Rubicon Research Secures ₹619 Crore from Anchor Investors Before IPO Launch

Rubicon Research, a Mumbai-based pharmaceutical company, has secured ₹619 crore from anchor investors ahead of its public issue. The strong anchor round signals institutional trust in the company’s model, its export focus, and its R&D pipeline.

According to reports from authentic sources, the public offer opens this week, and proceeds will target debt repayment, R&D expansion, and strategic growth moves.

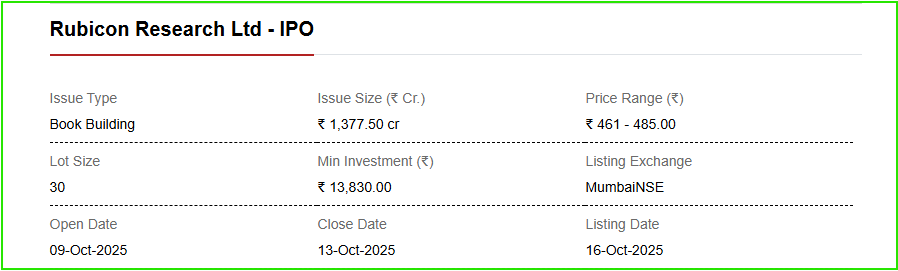

Rubicon Research IPO Details and Price Band

The Rubicon Research IPO is sized at about ₹1,375 crore, mixing a fresh issue and an offer for sale. The company fixed a price band of ₹461 to ₹485 per share. The issue window opens soon, and the shares are slated to list on the NSE and BSE once the allotment and listing process are completed.

The Hindu Business Line notes that the pricing makes the IPO accessible to both retail and institutional investors.

What should investors note about the price band?

The band reflects management’s valuation and market conditions. Retail investors should compare the band to peer valuations and check subscription momentum before subscribing.

Rubicon Research Anchor Investors and Allocation

The anchor portion saw ₹619 crore committed by about 20 institutional buyers. The allocation included mutual funds, insurance companies, and foreign institutional investors. Reports list participants such as HDFC Mutual Fund, ICICI Prudential Life Insurance, and Aditya Birla Sun Life, among others. Market commentator Systematix Group highlighted the strong anchor demand on social media.

Why did Rubicon Research attract anchor investors?

Institutional interest stems from Rubicon’s work in formulations, complex generics, and contract development services.

The company sells into regulated markets such as the United States, Europe, and the United Kingdom. Its export revenue mix and focus on specialty formulations attract funds looking for stable pharma cash flows.

Rubicon Research Financial Performance and Growth Outlook

Rubicon Research reported steady results in FY24. Revenues rose about 12 percent, supported by demand for oral solid dosage formulations and contract services. Profit after tax stood at roughly ₹186 crore, showing operational resilience. Rediff Money and LiveMint highlight the firm’s steady expansion in North America and Europe, and its improving margins through cost management and scale.

Analyst view: Investors now favour mid-cap pharma plays with R&D pipelines and export capabilities. Rubicon fits these criteria, which partly explains the strong anchor round.

How Rubicon Research Will Use IPO Proceeds

Management has outlined clear uses for the funds:

- Repay corporate debt, strengthening the balance sheet.

- Expand R&D capabilities in Mumbai and Pune.

- Fund strategic acquisitions in formulation development.

- Enhance the supply chain for export focus.

LiveMint reports that around ₹300 crore from the fresh issue will be allocated to debt repayment, aiming to lower leverage and free up cash for growth.

Rubicon Research Valuation and Market View

Analysts have largely viewed the valuation as fair for a pharma firm with export scale. Brokerages that track the offer have issued subscribe or watch calls, noting the anchor backing adds credibility. IPO analyst ipowiz described the offering as promising given its anchor support and fundamentals.

Does anchor support mean a strong listing?

Strong anchor demand often boosts market confidence, but final listing performance depends on public subscription, market sentiment, and grey market indicators.

Industry Context: Why Rubicon Research Matters

India’s pharma sector has seen renewed investor interest, driven by global outsourcing and rising demand for generics. Investors are focusing on companies that combine regulatory strength with export scale.

The Economic Times notes that investors prefer firms that can deliver steady revenue and margin expansion. AI Stock research trends also show an appetite for pharma companies with demonstrable R&D and export credentials.

Risks Investors Should Consider

Rubicon Research carries typical sector risks: pricing pressure in international markets, regulatory or compliance hurdles, and integration risks from acquisitions. IPO market volatility is another risk in the short term. Analysts advise investors to weigh these risks against the company’s growth plans and anchor backing.

Market Reception, Retail Interest, and Social Signals

The anchor round has already shaped sentiment. Market watchers say retail interest will be high if the public offer gets robust QIB and HNI bids. Industry commentator thekripalsahu noted the strong anchor response and predicted healthy subscription levels across categories.

Video Insight: Rubicon Research IPO Explained

For a clear, step-by-step overview of the company and the offering, watch this explainer:

The video summarizes the business model, the use of proceeds, and key metrics investors should track.

What to Watch Next for Rubicon Research

Post anchor round, key items to monitor include: subscription pace across retail, QIB, and NII categories, grey market premium indications, and any last-minute changes in demand. After listing, watch the execution of the R&D expansion and the debt reduction impact on margins. Sustained revenue growth in regulated markets will validate the long-term case.

Conclusion: Rubicon Research Takes a Confident Step Toward Listing

Rubicon Research has taken a major step by securing ₹619 crore from anchor investors ahead of its IPO. The backing underscores confidence in the firm’s export-led model and R&D focus. With funds earmarked for debt repayment and growth, the company aims to position itself for scale in regulated markets.

If public subscription mirrors anchor enthusiasm, Rubicon Research could be one of the year’s notable pharma listings. Investors should track subscription trends, the listing day, and early quarterly performance to judge whether the strong anchor start translates to long-term value.

FAQ’S

Rubicon Research secured ₹619 crore from anchor investors ahead of its IPO. The strong anchor demand is a positive signal for the public issue.

The anchor pool included a mix of mutual funds, insurance firms and foreign investors, with names such as HDFC Mutual Fund, ICICI Prudential Life, and Aditya Birla Sun Life among the participants. Institutional interest helped fill the ₹619 crore allocation.

The IPO is sized at about ₹1,375 crore, with a price band set between ₹461 and ₹485 per share. The issue includes a fresh issue and an offer for sale, and plans to list on the NSE and BSE.

Proceeds will go to debt repayment, R&D expansion, strategic acquisitions, and strengthening the supply chain for export markets. About ₹300 crore is earmarked for reducing corporate debt.

Analysts generally recommend subscribing, noting solid financials and strong anchor backing, but retail investors should weigh valuation, sector risks, and their investment horizon before applying.

Disclaimer

This is for information only, not financial advice. Always do your research.