Rolls-Royce Announces £200 Million Interim Share Buyback Plan

On 16 December 2025, Rolls-Royce Holdings plc surprised many investors with a fresh £200 million interim share buyback plan. The move comes just weeks after the company completed most of its earlier £1 billion buyback programme for 2025.

This decision shows that Rolls-Royce’s leadership feels confident about its cash flow and future earnings. It also signals that the company wants to support its share price and reward long-term shareholders while it prepares to release full-year results early next year.

Unlike routine financial news, this interim buyback matters because it highlights how far the business has come in strengthening its balance sheet and generating steady cash. For years, Rolls-Royce fought to recover from pandemic-era losses and heavy debt. Now, it is in a position to return capital to investors instead of just cutting costs.

Let’s unpack what the £200 million plan means for the company, its stock, and its shareholders.

The Rolls-Royce £200 Million Buyback Plan

Rolls-Royce announced an interim, irrevocable share buyback of up to £200 million on 16 December 2025. The programme is set to start on 2 January 2026 and run no later than 24 February 2026, ahead of full-year results due 26 February 2026. UBS AG London Branch will execute market purchases. Shares acquired will be cancelled to reduce the issued share capital. This is an add-on to the £1 billion repurchase completed in November 2025.

The buyback’s size is modest versus the company’s market value. But it is meaningful as a signalling tool. Management framed this as a targeted capital return to support long-term shareholders. The plan is time-bound and non-discretionary.

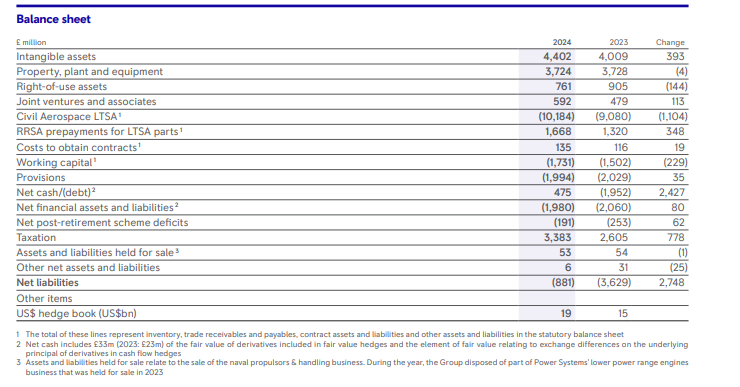

Rolls-Royce Balance Sheet Turnaround

Rolls-Royce moved from heavy pandemic debt to an investment-grade profile in 2024 and 2025. Rating agencies upgraded the company after steady cash-flow improvement and LTSA renegotiations. Free cash flow rose notably through 2024 and 2025. The stronger balance sheet enabled the company to resume dividends and to run large buybacks.

The prior £1 billion programme, completed in November 2025, materially reduced the free float. That earlier programme proved management’s commitment to returning surplus cash. The interim £200 million plan builds on that momentum. Investors will watch cash generation closely during the early 2026 buyback window.

Civil Aerospace Engine Flying Hours: The Hidden Driver Behind the Buyback

Civil Aerospace accounted for a large share of the operating profit recovery in 2025. Revenue growth came mainly from increased engine flying hours. Long-term service agreements (LTSAs) converted more flying hours into predictable cash. Higher time-on-wing improved margins without a proportional rise in new engine deliveries. That dynamic lifted cash flow and allowed the company to commit to share repurchases.

Engine flying hours remain a leading indicator. Wider global passenger travel and a rebound in long-haul flights pushed engine utilisation higher through 2025. That trend underpins the short-term liquidity cushion that funds the buyback.

Defence and Power Systems

The Defence and Power Systems delivered steady revenue and margins in 2025. Defence contracts provided a visible backlog. Power Systems benefited from energy transition projects and service agreements. These divisions reduce reliance on cyclical engine deliveries. Their cash flows add resilience to the group’s overall cash generation. That diversification lowers the risk of committing to further capital returns.

What does the Buyback Say About Leadership Confidence?

