SEC Suspends Trading of Firm After 959% Surge on Crypto News

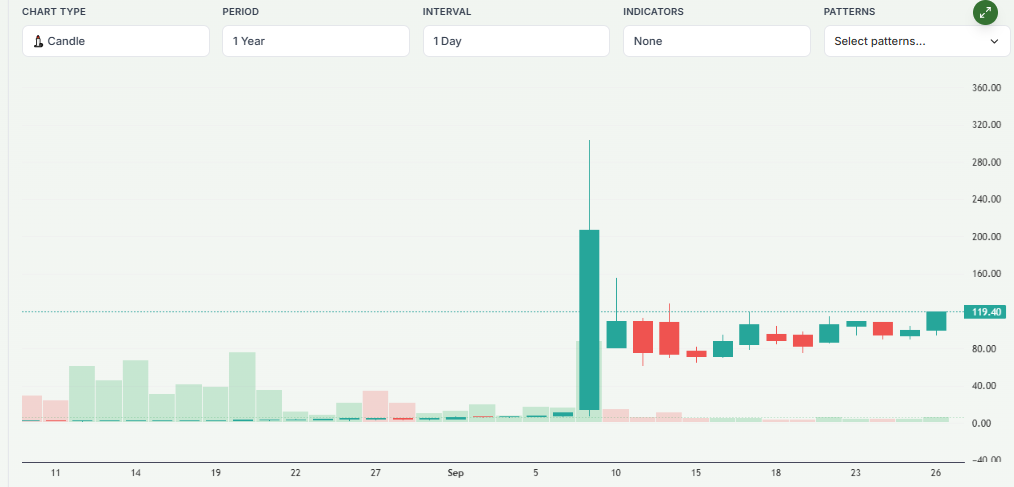

On September 9, 2025, QMMM Holdings Ltd., a Hong Kong-based advertising firm, announced plans to establish a $100 million cryptocurrency treasury. This move sent shockwaves through the market, propelling the company’s stock price from $11 to a staggering $207 in just 14 trading sessions, a 959% surge. Such rapid gains are rare and often attract scrutiny.

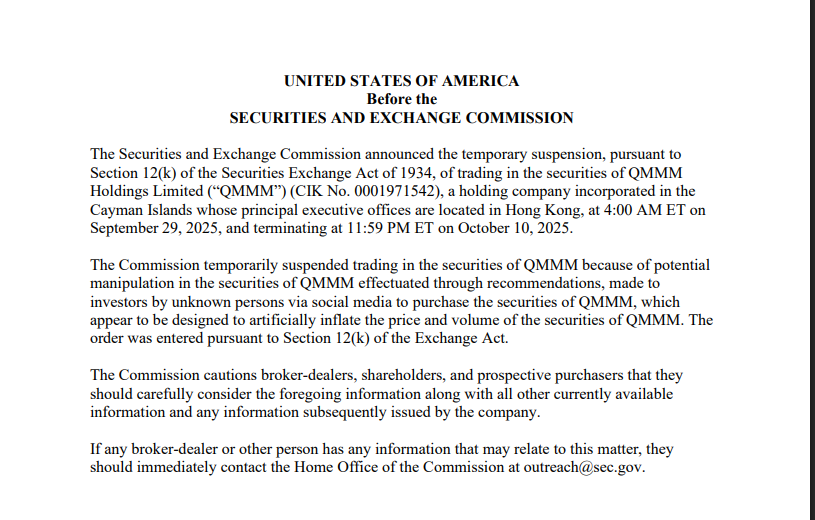

The U.S. Securities and Exchange Commission (SEC) intervened swiftly, suspending trading of QMMM on September 29, 2025. The SEC cited concerns over potential market manipulation, particularly through social media channels, where unknown individuals allegedly encouraged investors to buy the stock. This action underscores the growing tension between traditional financial regulations and the volatile world of cryptocurrency.

Let’s look into the events leading up to the SEC’s suspension, explore the implications for investors, and examine the broader impact on the market.

Background on QMMM Holdings Ltd.

QMMM Holdings Ltd. is a Hong Kong-based digital advertising company. It mainly offers advertising services and solutions for marketing campaigns. In September 2025, QMMM announced a $100 million cryptocurrency treasury. This was a big change from its usual business and got investors’ attention. The company wanted to invest in cryptocurrencies like Bitcoin, Ethereum, and Solana.

