Sensex Live Today: Markets Open Positive on 8 September 2025

On 8 September 2025, the Sensex opened strongly, giving investors a positive start to the week. We saw the index rise steadily in the first few minutes of trading. This boost reflects growing optimism among traders and long-term investors alike. Global markets were mixed overnight, but Asian indices showed strength, while US markets posted moderate gains. This helped create a favorable mood in India.

Domestic factors also played a key role. Steady foreign fund inflows, strong corporate earnings, and positive economic data gave markets a lift. Sectors like banking, IT, and energy attracted early buying. Even small and mid-cap stocks joined the upward trend, adding momentum to the market.

As we follow the Sensex live today, it is clear that investors are cautious but hopeful. Let’s break down the Sensex opening snapshot, sector-wise trends, top gainers and losers, and expert views. This will help you understand the market movement and plan your trades more wisely.

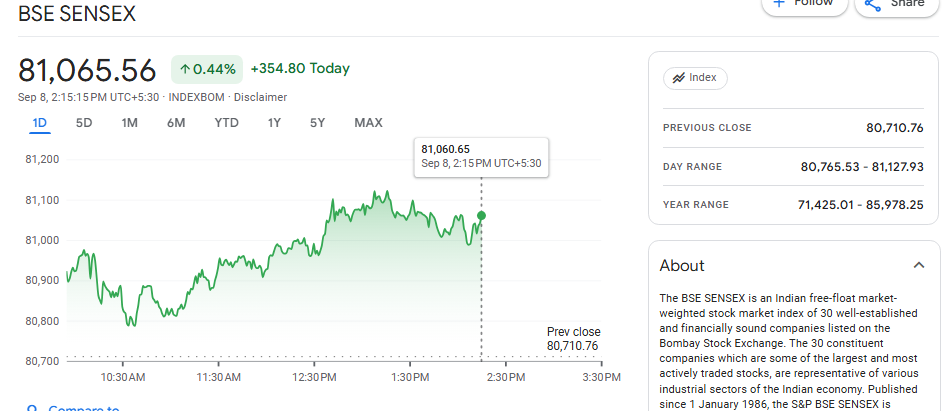

Sensex Opening Snapshot

On Monday, 8 September 2025, the BSE Sensex opened with a positive momentum. It gained 193.64 points to reach 80,904.40. The Nifty 50 also followed suit and rose 61.6 points to open at 24,802.60. This upward movement indicated a strong start to the trading session, with investor sentiment buoyed by favorable global cues and domestic factors.

The market’s positive opening was further supported by the GIFT Nifty, which was trading up by 71.50 points. This suggests a gap-up opening for the domestic indices.

Factors that Drive the Positive Opening

Several factors contributed to the optimistic market opening:

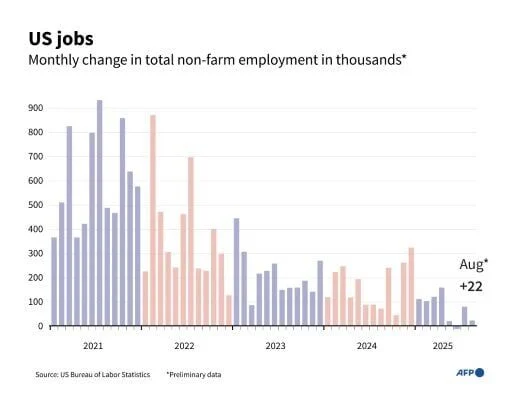

Global Cues: Asian markets were trading in the green, with indices like the Nikkei 225, Kospi, SSE Composite, and Hang Seng all showing positive movements. This global rally was fueled by a soft US jobs report for August, where only 22,000 jobs were added, and unemployment rose to 4.3%. This data increased expectations of a 25-basis-point rate reduction at the US Federal Reserve’s upcoming policy meeting. This lift sentiment in emerging markets like India.

Domestic Factors: The recent Goods and Services Tax (GST) reforms, effective from 22 September. We were seen as a boost to demand in sectors such as automobiles and consumer durables. Investors anticipated that these changes would stimulate consumption ahead of the festive season, positively impacting market sentiment.

