Sensex Stock Today: TCS, Infosys, NTPC, Oil India in Spotlight

The Indian stock market stayed in focus today, September 22, 2025, as the Sensex opened on a mixed note. Global cues, oil prices, and company updates shaped the early trade. Investors watch these moves closely because a few big stocks can swing the index.

Today, four names stand out: TCS, Infosys, NTPC, and Oil India. These companies sit in different sectors but hold strong weight in the Sensex. IT giants TCS and Infosys reflect the health of India’s tech exports. NTPC shows the direction of the power sector and its renewable push. Oil India, tied with global crude prices, signals energy trends. Together, they help us read where the market is heading.

We see investors tracking earnings, government policies, and global demand. For example, a rise in oil prices affects both Oil India’s outlook and NTPC’s costs. Similarly, weak global tech demand can slow down IT stocks.

This mix of opportunities and risks makes the Sensex a live reflection of India’s economy. Today’s spotlight reminds us that no single factor drives the market. Instead, it’s a balance of sectors, sentiment, and global signals.

Market Overview: Sensex Movement

Sensex opened lower on September 22, 2025. It dropped about 450 points early in trade. Nifty 50 also fell, slipping below 25,300. Most sectors traded with caution. The biggest decline came from IT stocks. On the other hand, the power and oil & gas sectors showed resilience. They gained or held steady. Global cues weighed heavily. The U.S. raised the fee for new H-1B visa applications to USD 100,000, causing concern. Also, expectations of U.S. rate cuts and India-U.S. trade talks offered some support.

Spotlight on IT Stocks – TCS & Infosys

TCS and Infosys faced sharp losses today. They dropped between 3-5% after the U.S. policy change on H-1B visas. The visa fee rise is a one-time charge, applying only to new visa applications. Investors worry about how much cost will be passed down to clients. Project budgets may be affected.

TCS is among the largest beneficiaries of H-1B visas in recent years. Infosys, meanwhile, has been focusing on reskilling staff. It is trying to reduce reliance on onsite models. The drop in IT also dragged down broader indices. Nifty IT index fell by more than 3-3.5%. All major IT stocks were red.

Energy & Power Sector Movers – NTPC & Oil India

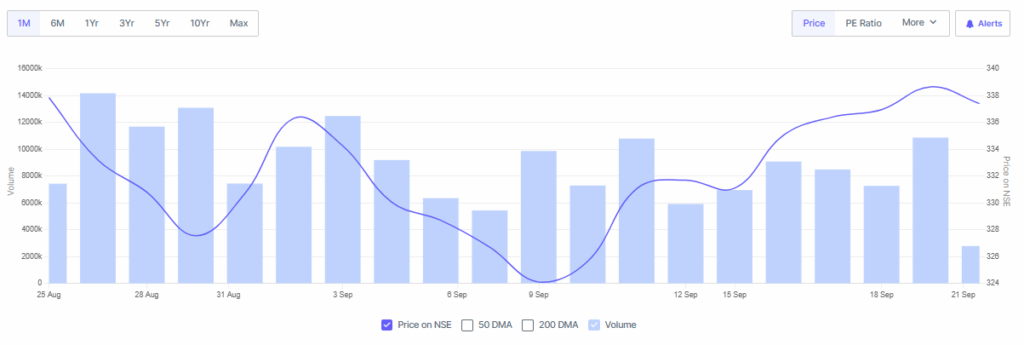

NTPC held up better relative to IT. Its stock was trading around ₹338. It showed small gains or minor drops depending on the trade-time moments. Its six-month beta is low (about 0.8738), which shows steady volatility. Analysts at IIFL picked NTPC as a defensive buy. They see value in its stable cash flows and power demand recovery. However, there is concern. NTPC’s capacity addition in the recent fiscal year lagged expectations. Investors want faster execution.

Oil India also drew attention. It recently signed a Joint Venture Agreement (JVA) with Rajasthan Rajya Vidyut Utpadan Nigam Limited (RVUNL). The deal covers 1.2 GW of renewable energy projects (solar and wind) in Rajasthan. Oil India is also part of the Mozambique LNG project. It expects a restart by late 2025. That could boost its gas supply business. The Oil India share price was around ₹406.85 at mid-morning trade, up modestly.

Broader Market Trends

Foreign investors remain cautious. As of September 2025, FPIs have pulled out nearly ₹7,945 crore in equities. Year-to-date net outflow stands at about ₹1.38 lakh crore. Weak global demand, trade tensions, and policy changes (visa fees) are some of the reasons.

Other sectors like oil & gas, realty, and power saw some buying interest. Also, GST rate cuts on many goods started from September 22, which may improve spending in consumer sectors.

Investor Takeaways

TCS & Infosys face headwinds from the visa policy. Their profits could be under pressure if clients resist higher costs. Investors may watch how they shift to offshore or local delivery models. NTPC seems less vulnerable to policy shocks. It may be safer as demand for power remains stable. But its growth depends on how fast it can add capacity.

Oil India has some tailwinds. Renewables JV and LNG project could improve its earnings. But execution risk exists. Market remains volatile. Global policy moves will have short-term effects. Long-term players may focus on companies with clear transition plans.

Bottom Line

Sensex traded lower on September 22, 2025. The IT sector is dragged by the U.S. visa fee hike. TCS and Infosys traded under pressure. NTPC and Oil India showed strength in the energy and power sectors. Market moved on mixed cues: global policy shocks, domestic reforms, trade talks. Investors may stay cautious, using AI stock analysis tools to track trends and assess risks before making fresh market decisions. The focus will likely remain on execution, policy clarity, and how firms adapt to cost changes.

Frequently Asked Questions (FAQs)

TCS and Infosys fell on September 22, 2025, after the U.S. raised H-1B visa fees. Investors feared higher costs could reduce profits and impact IT sector growth.

NTPC looks stable with steady power demand, while Oil India gains from renewables and LNG projects. Both have opportunities and risks. Choice depends on investor goals.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.