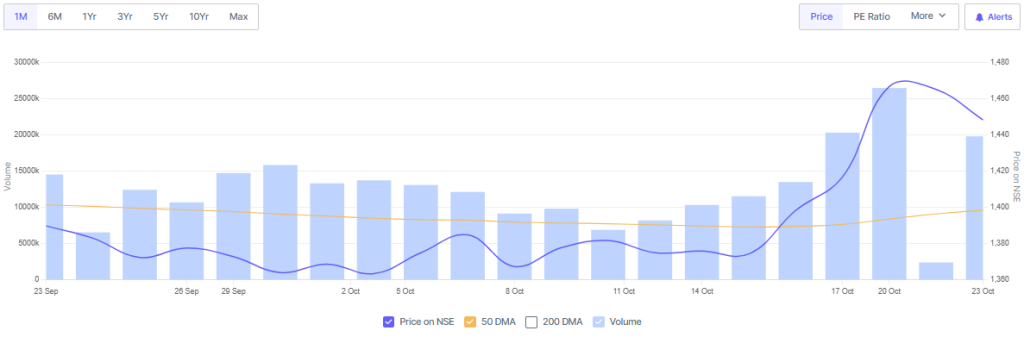

Market Reaction and Share Price Performance

The announcement triggered an immediate market response. The stock of the contractor jumped as traders reacted to the new order. Media reports put the intraday uplift for the infra stock in the region of 3-6% on the same day.

Reliance Industries shares also moved as markets digested the news and other concurrent developments. Trading volumes were higher for the smaller supplier that won the contract. This pattern is common. Big clients like Reliance boost investor confidence in suppliers.

Broader Impact on Reliance’s Business Segments

Reliance Consumer Products is expanding its manufacturing base to support higher demand. Adding a beverage plant in Kurnool helps the company secure local supply chains. This reduces dependence on long logistics runs. It also speeds up deliveries to southern markets. The project fits into Reliance’s push to grow its consumer goods business. This expansion complements Jio’s digital reach and Reliance Retail’s distribution network. The move improves the firm’s integrated value chain from factory to consumer.

Expert Opinions and Analyst Views

Analysts see such orders as positive signals for both suppliers and the parent group. For the contractor, a Reliance order is a quality win. For Reliance, the spend is modest but strategic. Brokerage notes after the quarter pointed to strong numbers across Jio and Retail, which support ongoing capex and operational scale-up.

Some market watchers use AI research tools for quick screening of such contract wins and their likely impact on small-cap balance sheets. The tool often flags improvements in order books as a near-term positive for the executing company.

Financial Overview and Expected Earnings Impact

A ₹41-42 crore contract is small for a conglomerate like Reliance. It will not shift consolidated revenues in a material way. For the executing firm, the contract could add several percentage points to revenue for the fiscal year, depending on its size. The profit impact depends on margins and project execution costs.

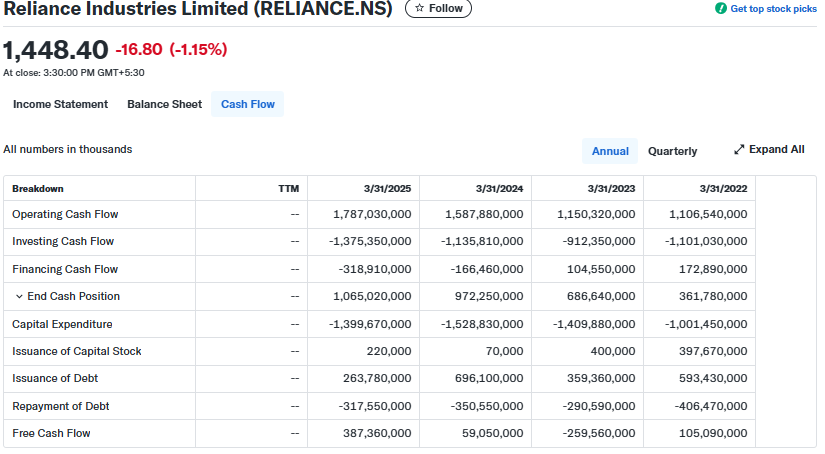

For Reliance Consumer Products, the order is part of steady capex that aims to boost domestic production and lower logistics costs. Recent RIL financial documents show a solid balance sheet and healthy cash flow. These resources allow the group to keep investing in consumer capacity and in other growth areas without stressing the core business.

Risk Factors and Execution Challenges

Project execution risk can affect any construction contract. Delays, cost overruns, or supply chain problems could reduce margins for the contractor. For Reliance, delays affect production ramp-up and distribution plans.

Regulatory clearances, labour availability, and local logistics are possible friction points in Andhra Pradesh and elsewhere. Investors should watch progress updates and milestone completions to judge whether the work is on track. Public companies usually disclose material project developments in stock exchange filings or press releases.

Strategic Context and Future Outlook

This contract fits a larger pattern. Reliance has shown steady interest in building manufacturing capability for consumer products. The company also reported strong quarterly performance across Jio and Retail, which underpins its ability to scale operations.

Continued factory expansion will support faster product rollouts. It will also strengthen the supply chain for retail and e-commerce. For investors in supplier stocks, landing work from Reliance often triggers renewed order flows from other large clients. For Reliance, such projects raise resilience in sourcing and cut time-to-market for new launches.

Wrap Up

The ₹41.88 crore civil works order announced on 23 October 2025 is a gain for both Reliance Consumer Products and the contractor. For the contractor, the work boosts revenue visibility and the order book. For Reliance, the plant expands manufacturing reach in southern India and tightens the supply chain. Market reactions were immediate but measured.

The order is not a game-changer for Reliance at the group level. Still, it is a signal of continued capital spending and operational expansion. Investors should monitor execution, follow-up orders, and quarterly updates for clearer signs of lasting impact.

Frequently Asked Questions (FAQs)

On October 23, 2025, Reliance shares gained after its infra arm won a ₹41 crore project order, showing steady business growth and market trust.

The ₹41 crore order is for civil work at a new beverage plant in Kurnool, Andhra Pradesh, helping expand Reliance’s consumer product operations in India.

Yes, the project supports Reliance’s long-term growth by adding production capacity, improving supply chains, and strengthening its presence in India’s growing consumer market.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.