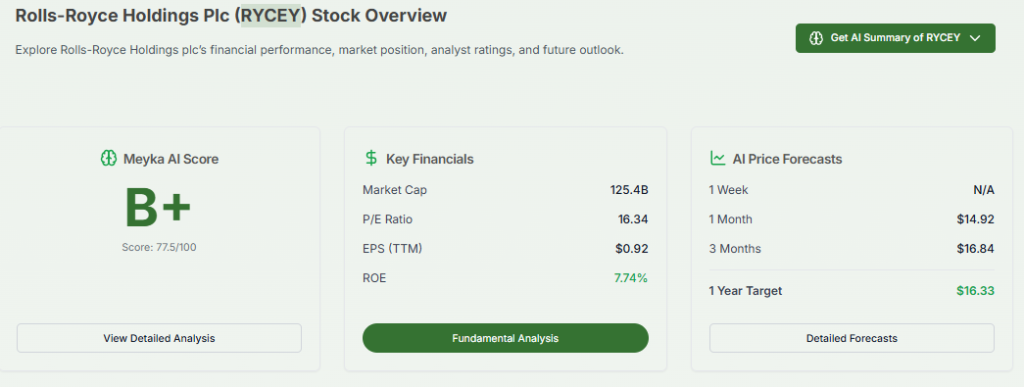

The board’s timed, irrevocable plan signals confidence in near-term cash flow. Choosing a buyback over a special dividend suggests a desire to improve per-share metrics. Cancellation of repurchased shares shows a focus on structural EPS growth. The move also sends a message to institutional investors that management views the current share price as undervalued enough to repurchase stock.

This signal is stronger because it follows a sizeable prior buyback and a dividend reinstatement in 2025. Together, these steps indicate a shift from survival to capital allocation for shareholder value.

Market Reaction: How Rolls-Royce Shares Responded

Markets reacted positively to the announcement on 16 December 2025. Volume spiked, and sentiment turned upbeat in early trade. Analysts noted the buyback as supportive for the share price ahead of the full-year results. Broker comments ranged from cautious praise to suggestions of upside if operating trends hold. Price movement reflected both the cash return and stronger earnings guidance delivered earlier in 2025.

Short-term traders saw the buyback as a catalyst. Long-term holders weighed the buyback alongside fundamental improvements. Attention now shifts to execution details and how much will actually be repurchased in the specified window.

Valuation Impact: Does the Buyback Make Rolls-Royce Stock More Attractive?

A £200 million buyback reduces shares outstanding and should raise EPS, all else equal. The effect on valuation depends on the price paid and on future earnings. If repurchases occur at fair or cheap levels, EPS accretion will be meaningful. If purchases happen at elevated prices, benefits decline. Analysts will model accretion under different buyback execution scenarios ahead of the February results.

Buybacks also help return capital without committing to recurring payouts. That preserves flexibility to fund R&D and strategic investments in engines and new platforms. For yield-seeking investors, the recent dividend reinstatement remains the key recurring income signal rather than the interim buyback.

Risks Investors Should Still Watch Despite the Buyback

Several risks remain. A downturn in global air travel could reduce flying hours and service revenue. Supply chain bottlenecks or titanium shortages could slow engine maintenance and production. Defence spending shifts or contract delays would hurt backlog visibility. Currency moves and higher interest rates could also pressure margins and cash flow. A buyback does not remove these macro and operational risks.

Execution risk is real, too. The programme’s time limits mean purchases must occur in a compressed window. That could push the company to buy at higher prices if market liquidity tightens. Watch actual repurchase notices for the precise amount bought each trading day.

What Comes Next: Could Rolls-Royce Expand Buybacks or Reinstate Dividends?

Future capital returns hinge on sustainable free cash flow. The board said total buybacks for 2026 will be reviewed and may be announced with full-year results. If cash remains robust, a larger or repeat buyback is possible. Dividend policy restoration permanently depends on consistent profit and cash outlooks. Analysts expect management to use the February 26, 2026, results to outline medium-term return plans.

Investor Takeaway: Strategic Buyback or Short-Term Market Support?

The £200 million interim buyback is both strategic and tactical. It is strategic because it complements prior capital returns and highlights improved cash conversion across Civil Aerospace, Defence, and Power Systems. It is tactical because it is time-bound and likely aims to support the share price ahead of full-year results on 26 February 2026. Execution quality and cash-flow continuity remain the decisive factors for whether this action enhances long-term shareholder value.

For investors building models, consider running accretion scenarios using an AI tool or traditional valuation checks. Pay close attention to daily repurchase notices. These will reveal how much of the £200 million is actually deployed and at what prices.

Frequently Asked Questions (FAQs)

Rolls-Royce announced a £200 million share buyback on 16 December 2025. It aims to return cash to shareholders and show confidence in the company’s cash flow and future earnings.

The buyback may support Rolls-Royce shares by reducing the number of shares available. However, the stock price will still depend on market trends and company performance in early 2026.

The interim buyback will start on 2 January 2026 and finish by 24 February 2026. Shares bought will be cancelled, lowering the total number of Rolls-Royce shares.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.