Management believes digital assets could boost the company’s finances and growth. However, this move raises questions. QMMM has focused on advertising, so it may lack the skills and systems to handle crypto’s challenges. The shift is risky and will test the company’s ability to manage new markets.

The Surge in Stock Price

The announcement of QMMM’s plans to establish a $100 million cryptocurrency treasury on September 9, 2025, led to an unprecedented surge in the company’s stock price. Within less than three weeks, QMMM’s shares skyrocketed by 959%, a remarkable increase that caught the attention of investors and regulators.

The rapid ascent of QMMM’s stock price was fueled by a combination of factors. The company’s strategic pivot into the cryptocurrency sector generated significant media coverage and investor interest. Additionally, the growing popularity of digital assets and blockchain technology contributed to the heightened demand for QMMM’s shares.

However, the sudden and dramatic rise in stock price also raised concerns about the potential for market manipulation. Reports indicated that unknown individuals on social media platforms were promoting QMMM’s stock, encouraging investors to purchase shares and further driving up the price.

SEC’s Intervention

In response to the extraordinary surge in QMMM’s stock price, the U.S. Securities and Exchange Commission (SEC) intervened by temporarily halting trading of the company’s shares. The SEC cited concerns over potential market manipulation, specifically through recommendations made by unknown individuals on social media platforms to purchase QMMM’s stock.

The trading suspension, effective immediately, is set to last until October 10, 2025. During this period, the SEC will investigate the circumstances surrounding the rapid increase in QMMM’s stock price and assess whether any violations of securities laws have occurred.

The SEC’s decision underscores the agency’s commitment to maintaining fair and orderly markets and protecting investors from fraudulent activities. By intervening in cases of suspected market manipulation, the SEC aims to uphold the integrity of the financial markets and ensure that all investors have equal access to information and opportunities.

Implications for Investors

The suspension of trading in QMMM’s stock has significant implications for investors. Those who purchased shares during the recent surge may face challenges in liquidating their positions, as trading is temporarily halted. Additionally, the uncertainty surrounding the outcome of the SEC’s investigation adds an element of risk to holding QMMM’s shares.

Investors should exercise caution and consider the potential for continued volatility in QMMM’s stock price. The outcome of the SEC’s investigation could lead to various scenarios, including the resumption of trading, further regulatory actions, or potential legal consequences for those involved in any illicit activities.

Investors should stay informed about developments related to QMMM and the SEC’s investigation. Monitoring official announcements from the SEC and the company itself will provide valuable insights into the situation and help investors make informed decisions regarding their investments.

Broader Market Context

QMMM’s situation shows how traditional markets and the fast-growing cryptocurrency sector are coming together. More companies want to enter crypto, but rules must be followed to keep markets fair.

The SEC’s action fits a wider trend of strict checks on crypto activities. The agency has acted against other companies before, showing it wants to manage risks when digital assets join regular business.

QMMM’s case also warns other firms. Crypto is volatile and rules are unclear, so careful planning and risk checks are needed before starting similar projects.

Expert Opinions and Analysis

Financial analysts have shared their views on QMMM’s case. Many see the SEC’s action as needed to protect investors and keep markets fair. Some warn that strict rules may stop other companies from using crypto, slowing its adoption in normal business. Balancing innovation and regulation will be key for the future of digital assets.

The results of the SEC’s investigation could set a rule for similar cases. How the agency applies securities laws to crypto will affect both companies and investors going forward.

Wrap Up

QMMM Holdings Ltd.’s stock rose very fast, and then trading was stopped. This shows how risky it is to mix crypto with regular business. The SEC stepped in to keep markets fair. For investors, it reminds us that crypto is very volatile. Digital assets can bring gains but also bring big risks that need careful thought.

Frequently Asked Questions (FAQs)

The SEC stopped trading QMMM stock on September 29, 2025, after it rose 959% fast. The pause lets them check if social media caused unfair buying.

QMMM’s stock jumped after September 9, 2025, news about a $100 million crypto treasury. Investors reacted quickly, and social media hype may have added to the price surge.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.