Sensex Dec 9: Market Slides 400 Points as Nifty Closes Below 25,850

On 9 December 2025, the Indian stock market turned sharply lower. The Sensex fell about 436 points and closed well below its last session’s level. The Nifty 50 also broke the key 25,850 mark. Both indices slipped for a second straight day. This was a clear sign that bulls gave up some recent gains. Investors moved to safer bets. Selling pressure hit many top stocks. Weak global cues and fear about world markets made traders cautious.

Foreign investors also pulled money out, adding to the slide. Domestic investors stayed active, but it was not enough to hold up the market. The drop on Tuesday shows that confidence is shaky right now. Many traders are now asking what comes next for the market. Tomorrow’s session will be watched closely by investors.

What Triggered the Sell-off: Five Pressure Points

The fall on 9 December 2025 followed clear global caution. Traders grew nervous ahead of the U.S. Federal Reserve decision. That made yields volatile. Higher yields pushed money away from risk assets. Foreign investors turned net sellers. This outflow added real downward pressure on Indian stocks.

Domestic traders trimmed positions ahead of monthly options expiry. Commodity moves also mattered. A jump in crude raised cost worries for transport and margins. Together, these forces nudged indices lower and intensified intraday selling.

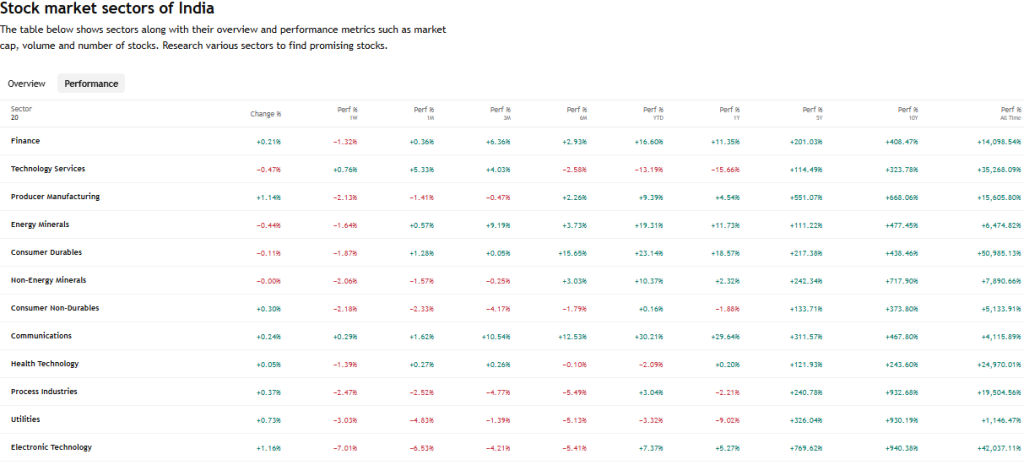

Sensex: Sector-by-Sector Breakdown of the 400-point slide

Banks and financials bore the brunt. Large private banks saw profit-booking after recent gains. Rate sensitive lenders dropped as bond yields rose. IT names were mixed. Some large caps held up, but mid-tier tech fell on weak global cues.

Auto stocks showed early weakness. The selling looked tied to growth concerns and softer consumer signals. FMCG names provided partial support. Defensive pharma and some consumer staples limited losses. Trading volumes suggested selective exits, not a full market panic.