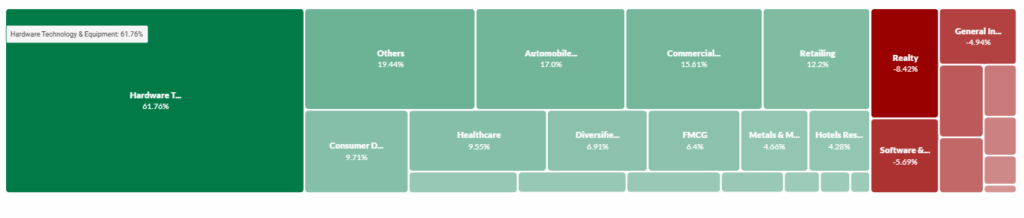

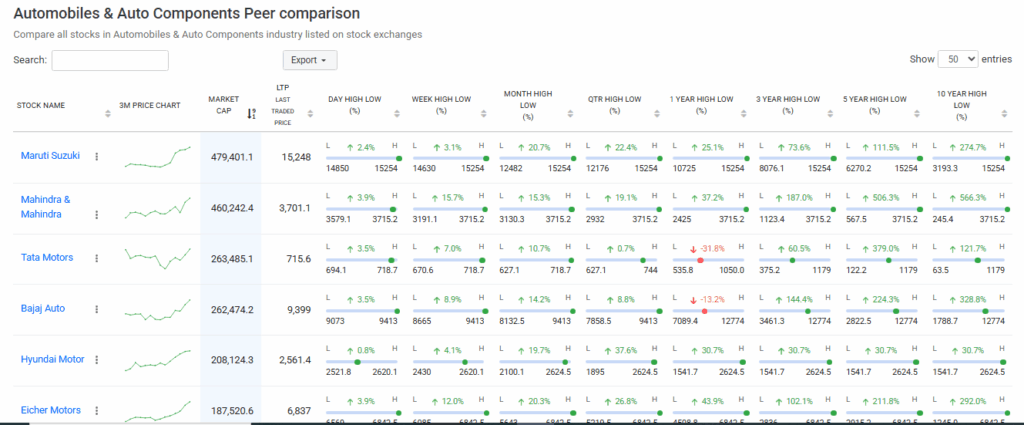

Sectoral Performance: Early trading saw gains in sectors like metals, auto, and infrastructure. Stocks such as Tata Steel, Tata Motors, Mahindra & Mahindra, Adani Ports, UltraTech Cement, and Power Grid were among the top gainers. Conversely, IT and FMCG stocks experienced some profit-booking, with companies like TCS, Asian Paints, and Infosys showing declines.

Sector-wise Performance

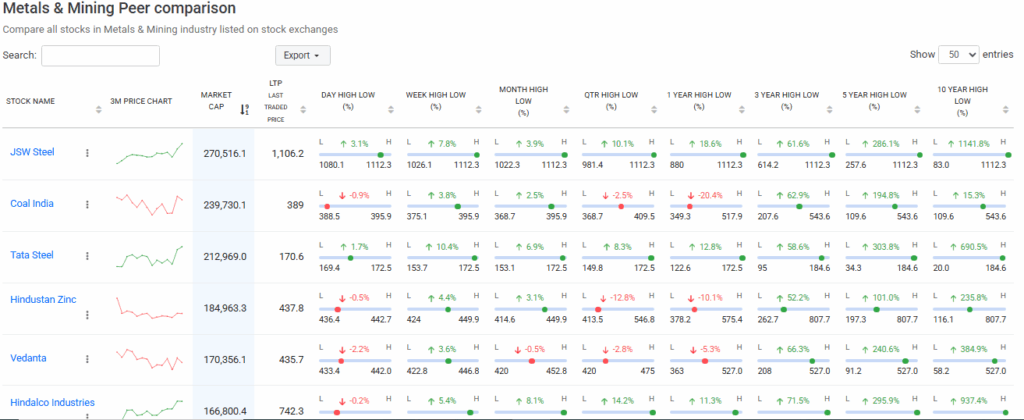

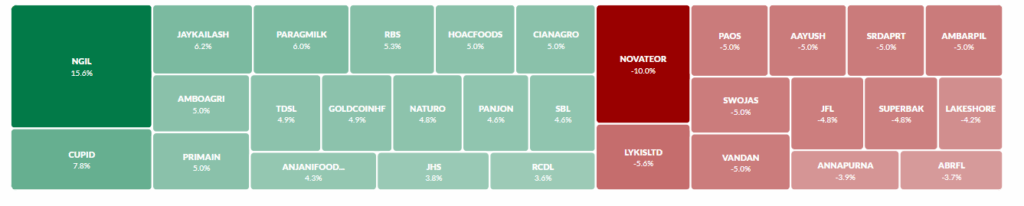

Metals: The metal sector led the gains, with Tata Steel and JSW Steel among the top performers. Analysts remained positive on steel stocks, citing expectations of increased demand due to infrastructure development and potential government initiatives to boost production.

Automobiles: Automakers like Tata Motors and Mahindra & Mahindra saw significant gains, driven by expectations of increased sales following the GST rate cuts. These reforms were anticipated to make vehicles more affordable, thereby stimulating demand.

Infrastructure: Companies in the infrastructure sector, including UltraTech Cement and Power Grid, benefited from increased government spending on infrastructure projects. This sector’s performance was also bolstered by positive global cues and domestic policy support.

IT and FMCG: The IT sector experienced some profit-booking, with stocks like TCS and Infosys declining in early trade. Similarly, FMCG stocks such as Asian Paints and Trent faced selling pressure, reflecting a cautious approach by investors amid broader market optimism.

Top Gainers and Losers

- Top Gainers: Tata Motors (+2.91%), Tata Steel (+2.33%), Mahindra & Mahindra (+1.95%), Adani Ports (+1.71%), Maruti (+1.10%).

- Top Losers: TCS (-0.62%), Asian Paints (-0.50%), Infosys (-0.24%).

Expert Opinions and Market Insights

Market experts expressed cautious optimism regarding the market’s positive opening:

- Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Investments, highlighted that while optimism around GST reforms is evident, external risks, particularly concerning US-India trade relations, could weigh on markets. He noted that the worst-case scenario for tariffs had played out, with the US imposing an effective 50% tariff on imports from India, which could impact investor sentiment.

- Prashanth Tapse, Senior VP (Research) at Mehta Equities, pointed out that global factors, including the US Federal Reserve’s potential rate cut and uncertainties around President Trump’s tariff strategy, continue to cloud the outlook. He emphasized that the Nifty remains capped below the crucial 25,155 level, with volatility expected to dominate until a decisive breakout occurs.

Trading Strategies for Investors

Investors are advised to adopt a cautious approach:

Short-term Traders: Focus on sectors showing strong momentum, such as metals and automobiles. Stocks like Tata Steel and Tata Motors may offer short-term trading opportunities.

Long-term Investors: Consider sectors poised for growth due to policy support, such as infrastructure and consumer durables. Companies like UltraTech Cement and Maruti could be potential long-term investments.

Risk Management: Maintain a diversified portfolio to mitigate risks associated with sector-specific downturns. Regularly review and adjust holdings based on market developments.

Global Market Overview

Global markets provided a supportive backdrop for the Indian market’s positive opening:

US Markets: The US stock market showed resilience, with major indices posting modest gains. The soft jobs report for August increased expectations of a rate cut by the Federal Reserve, which positively influenced global investor sentiment.

Asian Markets: Asian indices, including the Nikkei 225, Kospi, SSE Composite, and Hang Seng, were all trading in the green, reflecting a broad-based regional rally.

European Markets: European markets were also expected to open higher, supported by positive economic data and expectations of accommodative monetary policies from central banks.

Bottom Line

The Indian stock market’s positive opening on 8 September 2025 was driven by a combination of favorable global cues, domestic policy reforms, and sector-specific momentum. While optimism prevails, investors are advised to remain vigilant of external risks and market volatility. Monitoring global developments and domestic policy changes will be crucial in navigating the market’s near-term outlook.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.