Nifty drops below 25,850: Technical levels that broke

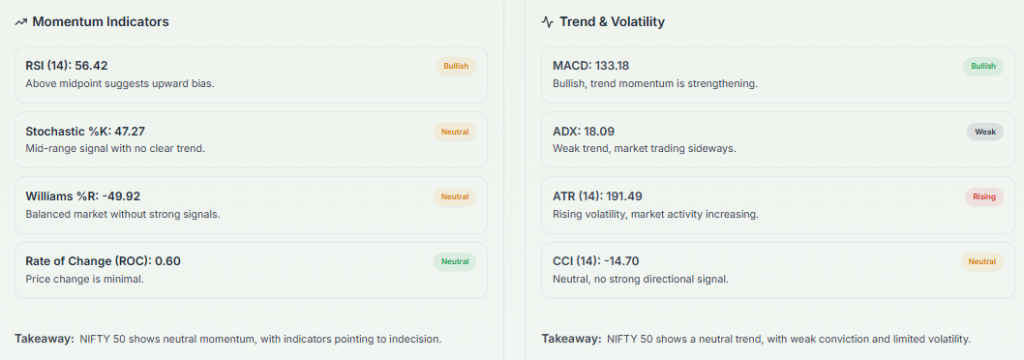

The decisive break below 25,850 mattered. That level had acted as short-term support. Once it failed, automated strategies added selling pressure. The chart now shows near-term support at 25,780 and then 25,650. A move back above 25,900-26,000 would be needed to calm traders.

Indicators showed rising selling momentum. RSI was in a weakening phase while moving averages flattened. Algorithms and option hedges accelerated moves after the breach. Money managers will watch volume on any bounce to judge conviction.

Top Gainers and Losers: Why did these stocks move?

Large financials and select IT names were among the top losers. News flow and rate sensitivity explained much of that weakness. TechM and HCL Tech dropped nearly 2% each during the session. Some midcaps behaved erratically after company-specific reports or broker calls.

On the upside, defensive pharma and smaller consumer firms gained as investors sought stable earnings. A few exporters rose on a weaker rupee. A notable midcap rebound came after clarification from management on earlier issues, lifting investor sentiment for that stock. These stock moves reflect both macro forces and isolated company triggers.

Broader Market Mood: mid-caps and VIX send a signal

Midcap and smallcap indices lagged the large caps. That shows risk aversion taking hold. India VIX ticked up, indicating higher hedging activity. Market breadth was weak with declines outnumbering advances. The pattern suggests traders favored liquidity and quality. Short covering will be needed for a broad recovery. Until then, expect bouts of sector rotation and narrow rallies in defensive names.

FII-DII Flow Snapshot and What it Indicates?

Foreign institutional investors booked net sales in early December. Reuters noted notable outflows in the first week of the month. That trend added pressure on price levels. Domestic institutions continued to buy selectively. Their purchases helped limit the fall but did not fully offset FII exits. Currency moves also played a role.

A softer rupee made foreign buyers cautious and increased hedging costs. Overall, the flow picture points to cautious positioning rather than full capitulation.

What to Expect Tomorrow: Key levels and a short playbook

Expect the market to remain sensitive to global cues. The Fed decision and any commentary on rates will set the next tone. Traders should watch 25,650-25,780 as support and 25,900-26,000 as resistance. Short traders may look for momentum below support. Long traders should wait for a clear reclaim of 26,000 on firm volume.

Sector plays include cautious exposure to pharma and staples. Rate-sensitive sectors may underperform until yields settle. An AI stock research analysis tool flagged rising yields and FII flows as immediate risks; model-based signals also point to higher volatility in near term. Monitor crude and USD/INR for second-order effects.

Closing: correction or trend shift?

The drop on 9 December 2025 looks like a corrective pullback. The move followed global jitters and portfolio repositioning. It did not show the breadth of a structural bear market. Still, caution is warranted until key supports hold and foreign flows stabilize.

Traders should focus on clear price action and manage risk tightly. Markets can swing quickly around big global events. Keep an eye on yields, the Fed outcome, and flows before expanding exposure.

Frequently Asked Questions (FAQs)

The Sensex fell on 9 December 2025 because global markets were weak, foreign investors sold shares, and traders booked profits. Higher U.S. rate worries also pushed investors to reduce risk.

Nifty falling below 25,850 shows short-term pressure, not a confirmed long downturn. The trend depends on global cues, foreign flow, and how markets react in the next few sessions.

FII outflows pull money out of the market. This reduces demand for shares and often pushes prices lower. On days like 9 December 2025, it can increase selling pressure.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.